Jamie Dimon backs minimum wage hike: ‘We’ve got to give people more of a living wage’

The chief executive of the largest bank in the U.S. is fed up with the low pay received by many Americans. JPMorgan Chase (JPM) CEO Jamie Dimon, who has received criticism for the rate of entry-level pay at his bank, said in a new interview he’s “generally” in favor of minumum wages going up.

“We’ve got to give people more of a living wage,” he says.

Dimon qualified his support, noting that increasing the minimum wage nationwide could slow down U.S. economic performance.

“If the federal maybe raises, then states should do more locally so it doesn't damage the economy too much,” he adds.

Dimon voiced a similar position in his annual shareholder letter, in April, in which he noted that “forty percent of American workers earn less than $15 an hour, and about 5% of full-time American workers earn the minimum wage or less, which is certainly not a living wage.”

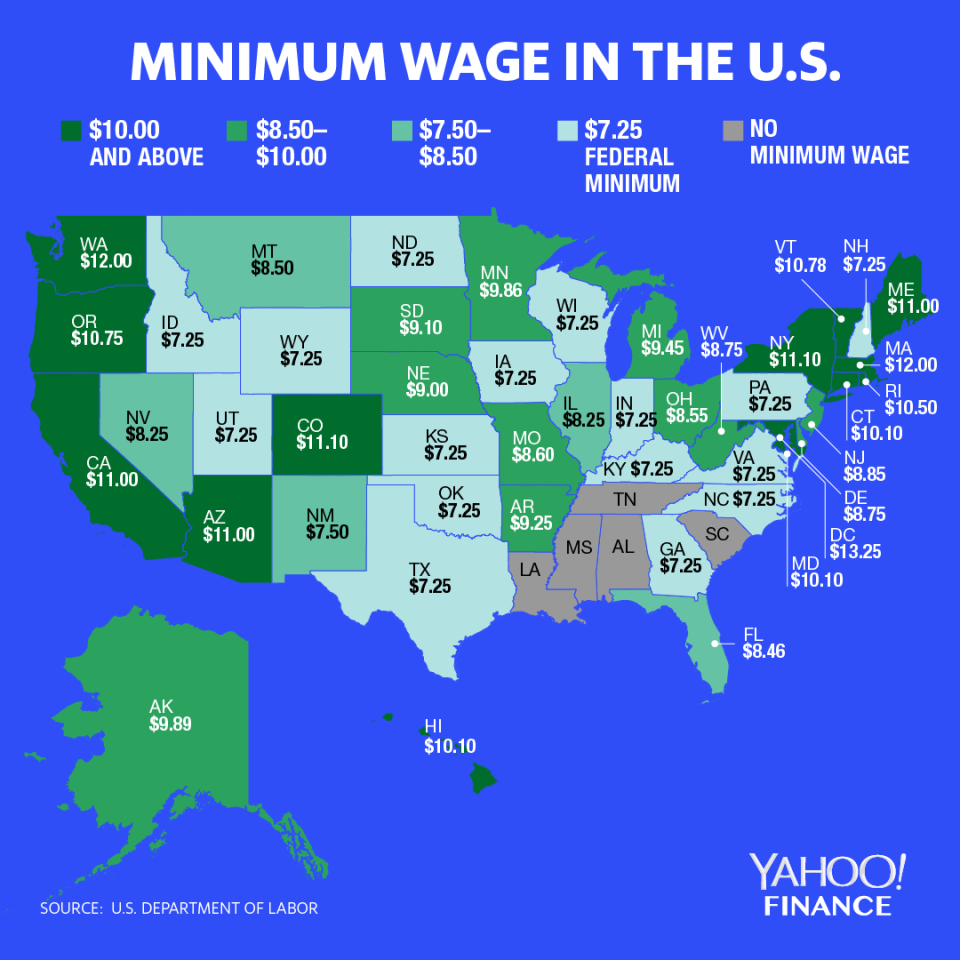

The federal minimum wage currently stands at $7.25 an hour, a rate that was set 10 years ago. In March, House Democrats took a significant step toward the passage of a bill that would set a $15 minimum wage, advancing the measure out of committee. House Speaker Nancy Pelosi, who supports the bill, plans to bring it to a full vote in the chamber. Even if the bill were to pass, it would likely fail to gain support from the GOP-controlled senate and President Donald Trump.

The minimum starting wage at JPMorgan Chase is $16.50 per hour, though it can start at $18 for workers in high-cost regions.

“Remember, that's already at the median level of Americans,” Dimon said of the entry-level wage. “And hopefully, it's the first rung on the ladder.”

Bank of America announced in April that its hourly pay would rise to $17 in May and increase to $20 by 2021. At a hearing on Capitol Hill that month, Rep. Katie Porter (D-CA) pressed Dimon on the entry-level wage at the bank, detailing the budget of a single mother who made $16.50 per hour at the company but could not afford to support herself and her daughter. "Would you recommend that she overdraft at your bank and be charged overdraft fees?" Porter asked.

"I don't know,” Dimon said. “I'd have to think about it.”

In the interview with Serwer, Dimon said the bank might raise its minimum pay in the coming years.

“It may go up over time,” he says. “We look at it every year and decide how we're going to compete or not.”

Dimon made the comments to Yahoo Finance Editor-in-Chief Andy Serwer in a conversation that aired on Yahoo Finance in an episode of “Influencers with Andy Serwer,” a weekly interview series with leaders in business, politics, and entertainment.

Democratic lawmakers have also targeted the tens of millions in compensation received by top bank executives, including Dimon, who received $31 million in compensation last year. The ratio between CEO pay and entry-level wages at JPMorgan Chase stands at 381:1, ranking it second highest among the large banks, after Citigroup.

But juxtaposition of CEO and entry-level pay is “comparing apples and oranges,” Dimon tells Serwer, calling the calculation “a complete waste of time.”

“People don't think clearly about stuff like that,” he adds. “We treat our people well, we educate our people, we give them a huge opportunity — and that's what we should do.”

Dimon pointed to the benefits package JPMorgan offers entry-level employees, recounting how the company improved its health care coverage when he found out some employees couldn’t afford the deductibles.

“The second we found out for our lower paid folks making under $60,000 a year, we cut the deductible to the extent that if they do the wellness programs it's effectively zero,” he says.

Dimon also pointed to the competitive pressure that compels him to pay enough to hire and retain effective workers.

“To act like somehow I can steal from them and do a good job at my company is a little bit crazy,” he says.

Andy Serwer is editor-in-chief of Yahoo Finance. Follow him on Twitter: @serwer.

Read more:

Jamie Dimon: Donald Trump should 'walk away' if he can't get a good deal with China

Jamie Dimon: Donald Trump deserves ‘some’ credit for the strong economy

Charlie Munger: Trump is not primarily responsible for US economic success