How changes in retirement and tax law will help save you cash in 2020

Time to pick your brackets. Not for your March Madness office pool, but for April 15th when 2019 federal taxes are due to be filed.

Changes in tax and retirement law for 2020 will allow Americans to save more money this year than last. “Here’s an opportunity to put money away tax deferred,” according to Geltrude & Company Founder Dan Geltrude who is also known as America’s accountant.

Geltrude told Yahoo Finance’s On the Move that 2017’s tax reform legislation successfully simplified the tax code. “A lot of people really lost their deductions. Now they made up for it with the standard deduction because that became much higher than it was,” he said.

Geltrude says the Secure Act, which became law at the start of this year, will help taxpayers use their tax savings to invest in their future retirement.

IRS Changes for 2020

The IRS raised the cap on 401(k) contributions $500 to $19,500. People 50 and older can contribute an additional $6500 as part of their catch-up contributions. That’s also $500 more than last year. One incentive to save is that traditional pre-tax contributions to a 401(k) can reduce your adjusted gross income or taxable income.

“The key here is you want to make sure you are putting away the maximum amount,” Geltrude said.

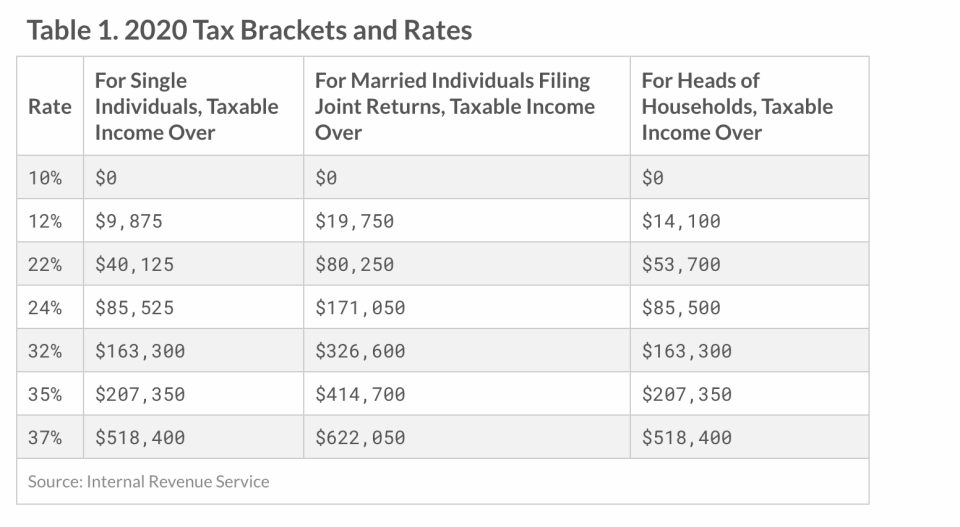

The IRS released its inflation adjusted personal tax brackets for 2020 at the end of last year. This Tax Foundation chart helps you determine your federal tax bracket based on the income you will earn in 2020.

For 2020, the IRS has increased the standard deduction by $400 for married couples filing jointly to $24,800. The standard deduction for single taxpayers increased $200 and rose to $12,400. For heads of households, the standard deduction will be $18,650 for tax year 2020, up $300.

Tax Refunds

The IRS issued 111,596,000 refunds in 2019. That was about 300,000 fewer than it issued in 2018. The average refund check in 2019 was $2,860, down slightly from the average $2,899 refunded in 2018. Geltrude says taxpayers were a bit confused last year because it was the first time they filed under the new tax reform guidelines.

“Hopefully people learned their lesson and adjusted their withholdings and have become aware of what their tax picture now is,” he said.

Geltrude points out the Trump tax cuts “were primarily geared towards corporations. They certainly didn’t do a heck of a lot for people in high tax states like New York, New Jersey and California.” Geltrude says there is no question that a lot of people benefited last year just not everyone. “So yes it was a disappointment for a lot of individuals,” he said.

Adam Shapiro is co-anchor of Yahoo Finance On the Move.

Trump calls Jerome Powell and Fed 'boneheads,' former economic adviser says he's right

President Trump will be out of office by March 2020, says Anthony Scaramucci

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.