Inside Look At Three Indian Growth Companies With High Insider Ownership

The Indian market has shown robust performance, rising 2.4% in the past week and achieving a remarkable 45% growth over the last year, with earnings projected to grow by 16% annually. In such an optimistic climate, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those most familiar with the business.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.5% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Let's uncover some gems from our specialized screener.

Chalet Hotels

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chalet Hotels Limited is an Indian company that owns, develops, manages, and operates hotels, with a market capitalization of approximately ?180.24 billion.

Operations: The company generates revenue primarily through its hospitality segment, which brought in ?12.93 billion, and its rental/annuity business, contributing ?1.24 billion.

Insider Ownership: 13.1%

Revenue Growth Forecast: 19.7% p.a.

Chalet Hotels, a company with high insider ownership in India, has shown promising growth prospects with its revenue and earnings forecasted to outpace the broader Indian market. Recent strategic hires and executive shifts aim to bolster its marketing and financial leadership amid ongoing legal challenges from GST demands which the company is contesting. Despite some concerns over interest coverage, Chalet's robust projected profit growth positions it well for future performance. However, shareholder dilution over the past year and moderate insider transactions may temper investor enthusiasm.

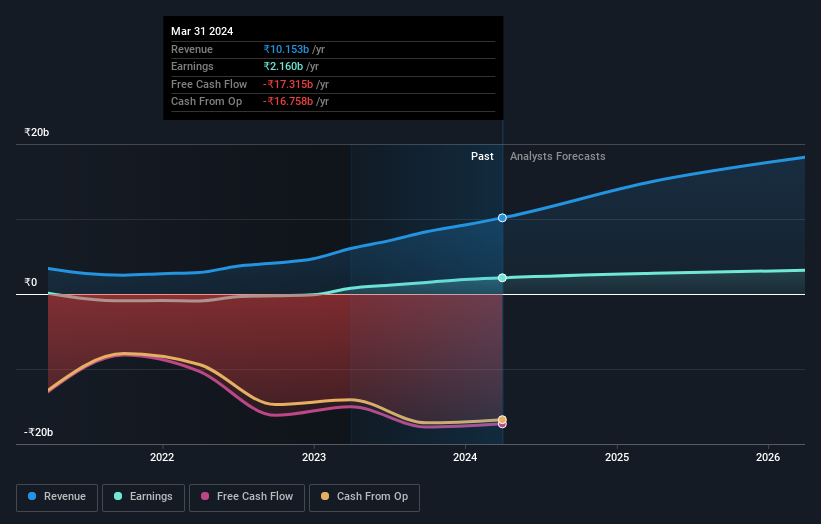

Suryoday Small Finance Bank

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suryoday Small Finance Bank Limited operates as a small finance bank in India, focusing on financial inclusion by serving primarily the unserved and underserved segments, with a market capitalization of approximately ?21.45 billion.

Operations: The bank's revenue is derived from treasury operations (?2.07 billion), corporate banking (?1.00 billion), and retail banking (?17.05 billion).

Insider Ownership: 25.6%

Revenue Growth Forecast: 29.8% p.a.

Suryoday Small Finance Bank, a growth-oriented company in India with high insider ownership, has recently seen substantial earnings growth. In the last fiscal year, its net interest income and net income saw significant increases. The bank is expected to continue this trajectory with revenue and earnings forecasted to grow at a robust pace annually. Recent appointments and executive changes, including a new Chief Information Officer, aim to enhance its digital banking capabilities. However, the bank does face challenges with a higher-than-average ratio of non-performing loans.

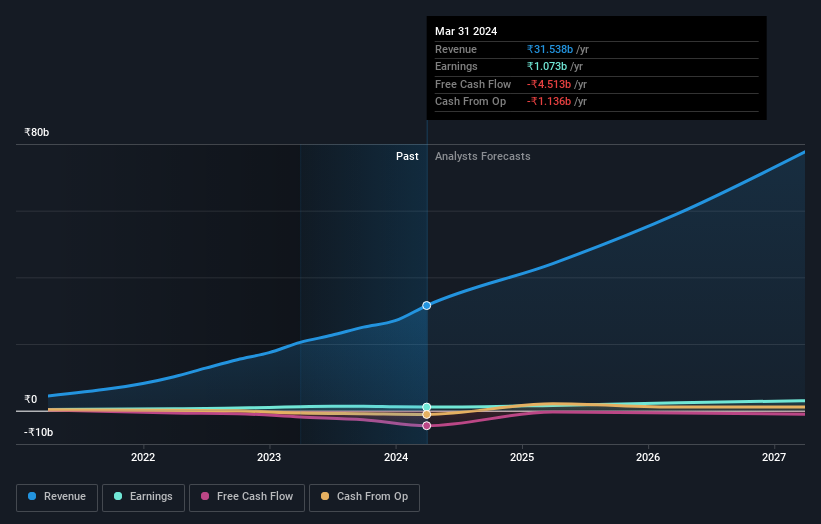

Syrma SGS Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Syrma SGS Technology Limited operates as a provider of turnkey electronic manufacturing services in India, the United States, Germany, and other international markets, with a market capitalization of approximately ?82.72 billion.

Operations: The company generates ?31.54 billion in revenue from electronic manufacturing services.

Insider Ownership: 27.8%

Revenue Growth Forecast: 22.1% p.a.

Syrma SGS Technology, a growth-focused firm in India with high insider ownership, is poised for substantial growth with earnings and revenue forecasted to outpace the Indian market significantly. Despite this promising outlook, the company's recent financial performance shows mixed results; while annual sales increased substantially, net income and profit margins have declined compared to the previous year. Moreover, a modest dividend proposal suggests potential concerns about cash flow coverage.

Where To Now?

Click this link to deep-dive into the 82 companies within our Fast Growing Indian Companies With High Insider Ownership screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:CHALETNSEI:SURYODAY and NSEI:SYRMA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]