U.S. job losses are accelerating, and it's about to get much worse

The U.S. labor market is rapidly deteriorating.

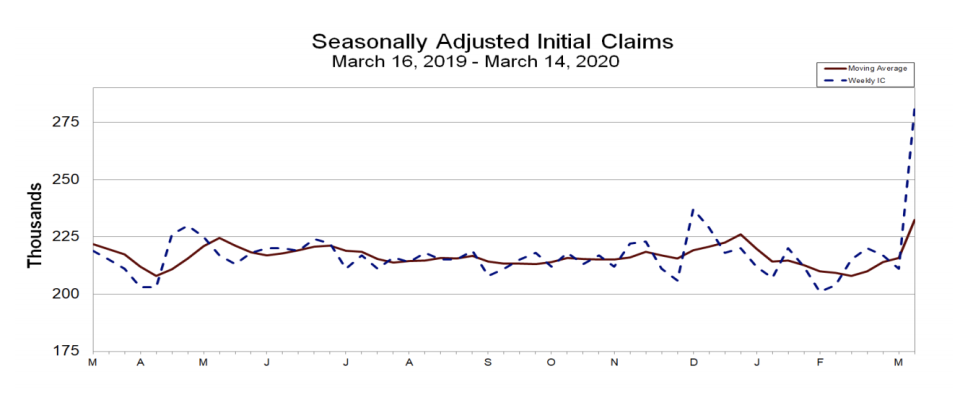

Initial weekly claims for unemployment insurance jumped to 281,000 during the week ending March 14. This was up from 211,000 the week prior, and it was much worse than the 220,000 expected by economists.

This is the highest reading since January 2018. And it comes as workers begin to lose jobs amid the coronavirus crisis.

[See Also: Unemployment insurance: What it is and how to get it]

“During the week ending March 14, the increase in initial claims are clearly attributable to impacts from the COVID-19 virus,” the Department of Labor said. “A number of states specifically cited COVID-19 related layoffs, while many states reported increased layoffs in service related industries broadly and in the accommodation and food services industries specifically, as well as in the transportation and warehousing industry, whether COVID-19 was identified directly or not.”

All signs suggest this will get much worse.

“Timelier reports of state-level data point to an unprecedented surge in layoffs over the next couple of weeks,” Capital Economics Andrew Hunter said following the report. “The more aggressive coronavirus containment measures imposed in recent days – involving the near total shutdown of the retail, leisure and travel sectors in some parts of the country – are clearly starting to have a dramatic impact on the labour market.”

Looking at the state-level data, Hunter noted that Ohio has received 80,000 initial jobless claims in the past three days alone. This is up from 7,051 the week prior.

“If the national data follow a similar pattern, overall jobless claims could surge to well over one million within the next couple of weeks, easily exceeding the peak of 665,000 in the depths of the 2007-09 recession,” Hunter said.

Even timelier than the state-level reports are Google search trends. Initial spotted by Renaissance Macro’s Neil Dutta and Bespoke Investment Group’s George Pearkes, searches for “unemployment benefits,” which tracks the Dept. of Labor’s official reports, have gone parabolic.

‘3.5 million jobs will be lost’

In a research note to clients on Thursday morning, Bank of America economists state: “The US recession is here.“

“We expect a total of approximately 3.5 million jobs will be lost with the biggest hit in 2Q of 1 million per month,” the economists wrote. “This will send the unemployment rate higher, nearly doubling to 6.3%.”

“The industries to be hit the hardest are leisure & hospitality and retail. These sectors have a high share of hourly workers - about 80% for the former and 70% for the latter. And these workers struggle to work from home. This means they are vulnerable to a reduction in hours worked and likely outright job cuts.”

[See Also: What to do before you lose your job]

Economists across Wall Street warn that uncertainty is very high as the coronavirus pandemic is unprecedented. And so, forecasts about anything come with a huge margin for error.

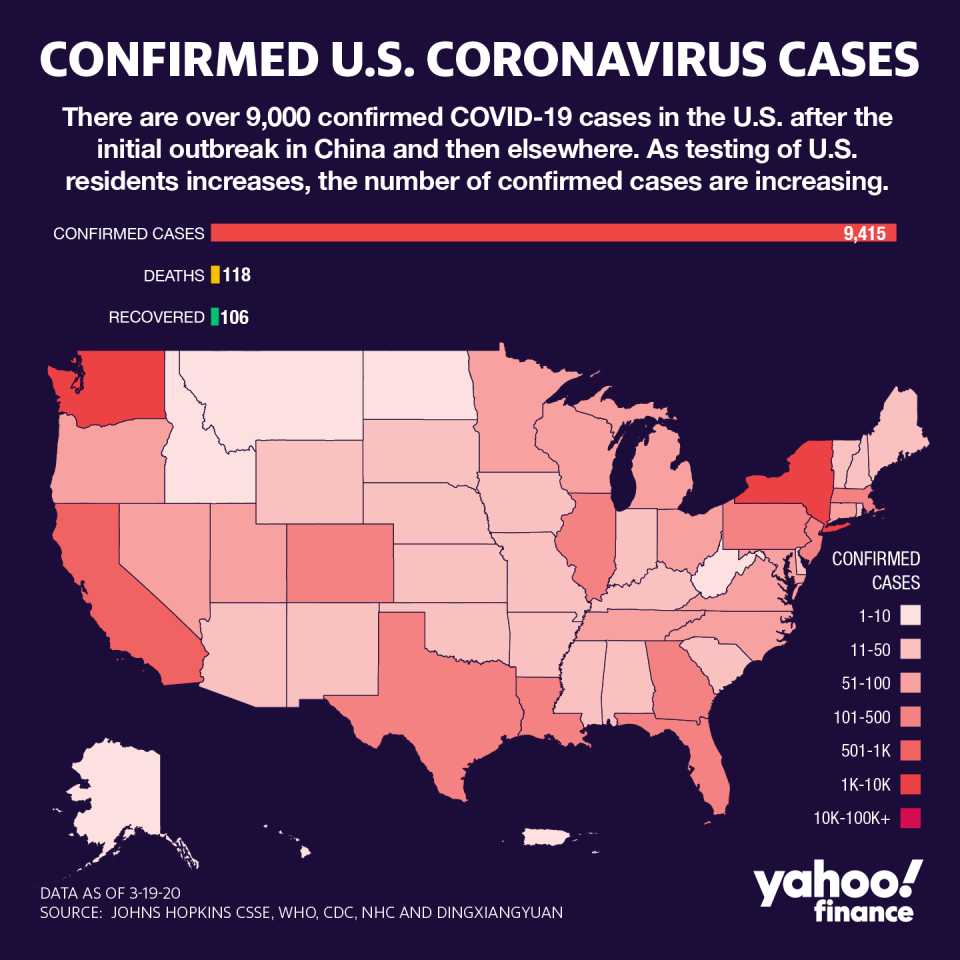

However, most economists agree that it won’t be until there’s an inflection in confirmed cases of COVID-19 that we can begin to get a sense of when and how the economy will recover.

“Spending and jobs in the economy won't come back come back until the virus counts of positive cases levels out and people are once again free to roam the Main Streets of America and frequent the shops and bars and restaurants again,” MUFG economist Chris Rupkey said.

—

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @SamRo

Read more:

'We are all in the dark': Wall Street's smartest are making guesstimates

Why Warren Buffett’s 2008 message to investors was perfectly timed

Why a big market rally right now is no reason to get excited

Something dangerous is happening beneath the surface of the selloff

The incredibly bullish force investors can’t afford to ignore

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay