The housing market is peaking

It’s official, the housing market has cooled off, but it will take some time for it to become a buyers’ market.

“Now we have seen several months of data that tells me the housing market is softening,” said Cheryl Young, a senior economist at Trulia.

Existing home sales have peaked, according to Michelle Meyer, an economist at BAML, and a number of experts have adjusted their forecasts downward for key housing indicators, including home sales and single-family housing starts. Even home prices, which have been heading north, are rising at a slower clip.

Last month, Freddie Mac said it expects home sales (existing and new) this year to come in below 2017. It projects total home sales to decline 0.9% to 6.07 million.

“The spring and summer home buying and selling season ultimately ended up being a letdown, despite a faster growing economy and healthy demand for buying a home,” said Freddie Mac Chief Economist Sam Khater in a press statement.

Meyer recently noted that existing home sales peaked in November 2017 at 5.72 million. Existing home sales remained unchanged in August, as rising mortgage rates and stagnant wage growth held back sales. New homes sales, a smaller portion of the market, recorded a small uptick of 3.5% but are still well below levels prior to the Great Recession.

In previous housing cycles, a peak in existing home sales is usually followed by a peak in home price growth, according to Meyer, referencing the peak in existing home sales and home price growth in September 2005. But this time around that’s probably not going to be the case.

Low inventory levels

“An outright contraction in home prices seems unlikely,” said Meyer, adding that she does think the rate of home price appreciation will slow. “Remember, this is not a normal market. The supply of homes on the market for sale has been quite low.”

Historically low inventory levels have been choking overall sales and putting pressure on home prices. The number of homes for sale in the U.S. has fallen for three straight years, eight of the past 10 years, according to the National Association of Realtors.

But relief may be on the way. Last month, the NAR said inventory appears to finally be leveling off — declining only 0.2% from a year ago. Trulia recently predicted that inventory is close to hitting a bottom. According to Trulia, the total number of homes available for sale in the third quarter was the highest since 2018 but lower than it was a year ago. Inventory fell by 2.5% in the third quarter — the smallest annual decline since the beginning of 2015.

And in certain markets of the U.S., inventory is already starting to pick up. Brokerage Redfin reported Friday a surge in homes for sale in major cities on the West Coast during the third quarter of this year. At Yahoo Finance All Markets Summit last month, Zillow CEO Spencer Rascoff said in Los Angeles there was a period of 42 months of declining inventory but In August inventory was up 13% year-over-year.

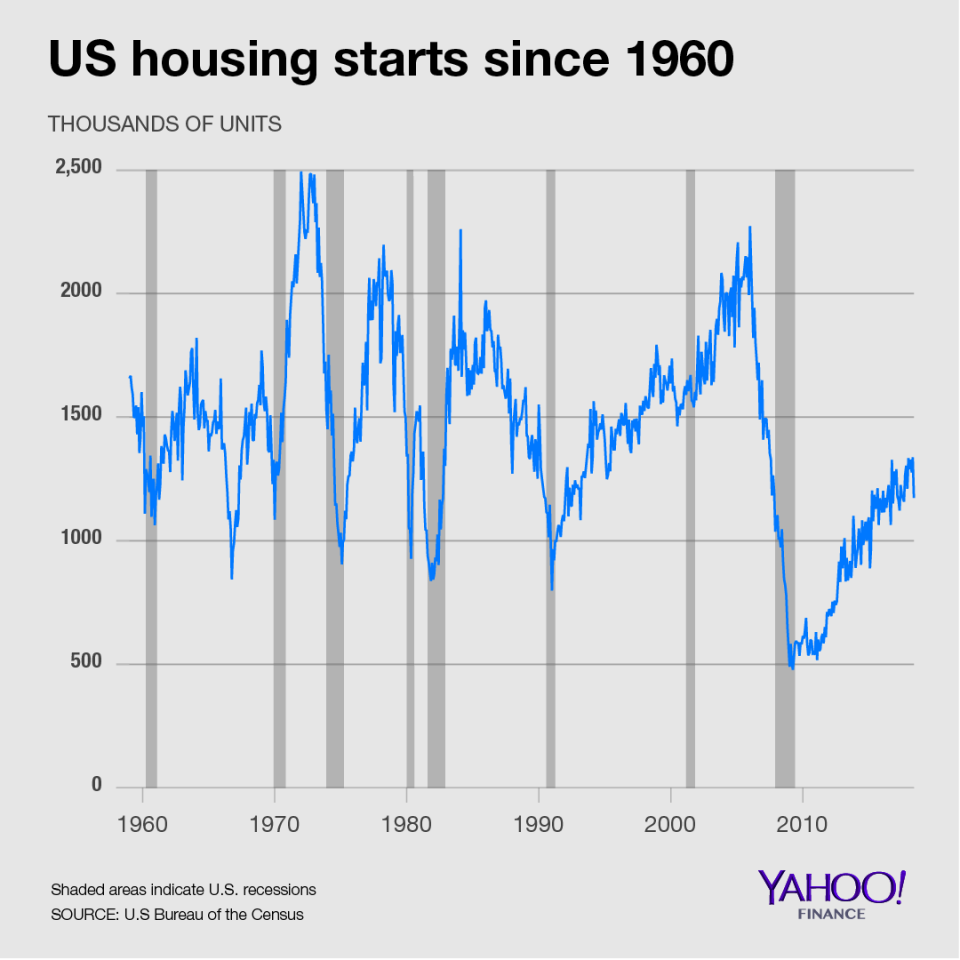

But challenges in the homebuilding industry — an ongoing construction labor shortage and increased building costs due to steel and lumber tariffs — could put a damper on inventory levels. While housing starts, a measure of the creation of new homes, rose 9.2% to a seasonally adjusted annual rate of 1.282 million units in August, according to the U.S. Commerce Department, building permits, a leading indicator of future housing supply, fell 5.7%.

The Urban Land Institute, which just revised its forecasts for housing starts, said growth would remain below the long-term average. It lowered its prediction to 900,000 from 923,000 in 2018, 930,000 from 987,500 in 2019 and 900,000 from 925,000 in 2020.

“It is going to take a long time to get enough supply for major tides to turn,” said Young.

The tight inventory will do little to alleviate home prices in the near term. But the good news is home prices have been retreating, ever so slightly. From April to July, home prices increased at a slower annual rate, according to the S&P CoreLogic Case-Shiller national home price index. In July, 15 of 20 cities in its 20-City Composite Index saw smaller monthly increases than from the same month a year ago. And experts expect the slowdown to continue.

For 2018, the Urban Land Institute predicts a 5% increase in home prices, down from its 5.2% estimate in April. Next year, the research group forecasts a 4.2% rise compared to 4.3%, and a 3.4% increase instead of 4% in 2020.

“We’re starting to see a shift, the percentage of price reductions is on the rise,” said Meyer, citing recent Zillow data indicating that 15% of homes listed for sale in the U.S. had a price reduction.

Amanda Fung is an editor at Yahoo Finance.

Related stories

Zillow CEO: Housing market ‘is starting to slow a little bit’

Home prices in the spring remain high

The housing market is slowing down, and that’s a bad sign for the economy