Investors enter 2017 in front of a stock market 'steam roller'

The stock market looks very expensive.

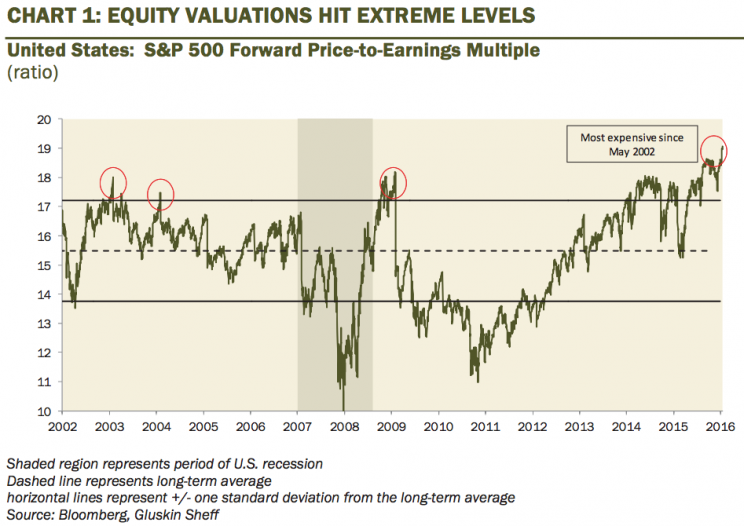

Stock prices have been rallying as earnings growth has been stagnating, which has inflated the forward price/earnings (P/E) multiple on the S&P 500 (^GSPC) to levels we haven’t seen in years.

“[A]t this stage, chasing the rally is akin to picking up nickels in front of a steam roller,” Gluskin Sheff’s David Rosenberg wrote on Wednesday. “[T]he forward multiple is back challenging the cycle highs and already tops the 2007 peak which is worrisome to me, but obviously not the masses.”

It’s totally fair to say stocks are looking very expensive. And to some extent, it’s arguably fair to suggest that P/Es have historically reverted to their long-term averages (although not everyone would say that), which is a risk to prices.

But it’s a big mistake to argue that stock prices are doomed to fall soon because P/Es are too high.

In other words, you may be face-to-face with the steam roller. But that’s not to say that steam roller will ever actually crush you.

High P/Es reveal nothing about the near-term moves

Most experts agree that P/Es should be considered in the context of interest rates and/or inflation rates. Most experts would also acknowledge that P/E ratios, nevertheless, reveal little about how the market will move in the near-term.

“The forward P/E is a horrible indicator,” BMO’s Brian Belski said to Yahoo Finance.

Belski’s seen it all in his 27+ years on Wall Street, and he has shared some very smart observations about P/Es. In an October 2015 note to clients, Belski wrote (emphasis ours): “we have found that the average P/E at the end of prior bull markets has fluctuated rather significantly, averaging 18.4x but with a standard deviation of 5.4x. This suggests to us that valuation by itself is not reason enough for a bull market to end.”

As you can see, there’s no P/E level that signals an end to a bull market. Furthermore, we see that P/E ratios will sometimes drift very far above its average before stock prices turn. Notably, there are instances when a bull market will end even when P/Es suggest stocks are cheap.

Earnings growth becomes critical

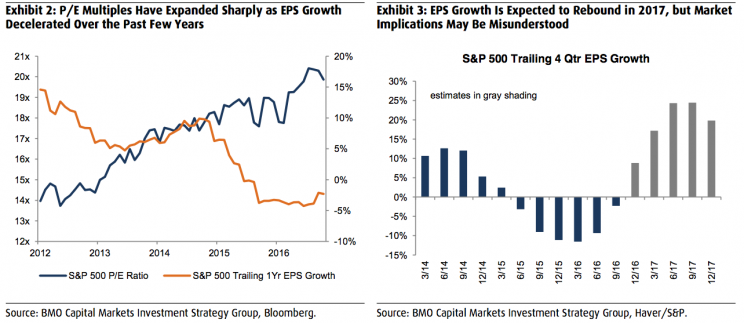

Belski’s outlook for the stock market is not dictated by his expectations for P/E multiples. However, he does consider the role P/E fluctuations played in getting the market to where it is today.

“We believe the S&P 500 has a very good chance of delivering at least high-single-digit percentage gains in 2017 as the market transitions from P/E to EPS-driven gains and copes with the positives and negatives associated with a Trump administration and the changing policy dynamics it generates,” he said in a November 18 note.

An expanding P/E is a normal occurrence in bull markets. But in this next phase, Belski sees the market being fueled by earnings growth.

He reiterated: “Valuation multiple expansion has been a key contributor to stock market performance over the past several years as earnings growth has decelerated. However, given above-average valuation levels, we believe this trend has largely played out (particularly given the interest rate and inflation outlook), and earnings growth will be required for the next leg higher.”

This thesis is very similar to what we heard in June from RBA’s Richard Bernstein. (It’s no surprise Belski and Bernstein think similarly since they were long-time colleagues at Merrill Lynch years ago.)

“One of the most frustrating statements we hear is that bull markets are impossible without price/earnings ratios expanding,” Bernstein said at the time. “History shows that this simply is not true… There have been interest rate-driven bull markets during which interest rates fall and PE multiples expand, but there have also been earnings-driven bull markets during which interest rates rise and PE multiples contract.”

Indeed, earnings growth would assuage investor concerns over bloated P/Es.

P/Es might actually not be all that stretched

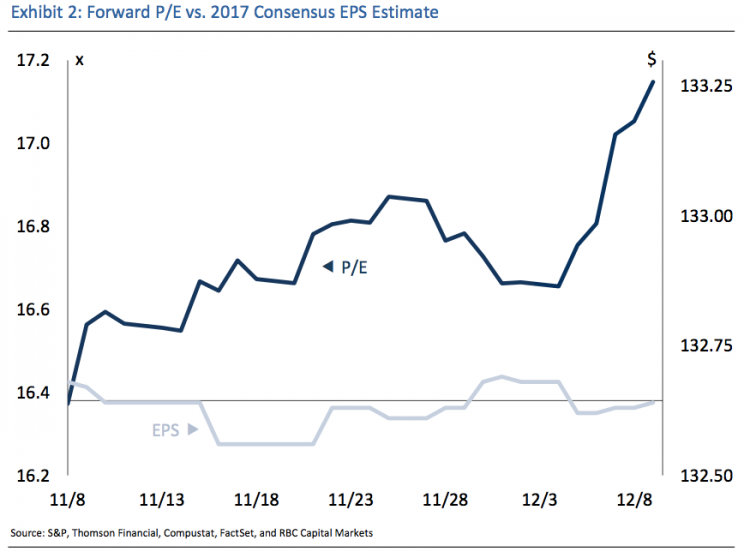

One story that’s been flying under the radar is how Donald Trump’s election is impacting the outlook for earnings. Keep in mind, the “E” in forward P/Es are 12-month forecasts for earnings.

And while most strategists agree that Trump’s proposals — should they be enacted — would be a big net positive for earnings, few have actually tweaked their official published earnings estimates.

“The ‘P’ is up but the ‘E’ is effectively stale,” RBC’s Jonathan Golub said to Yahoo Finance. “[We have] a market that has a P/E lower than the stated number and an ‘E’ that’s lower than the stated number.”

In other words, this forward P/E measure that has people freaked out is actually a bit of a mirage.

So, what gives?

“Analysts tend to be cautious in adjusting estimates following breaking news, acting only after ascertaining company-specific impacts,” Golub said. “Investors, by contrast, are quicker to respond to incomplete information.”

In other words, Golub is saying that investors are already pricing in the expectations for better earnings growth, which is driving up the “P.” Meanwhile, most analysts have yet to pull the trigger on their post-Election updated forecasts for earnings.

“This timing difference creates the false impression that valuations are stretched, and should correct as analysts catch up to the market,” Golub said.

So then, what’s taking so long?

Belski attributes this to issues within the business of forecasting where, as he says, “analysts are almost always wrong.”

“We are so afraid of being wrong that we don’t wanna be right,” Belski said, speaking to the issue of career risk. You see, there is a tendency for analysts to herd when they make forecasts. The rationale: it’s better to be wrong with everyone else than to be right at the risk of being wrong alone.

Belski and Golub have their money where their bullish mouths are. For 2017, Belski expects the S&P 500 to rally to 2,350 on EPS of $134, which is the highest EPS forecast of strategists followed by Yahoo Finance. Meanwhile, Golub is the most bullish strategist we follow with an S&P target of 2,500 target on EPS of $128.

Both Belski and Golub expect 2017 to be a year where earnings estimates are gradually revised up.

–

Sam Ro is managing editor at Yahoo Finance.

Read more: