Why some investors are worried about Amazon

Amazon reported revenue of $56.6 billion in the third quarter of 2018, missing Wall Street targets by 1%. The miss sent shares (AMZN) plummeting by nearly 10% during Friday early trading.

While it doesn’t sound like a big miss, the results are hardly impressive for the e-commerce behemoth which has been impressing investors in recent years. The company’s fourth-quarter revenue guidance also bummed many, while some worry that Amazon’s rapid expansion may be pausing.

Lower revenue guidance

Amazon expects net sales to grow between $66.5 billion and $72.5 billion, or 10% and 20%, compared with the fourth quarter of 2017. The midpoint of the guidance is about 25% below analysts’ expectations.

Rising costs is one of the major reasons why Amazon lowered its guidance. Amazon CFO Brian Olsavsky said the wage increase for nearly 400,000 employees in the U.S. and the U.K was factored into its fourth-quarter guidance and will impact guidance in 2019. Credit Suisse estimates the wage increases will cost Amazon an incremental $300 million in the fourth quarter and $1.1 billion more in 2019.

Amazon denied any negative effect of rising transportation costs related to the USPS plans to hike rates. “We’re not expecting a material impact from these rate changes in 2019,” Olsavsky said on Thursday. “Annual rate increases from our transportation partners is a really regular occurrence, and we negotiate hard, and we’ll always work hard internally to get even more efficient on our shipping method.”

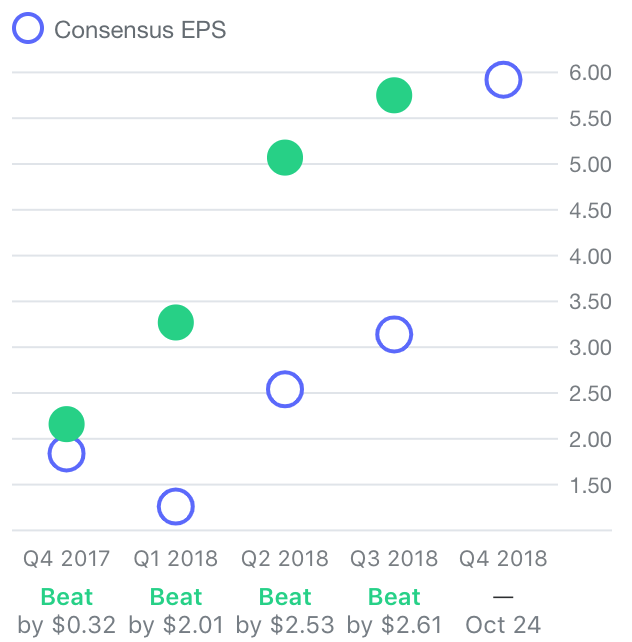

Amazon has a stunning record of beating its fourth-quarter guidance. It has exceeded the mid-point of guidance by an average of 94% over the past three years, with the lowest beat at 63% upside in 2015, according to Piper Jaffray. Analysts believe Amazon will continue to beat on the bottom line.

Commerce challenged domestically and overseas

The sales growth slowdown has raised a red flag for investors. Net sales growth has moderated to 29.3% — the weakest quarterly growth rate in over a year and a material slowdown from the past three quarters.

International sales growth of 13.4% marked a steep deceleration from 30.8% last quarter. Amazon’s business overseas now accounts for more than a quarter of total sales. Amazon attributed the slowdown to the acquisition of the Middle East e-commerce website Souk and the Diwali, India’s biggest holiday, which was pushed to the fourth quarter.

With 17 websites globally, Amazon has been heavily invested in the overseas market, which is still a money-losing segment for the company. It lost a bidding war for Flipkart in India and committed to spending $5 billion in the country, where it sees the fastest Prime membership growth rate.

Close to home, the competition in the online space is intensifying as well. Walmart and Target have been facilitating online delivery and leveraging in-store pick-up. Department store chains like Macy’s have also doubled down on digital investments. This holiday season, for instance, Target is offering free delivery with no minimum purchase required.

“The U.S. e-commerce market is also becoming saturated in books, electronics and groceries, fashion, there’s greater competition,” said Cooper Smith, head of Amazon research at Gartner L2, in an email. “Amazon is transitioning from being a company focused on customer acquisition and trying to figure out how it can increase the ARPU (Average revenue per user) of users and sellers.”

GlobalData research shows that online consumers are now using more online retail sites than a year ago, and spending is being spread more thinly among a greater number of retailers.

“Amazon needs to work doubly hard on the retail side as other determined players are now becoming more aggressive and are gaining ground,” said Neil Saunders, managing director of retail at GlobalData.

Krystal Hu covers technology and economy for Yahoo Finance. Follow her on Twitter.

Read more:

Some Amazon employees say they will make less after the raise

Amazon bought Whole Foods a year ago. Here’s what has changed