Why the yield curve's recession warning could be wrong this time

Judging by fluctuations in government bond yields, the U.S. may or may not be flirting with recession.

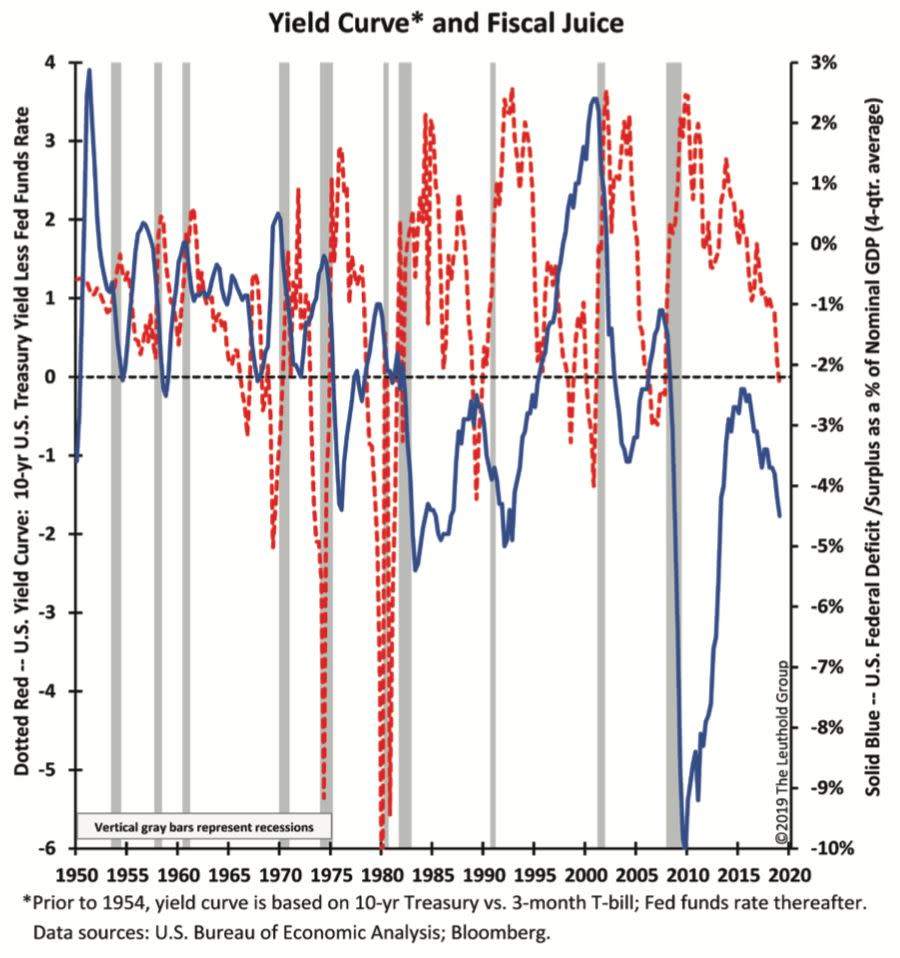

Amid festering fears about global growth, the U.S. yield curve temporarily inverted, an effect in which short term U.S. interest rates rise above longer-term yields. While economists disagree about what this means for the future of the economy, all acknowledge that it does bear watching.

“Rightly so, since a yield curve inversion has historically been an excellent indicator of a pending recession,” prominent economist Jim Paulsen said on Thursday.

However, if the economy manages to escape a prolonged slump, it may have Washington’s fiscal profligacy to thank.

Paulsen observed that over the last several decades, every recession has been preceded by a contraction in the U.S. federal deficit as a percentage of growth. That fiscal tightening effect “was true in the 1950s and most of the 1960s — when recessions occurred without an inversion in the yield curve — and since the late 1960s when recessions were preceded by both fiscal tightening and a yield curve inversion,” he said.

This time, the fiscal story is different.

‘Significant fiscal juice’

During economic downturns, a mix of higher spending and tax cuts have long been embraced as remedies to ward off recessions, even as economists lament the longer-term effects on the budget and interest rates.

All of which suggests fiscal policy — encapsulated by the sea of red ink being spilled by the government — could help support the U.S. even as the global economy slows.

A January Congressional Budget Office analysis showed the federal debt will be as big as 93% of U.S. GDP within the next decade, with the federal government expected to run trillion-dollar deficits every year beginning in 2022, if not sooner.

Amid a surge in spending and expected borrowing by the Treasury, President Donald Trump’s signature 2017 tax cut “fueled a surge in the federal deficit,” Paulsen said, joking that the yield curve may have been “Trumped.”

“An unconventional president has put the U.S. economy in a unique spot — an inverted yield curve with significant fiscal juice!” he added.

While many economists doubted the propriety of the boost from fiscal policy, “Today, however, with an inverted yield curve, many may agree with the president’s assertion that rates were raised too much last year,” Paulsen wrote.

“Moreover, those of us who thought additional fiscal stimulus (i.e., a tax cut) at a 4% unemployment rate was nonsense, should be thankful today that the potentially negative impact of an inverted yield curve may be mostly neutralized by more aggressive fiscal juice,” he added.

Yield curve-recession doubts grow

Indeed, economists at UBS said on Thursday that “while U.S. growth is decelerating, this is only back to trend levels of 2%–2.5% [economic growth] as the benefits of tax cuts and higher government spending fade.”

Wall Street’s economy watchers doubt that the yield curve’s inversion means a contraction in growth will occur soon — if at all.

“For all the focus on the Treasury yield curve, other leading indicators of activity are not yet signaling that a recession is imminent. But their recent deterioration does suggest that the risks are rising and, even if a recession is avoided, they reinforce our view that economic growth is set to slow sharply,” said Andrew Hunter, senior U.S. economist at Capital Economics.

He added that while the yield curve is an accurate predictor of a recession, it may be “giving a misleading signal” this time around. “The truth is that the exact timing of recessions is notoriously hard to predict and any claims to the contrary should be viewed with caution,” Hunter wrote in a research note to clients.

Meanwhile, while the rate on the 3-month Treasury bill trended slightly higher than longer-dated paper on Thursday, yields along the rest of the curve have begun to normalize. It’s a sign that Wall Street expects the Federal Reserve will soon cut borrowing costs, after pausing its rate hike campaign.

Javier David is an editor for Yahoo Finance. Read more:

Don't sweat the inverted yield curve and its recession warning, experts say

U.S. manufacturing hits 21-month low amid 'deteriorating' economy: IHS-Markit

JPMorgan's Kolanovic: Stocks are a buy after the Fed's 'enormous shift'

Follow Javier on Twitter: @TeflonGeek

Yahoo Finance

Yahoo Finance