India's High Growth Tech Stocks Including Info Edge (India) And Two More

Over the last 7 days, the Indian market has dropped 3.2%, yet it has shown remarkable resilience with a 40% increase over the past year and earnings expected to grow by 17% annually in the coming years. In this dynamic environment, identifying high growth tech stocks like Info Edge (India) and others involves looking for companies that demonstrate robust growth potential and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies In India

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Tips Music | 24.69% | 24.16% | ★★★★★★ |

Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

Coforge | 15.41% | 23.18% | ★★★★★☆ |

C. E. Info Systems | 29.86% | 26.39% | ★★★★★★ |

Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

GFL | 44.50% | 49.42% | ★★★★★☆ |

Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

Avalon Technologies | 20.28% | 42.94% | ★★★★★☆ |

INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Info Edge (India)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited is an online classifieds company providing services in recruitment, matrimony, real estate, and education both in India and internationally, with a market capitalization of ?1.08 trillion.

Operations: The company generates revenue primarily from recruitment solutions and real estate services, with recruitment solutions contributing significantly more. It operates in India and internationally, focusing on online classifieds in various sectors.

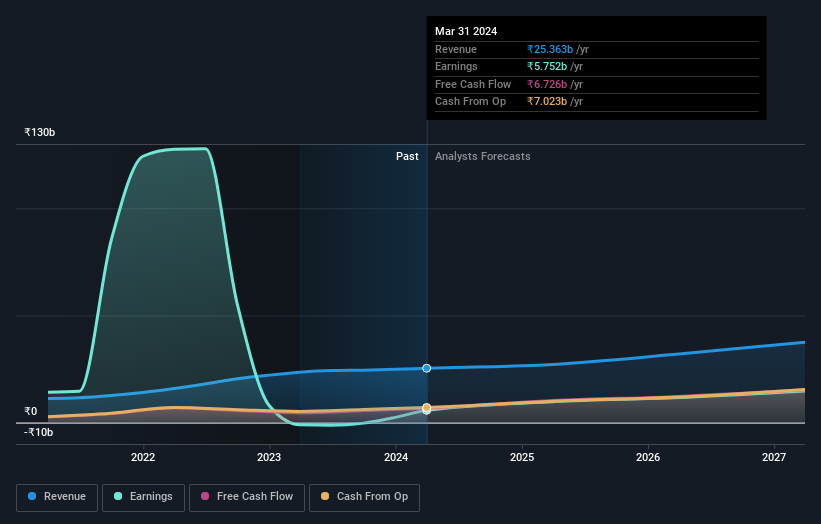

Info Edge (India) has demonstrated a robust trajectory with its earnings forecast to surge by 23.6% annually, outpacing the broader Indian market's growth of 17.3%. This growth is underpinned by a strategic increase in R&D spending, which not only fuels innovation but also enhances its competitive edge in the tech sector. Recently, the company decided to invest approximately INR 4.2 Crores in Nexstem India Private Limited, signaling its commitment to diversifying and strengthening its portfolio through targeted acquisitions and investments in emerging technologies. Moreover, with revenue expected to climb at 13% per year—faster than the market average of 10.1%—Info Edge is positioning itself as a dynamic player capable of sustaining high growth amidst evolving industry demands.

Take a closer look at Info Edge (India)'s potential here in our health report.

Assess Info Edge (India)'s past performance with our detailed historical performance reports.

PVR INOX

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PVR INOX Limited is a theatrical exhibition company involved in the exhibition, distribution, and production of movies across India and Sri Lanka, with a market capitalization of ?156.72 billion.

Operations: The company primarily generates revenue from movie exhibition, which amounts to ?59.48 billion. It operates in the theatrical exhibition industry across India and Sri Lanka, engaging in activities that include the distribution and production of films.

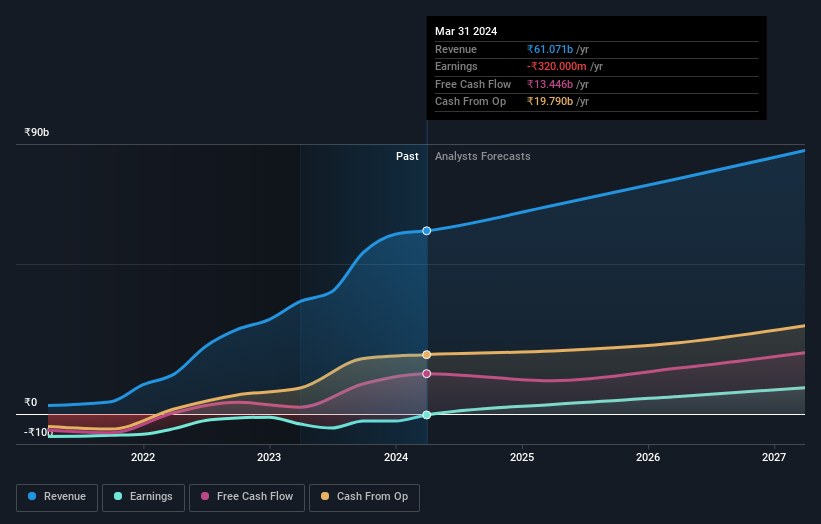

Despite PVR INOX's current unprofitability, its revenue is expected to grow by 12% annually, outpacing the broader Indian market's growth of 10.1%. This growth is supported by strategic expansions like the recent launch of a new cinema in Coimbatore, enhancing their presence in key markets. However, challenges remain as earnings are projected to surge by a significant 59.79% annually only over the next few years, indicating potential future profitability but current financial strain. The company’s commitment to innovation and customer experience is evident from their investment in cutting-edge cinema technologies and luxurious multiplex environments across India.

Click here to discover the nuances of PVR INOX with our detailed analytical health report.

Examine PVR INOX's past performance report to understand how it has performed in the past.

Tech Mahindra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tech Mahindra Limited offers information technology services and solutions across the Americas, Europe, India, and globally with a market capitalization of ?1.47 trillion.

Operations: The company generates revenue primarily from IT Services, accounting for ?439.48 billion, and Business Process Outsourcing (BPO), contributing ?78.94 billion.

Tech Mahindra's strategic focus on R&D is evident from its substantial investment, amounting to 6.9% of its revenue, underscoring a commitment to innovation and technology advancement. This allocation supports its significant earnings forecast growth of 28.9% annually, positioning it well above the broader market's expectation of 17.3%. Recent executive changes and regulatory challenges highlight a dynamic operational environment, yet the firm remains poised for robust future growth through initiatives like partnerships in emerging technologies such as ORAN and 6G with Northeastern University, promising enhanced network solutions and client services globally.

Dive into the specifics of Tech Mahindra here with our thorough health report.

Gain insights into Tech Mahindra's past trends and performance with our Past report.

Summing It All Up

Delve into our full catalog of 38 Indian High Growth Tech and AI Stocks here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:NAUKRI NSEI:PVRINOX and NSEI:TECHM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]