Why the housing slowdown won’t become a housing crash

The housing market has been cooling down, but there’s no need to panic.

U.S. homebuilding rose in October, led by multi-family housing projects. Single-family homebuilding, however, fell for the second month in a row, decreasing 2.6% year-over-year — the largest drop since March 2015.

Meanwhile, existing-home sales increased 1.4% in October from the previous month. But sales are down 5.1% from a year earlier, representing the largest annual decline since 2014.

“Given the rapid increase in home prices over the past few years, and the recent pick-up in mortgage rates, the housing market continues to struggle with diminished affordability. The notable deceleration in median home price growth, 3.8% in October compared to roughly 6% in 2017, is a positive sign, as it indicates that home prices are rising at a more sustainable pace,” according to Mortgage Bankers Association Chief Economist Mike Fratantoni.

But as Nobel laureate Robert Shiller has pointed out, the market has been overheated since 2012. And he has been getting flashbacks of 2006.

‘Expect a soft landing’

Economists across the board find that the looming housing crisis has been blown far out of proportion.

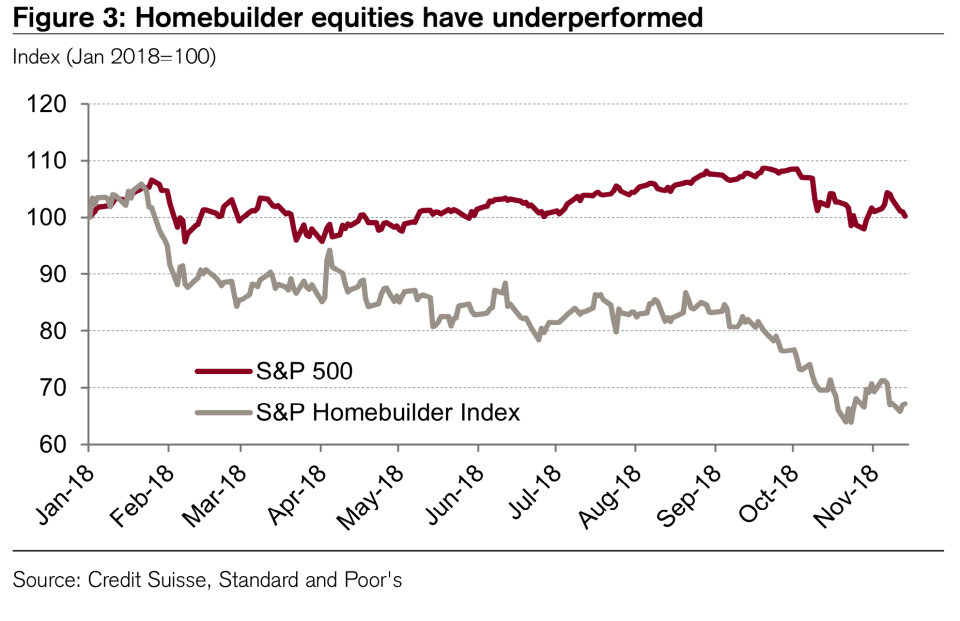

In a note to clients, Credit Suisse wrote, “We are not optimistic on housing, but the level of concern has become excessive,” citing accelerating income growth and low vacancy rates.

“The most likely scenario for housing is a soft landing, not a recessionary slowdown. With fiscal stimulus and a strong labor market boosting growth, the Fed should take comfort that rate hikes have traction slowing part of the economy. Rather than cause a recession, some managed weakness in housing may actually prolong the current recovery,” according to Credit Suisse.

Home price growth in September slowed for the sixth month in a row, reaching its lowest level since January 2017, and there’s no questioning the market’s downward trend. Still, Goldman Sachs believes that national average price appreciation will remain positive overall. In a recent note, Goldman reiterated its belief in a “soft landing,” pointing out that housing supply is still at historically low levels.

Another important point is that the price growth in the U.S. over the past six years does not necessarily indicate overvaluation. “The low supply of housing going into the current slowdown, combined with high but not unsustainable valuations, suggests to us that house price appreciation in the U.S. is poised to decelerate but not turn negative in 2019,” according to Goldman.

Higher rates on the horizon

Of course, higher interest rates will be headwind for the foreseeable future. The Federal Reserve has raised rates three times in 2018. And it is expected to do so again in December, and four more times in 2019.

Interest rates are currently in a target rate of 2% to 2.25%. Fed Vice Chair Richard Clarida said the central bank should proceed with caution in a speech Tuesday morning. Clarida said the monetary policy-setting FOMC, of which he is the newest member, is “much closer” to a neutral level than when it first began hiking rates in December 2015.

On Wednesday, Fed Chairman Jerome Powell may provide further guidance on where rate hikes will stop so the economy is running at its longer-run neutral real rate.

The housing industry is especially sensitive to interest rates. According to Barclays, it’s the first sector to feel the impact of the Fed’s tightening cycle. “With average rates for 30-year fixed rate mortgages up roughly 75 basis points since the Fed initiated tightening in late 2015 and house prices still on a gradual upward trajectory, the index of affordability has deteriorated somewhat of late.”

“Whether true or not, homebuilders are increasingly concerned that skyrocketing mortgage rates are driving buyers out of the market. Surveys cite a reduction in homebuyer foot traffic when it comes to looking over properties for sale,” said Chris Rupkey, chief financial economist at MUFG.

We should expect interest rates to continue to put a damper on the overall housing market with additional rate hikes down the line.

Melody Hahm is a senior writer at Yahoo Finance, covering entrepreneurship, technology, and real estate. Follow her on Twitter @melodyhahm.

READ MORE:

Tesla’s journey from electric car dream to Elon Musk’s behemoth

The biggest lesson Lin-Manuel Miranda learned from Hamilton

The cities most at risk of a housing bubble