Insurance ETFs Rally Through Hurricanes Milton, Helene

With the insurance industry positioned to be uniquely impacted by the recent hurricane activity hitting the southeastern United States, the two largest insurance ETFs are seeing increased volatility, but are maintaining relatively strong performance.

The $766 million iShares U.S. Insurance ETF (IAK) was up about 1% in mid-day trading Wednesday as Hurricane Milton was tracking as a Category 5 storm toward Tampa.

IAK, which tracks a market-capitalization weighted index of U.S. insurance companies, has a 16.4% weighting in Progressive Corp., an 11.8% weighting in Chubb Ltd., and 6.4% in Aflac Inc.

IAK is up 14.6% over the past three months and is up almost 29% so far this year.

By comparison, the SPDR S&P 500 ETF Trust (SPY) has gained 3.8% over the past three months and 21.3% this year.

KIE, IAK Gains

Meanwhile, the $922 million SPDR S&P Insurance ETF (KIE), which rallied by more than 1.2% in mid-day trading Wednesday, has shown performance similar to IAK this year.

“A lot of insurance companies have reduced their exposure to Florida, which should limit their payouts,” etf.com Senior Analyst Sumit Roy said.

“Insurance ETFs took a hit on Monday as it became apparent how powerful Hurricane Milton would be, with IAK falling by 3.6% on the session,” he said. “However, IAK has since recovered more than half of those losses and the ETF continues to outperform the broader stock market handily for the year as a whole.”

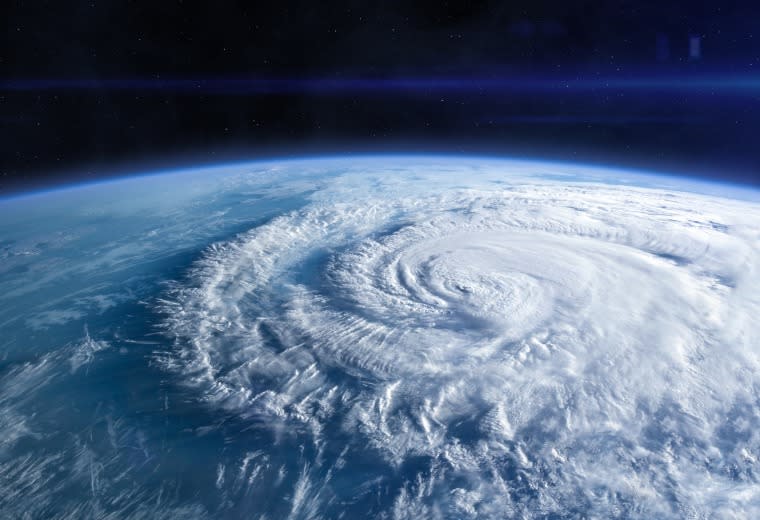

Hurricane Helene, a Category 4 storm that ravaged through Florida, Georgia, South Carolina and North Carolina, left property owners with an estimated $48 billion worth of losses.

The damage from Milton—described as a once-in-a-century storm—is expected to be worse than Helene, especially since it is hitting parts of Florida that were already impacted by Helene.

KIE, which has seen $14.5 million worth of net inflows this year, took in $3 million over the past five trading days.

Net flows into IAK this year have topped $184 million, but the ETF has experienced $6.5 million worth of net outflows over the past five trading days.

Meanwhile, one ETF that would seem well suited for the past few weeks, the Procure Disaster Recovery Strategy ETF (FIXT) announced last week plans to liquidate on Oct. 17. Launched in June 2022, FIXT tracks an equal weighted index of globally listed companies that aid in natural disaster recovery strategies.

The ETF, which has just $3 million, is up more than 28% from the start of the year.

According to a statement from ProcureAM in Levittown, Pennsylvania, the decision to close FIXT was part of the company’s “commitment to responding to investors’ needs” and “includes a regular review of its product lineup.”