Housing costs are growing fastest for lower-income families: report

President Trump’s key selling point for reelection in 2020 – a strong economy – got a big boost with the recent news that GDP grew by 3.2% in the first quarter.

But a closer look at the housing market reveals that many Americans are still struggling to keep a roof over their heads.

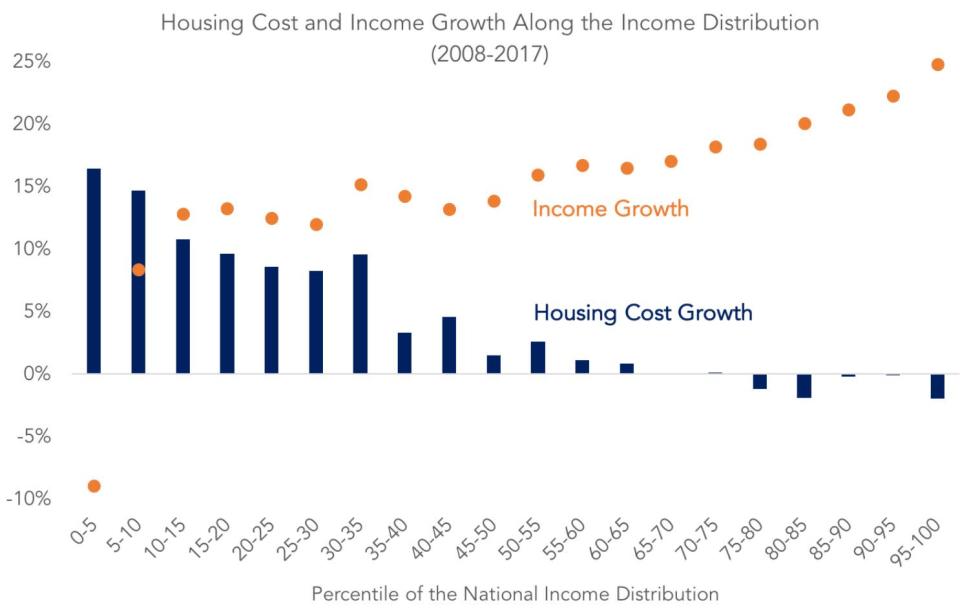

A new report by Apartment List, a rental listing site, found that housing costs are exacerbating the wealth gap in America. Americans in the bottom 10% of the income scale have faced the most rapid growth in housing costs over the past 10 years. Meanwhile, the wealthiest Americans – those in the top quarter of earners – have seen their housing costs fall drastically during the same period. As a result, bottom earners are spending an ever-increasing portion of their paycheck on housing costs, according to the report.

Trump’s 2020 budget proposes cutting $8.7 billion from the Department of Housing and Urban Development. These cuts would increase rent for thousands of HUD-assisted households according to NY Housing Conference, a nonprofit affordable housing policy group, by adding work requirements and rent reforms. National data continues to show that most Americans are getting crushed by housing costs: 1 in 4 renters spend more than half their paycheck on housing, according to the County Health Rankings database.

“If you are struggling today and every month you need to pay more and more of your income on your housing, that means less opportunity to invest, less opportunity to take risks, to invest in education – all these things that we kind of think are necessary to bridge the inequality gap,” says Apartment List’s chief economist Igor Popov.

Homeowners vs. renters

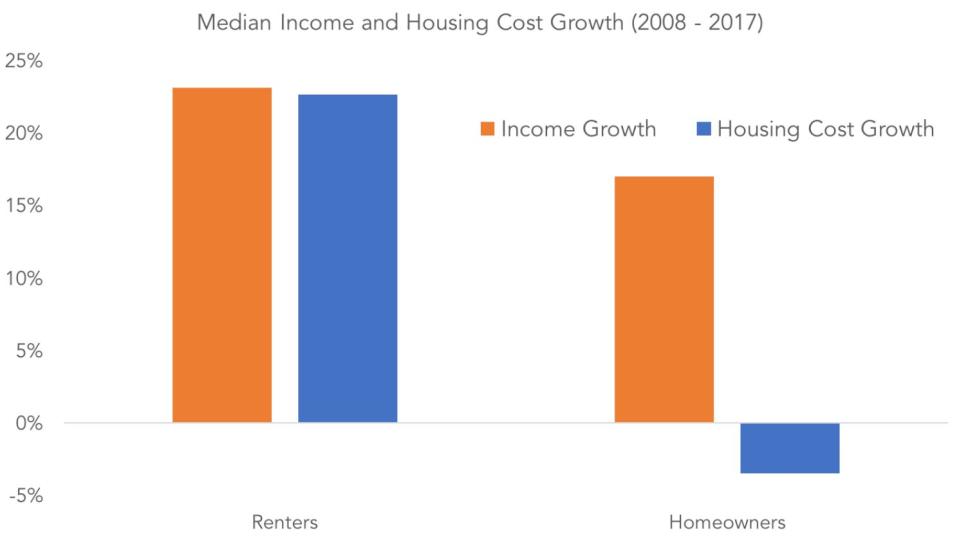

Differences in housing costs among homeowners and renters are a key driver of income inequality. While renters have a faster growing median income than homeowners, rental costs have risen just as quickly – 23% higher over the past decade (in nominal dollars).

“The lower you are in the income distribution today in America, the more likely you are to be a renter as opposed to an owner and the vast majority of renters, they’ve been exposed to essentially rising rents every time their 12-month or 24-month lease is up,” says Popov.

Homeowners are paying less out of pocket every month, due in large part to falling mortgage rates bringing housing costs down over the past decade.

Top metro areas

All the top 100 U.S. metro areas are seeing housing costs rise faster for lower earners; but income inequality growth is most pronounced in New Orleans, Philadelphia, and San Jose, Calif., according to Apartment List.

(In Philadelphia, for instance, the ratio of households that make more money than 90% of the population to those who make more than just 10% in 2017 was 17.2, compared with 12.7 in 2008. The widening increase means greater growing income inequality.)

“One potential damaging effect is that greater inequality leads to… gaps in opportunity,” says Popov. “Once folks segregate into different circles that are sort of in the same job network, it makes it harder to get ahead if you’re not in the group of haves vs. the group of have-nots.”

Follow Sibile Marcellus on @SibileTV.

More from Sibile:

Netflix comic Minhaj jokes: Do as much controversial work as possible to succeed

$1.5 trillion student debt crisis: Many borrowers still don’t understand the costs

Single women are more confident about managing money than married women: UBS

Millennials shatter money taboo on first dates

Closing the southern border could cost $2.5 billion a week: Wells Fargo