Now’s not the time to report disappointing earnings: Morning Brief

Monday, October 19, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Worse-than-expected earnings are coming with worse-than-average stock performance

Earnings season is gaining steam. IBM (IBM), Netflix (NFLX), Tesla (TSLA), and Yahoo Finance parent Verizon (VZ) are among the big names announcing Q3 financial results this week.

As Morning Brief readers know, the bar is already set high for companies to deliver impressive results as signaled by elevated stock prices, upward earnings estimate revisions, and bullish investor positioning.

It’s still pretty early in the season with only about 10% of the S&P 500’s (^GSPC) market cap having announced results. But on average, companies have been blowing out their numbers.

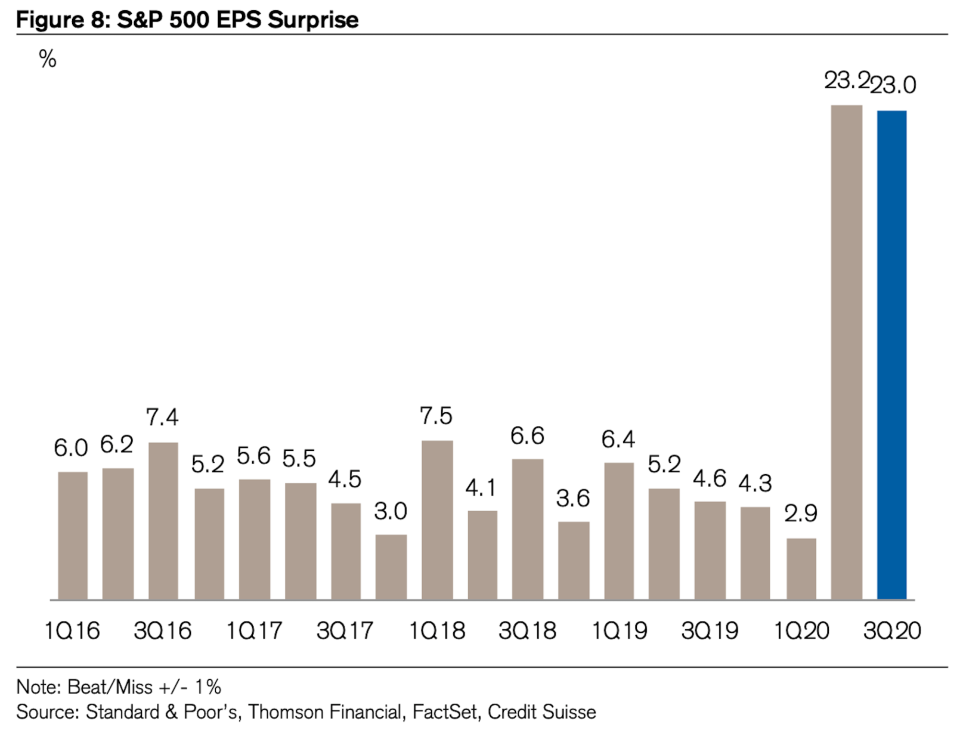

“Earnings have surpassed estimates by 23.0% in aggregate, with 86% of companies beating their projections,” Credit Suisse’s Jonathan Golub observed in a note to clients on Friday.

That 23% compares with the five-year average of just 5.6%, according to FactSet data.

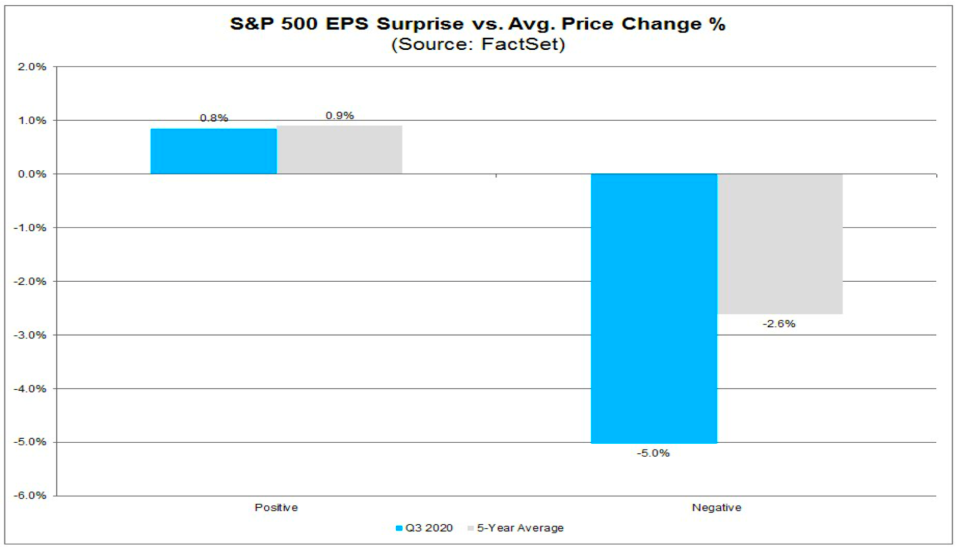

The fact that the companies beating estimates are beating by such a wide margin may be putting increased pressure on the stocks of companies missing estimates.

Indeed, investors seem to be punishing these negative surprises by sending stocks down by more than what we’ve seen in recent history.

“Companies that have reported negative earnings surprises for Q3 2020 have seen an average price decrease of -5.0% two days before the earnings release through two days after the earnings,” FactSet’s John Butters observed on Friday. “This percentage decrease is much larger than the 5-year average price decrease of -2.6% during this same window for companies reporting negative earnings surprises.”

It’s very early during this earnings season and these averages represent a pretty small sampling of the market.

But the numbers are not surprising given all the market warning signs we’ve seen in recent weeks.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

10:00 a.m. ET: NAHB Housing Market Index, October (83 expected, 83 in September)

Earnings

Pre-market

6:45 a.m. ET: Halliburton (HAL) is expected to report adjusted earnings of 8 cents per share on revenue of $3.11 billion

Post-market

4:05 p.m. ET: IBM (IBM) is expected to report adjusted earnings of $4.07 per share on revenue of $20.86 billion

Top News

Stocks up on US vaccine hopes this year despite China GDP miss [Yahoo Finance UK]

China’s economy plows on as world’s only major growth engine [Bloomberg]

Pelosi shifts deadline if Trump wants pre-election stimulus [Bloomberg]

EU set to gain WTO clearance for U.S. tariffs next week [Reuters]

YAHOO FINANCE HIGHLIGHTS

Facebook is 'the 800-pound gorilla in the misinformation market'

Millions of Americans are entering poverty amid pandemic as stimulus runs out

PepsiCo to invest $170 million to empower Hispanics, promote diversity

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay