How Biden's tax hike and social security fix fall short

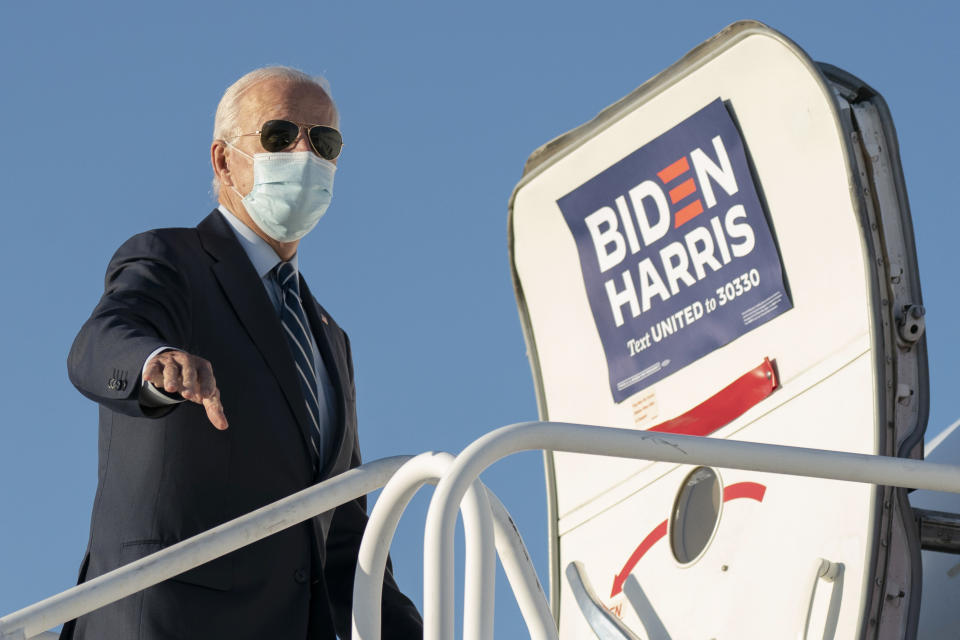

Presidential candidate Joe Biden says his plan to raise taxes will “protect Social Security” for millions of Americans as the program faces COVID-19 related losses and insolvency. But Biden’s supporters and critics say his plan falls short.

“It's a step in the right direction, but it doesn't take you at all where you need to be,” said Alicia Munnell, the director of the Center for Retirement Research at Boston College, during a recent Bipartisan Policy Center & Yahoo Finance webinar on retirement.

A recent Bipartisan Policy Center analysis of Social Security’s solvency found “COVID-19 could deplete reserves in each of the Social Security trust funds before the end of this decade, much sooner than previously forecasted.”

“We need a proposal to really restore financial solvency to Social Security over the long run,” says Munnell, who served on the President’s Council of Economic Advisers and was an Assistant Secretary of the Treasury for Economic Policy during the Clinton administration.

The Social Security Administration will pay more than $1 trillion in benefits to 65 million Americans this year. But the analysis shows benefits, in 2029, will fall 24% with Social Security only able to pay recipients 76 cents on the dollar. According to Munnell, Social Security can only avoid the drop in benefits with big cuts or additional taxpayer funding. “That takes a significant increase in revenues on the revenue side,” she says.

Biden’s plan will raise taxes for middle class

Biden has proposed keeping the current Social Security payroll tax temporarily capped at $137,700 of income. But he wants to raise federal taxes on incomes greater than $400,000. People in between would pay no additional tax.

The Biden plan, however, would reinstitute the payroll tax, at 12.4%, for incomes that exceed $400,000 and the $137,700 cap would be raised every year going forward until it was eliminated.

“So eventually all earnings would be taxed by Social Security,” said Andrew Biggs, a resident scholar at the American Enterprise Institute (AEI) who served as the principal deputy commissioner of the Social Security Administration (SSA) during the Bush administration.

Biggs says he’s happy to see Biden attempt to fix Social Security but warns taxes will rise for more people than just the top wage earners. “It's not just, the millionaires and billionaires,” according to Biggs. “The folks who are upper middle class folks, but not rich, they're paying an extra 12.5% of their earnings to Social Security. And that puts the U.S. in a pretty high kind of tax environment.”

Biden is also proposing raising benefits for Social Security recipients which would eat almost two-thirds of the new revenue generated from the tax increases. “So what you have is a plan that essentially taps out your higher earners on the tax end that only adds an extra five years to the trust fund,” Biggs pointed out.

The Center on Budget and Policy Priorities says Social Security kept 21 million Americans from falling into poverty last year. Munnell and Biggs agree more needs to be done to stabilize Social Security’s finances. But that alone won’t guarantee older Americans from avoiding poverty when they retire.

Munnell says, “About half of today's working households are not going to be prepared,” she warns, adding that millions of Americans will be unable to maintain their standard of living when they do retire.

Adam Shapiro is co-anchor of Yahoo Finance’s On the Move.

Exclusive: These airlines are most at risk of COVID-19-related default

Delta posts staggering Q3 loss as coronavirus hits demand, layoffs mount

Mass layoffs and smaller airlines loom after COVID-19, even with more aid

International travel could take until 2024 to recover from COVID-19

Southwest CEO: Bookings 'have recently stalled' because of coronavirus spike

'The corporate tax rate — I’m actually OK at 28%': Gary Cohn

Risk firm: 'American is most at risk' of coronavirus default among US airlines

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit