'The sun will shine again': Jefferies CEO Rich Handler encourages next generation amid coronavirus

Jefferies (JEF) CEO Rich Handler usually keeps a low-profile, rarely being quoted in the press and never appearing on financial television.

Lately, however, the 58-year-old has grown his presence on social media, with more than 15,000 followers on his Instagram account. In a surprising move two weeks ago, the usually media-shy CEO did a Q&A with @litquidity, a popular Instagram account with more than 265,000 followers known for its finance memes.

Handler, the longest-serving CEO of a Wall Street investment bank, was interviewed by Yahoo Finance to discuss how he thinks about management, careers, and communication as the coronavirus pandemic has quickly changed everything. He also spoke about the issue all of his client conversations involve.

Furthermore, he discusses how he’s grown to appreciate the value of social media as a way to communicate with and connect with millennials, including current and prospective employees.

Handler, who’s seen his fair share of crises in his career, explains why “This one feels the most scary.”

Nevertheless, his overall message is one of encouragement and optimism.

‘The world sucks right now my friends’

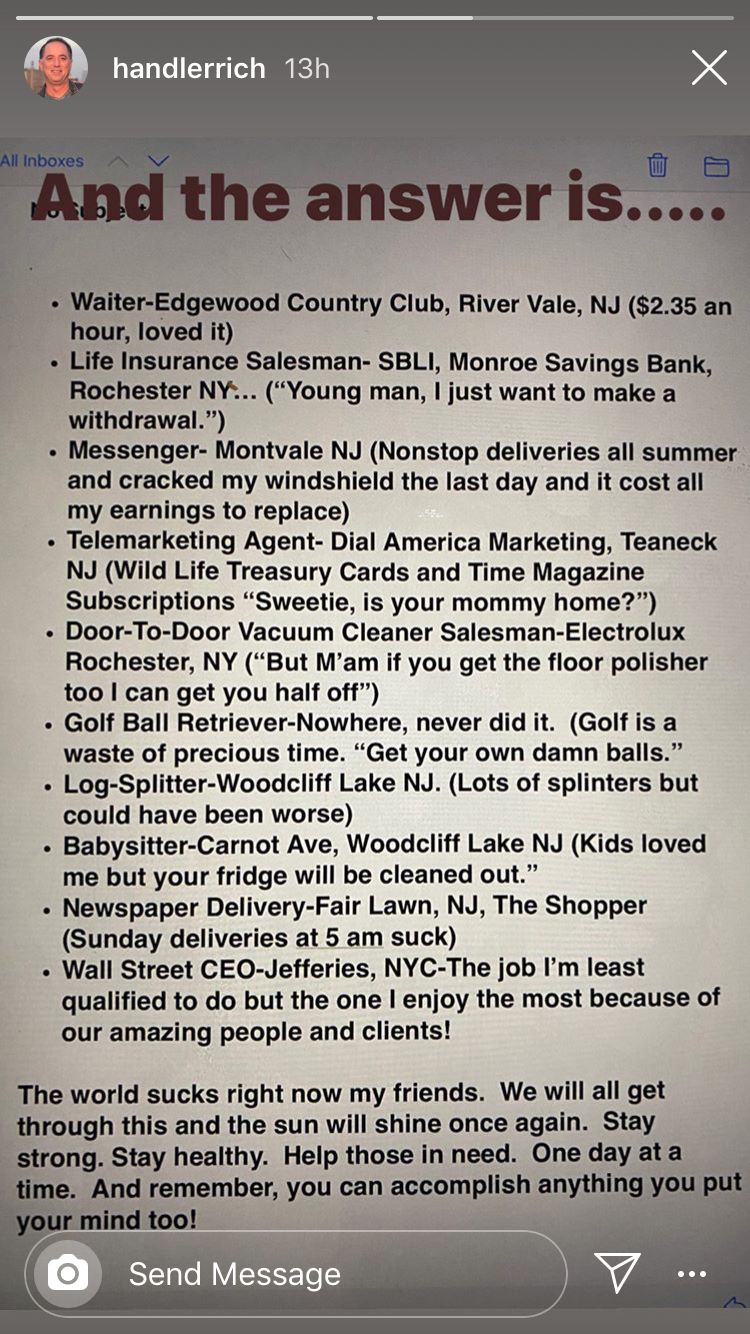

Handler recently posted an Instagram story entitled "nine jobs I have had and one lie." The list included "waiter, life insurance salesman, messenger, telemarketing agent, door-to-door vacuum cleaner salesman, golfball retriever, log-splitter, babysitter, newspaper delivery, Wall Street CEO."

The post also included a message: “The world sucks right now my friends. We will get through this and the sun will shine once again. Stay strong. Stay healthy. Help those in need. One day at a time. And remember, you can accomplish anything you put your mind [to]!”

About 13,000 people "viewed" the story, and almost 1,000 guesses flooded Handler's direct messages. He also received a deluge of messages expressing their appreciation for Handler's post and the messaging around it.

It turns out the "lie" for Handler is that he never had a job picking up golf balls. The bank CEO doesn't even play golf.

"I guess I don't look that trustworthy because most followers guessed I was never a babysitter," Handler told Yahoo Finance. "A lot of them have been appreciative that I showed in a very light manner anything is truly possible."

He revealed the worst job he held was selling Electrolux Vacuum Cleaners door-to-door in the winter in Rochester, New York.

"But I learned a lot, and it's a great vacuum!" he added.

'A long race and never a straight path'

The fleeting social media post struck a chord with the younger generation: Users began expressing their appreciation to the finance executive.

"I wanted people, especially younger ones who are beginning their career to realize that there are many paths to success and remember that everybody starts at the bottom,” Handler said. “It also shows that it is a long race and never a straight path, so people shouldn't be all consumed that the coronavirus detour will ruin their lives forever.”

A native of New Jersey and alumnus of the University of Rochester, a younger Handler learned from those early job experiences that shaped his career in finance today.

"When you are a waiter, a vacuum cleaner salesman, or a delivery person, you learn how people treat you,” he said. “I learned how I wanted to be treated and made sure that is how I treat others. Basically, you just want to be a good person. To this day, it amazes me how people will treat me before and after they realize what I do for a living. I push away all the phonies and surround myself with as many high-quality humans I possibly can. That is pretty much my secret for success."

‘I learn more from them than they do from me’

While publicly-traded company CEOs have increasingly embraced social media in recent years, setting up Twitter accounts and the occasional Instagram account, they tend to appear buttoned-up and very corporate. Handler, who runs his account, was encouraged by his millennial daughter, Skylar (@skylarhandler), to give Instagram a try. The idea was to clear up misconceptions about Wall Streeters, who were "broad-brushed as bad people" after the financial crisis.

"I have a lot of very good friends in the industry who are hardworking, love their families and friends, and are hugely philanthropic," Handler, whose firm never took bailout money during the crisis, said of his decision to join the platform. He added that the industry is comprised of "real people with the same hopes, fears, and beliefs as everyone else."

Handler's unfiltered approach to social media sometimes includes him appearing on his daughter's account with a pasta sauce stain on a white t-shirt or jumping on a trampoline in a group fitness class.

"Skylar has a way of making me look even more ridiculous than I am which she says is 'not very hard.'"

What Instagram ultimately provides Handler is a conduit to connect with Millennials and Gen-Z on their turf and in their language.

"I love spending time and having lunches with the juniors at Jefferies,” he said. “I learn more from them than they do from me. This platform allows me to share whatever knowledge I have picked up over the years and spread it to an even broader group. I'm a big believer that life is not zero-sum, and this next generation will need all the experience they can soak in to make their world a better place.”

'This one feels the most scary'

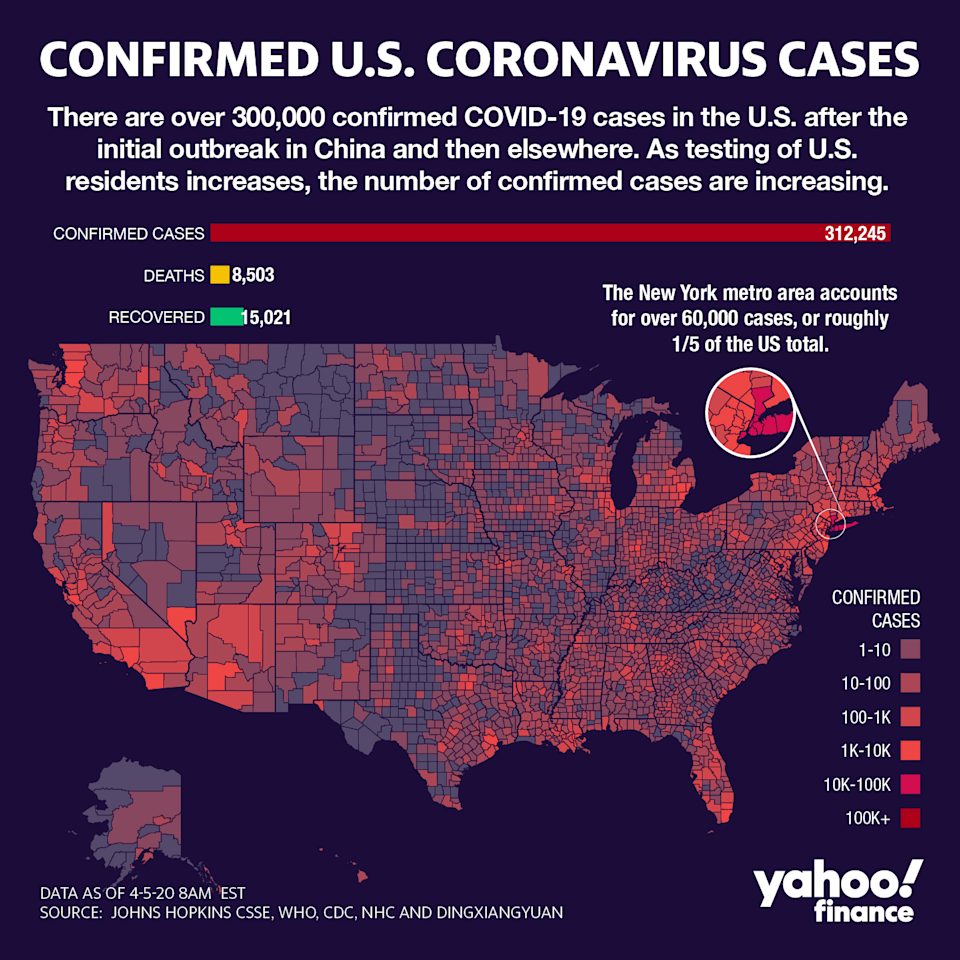

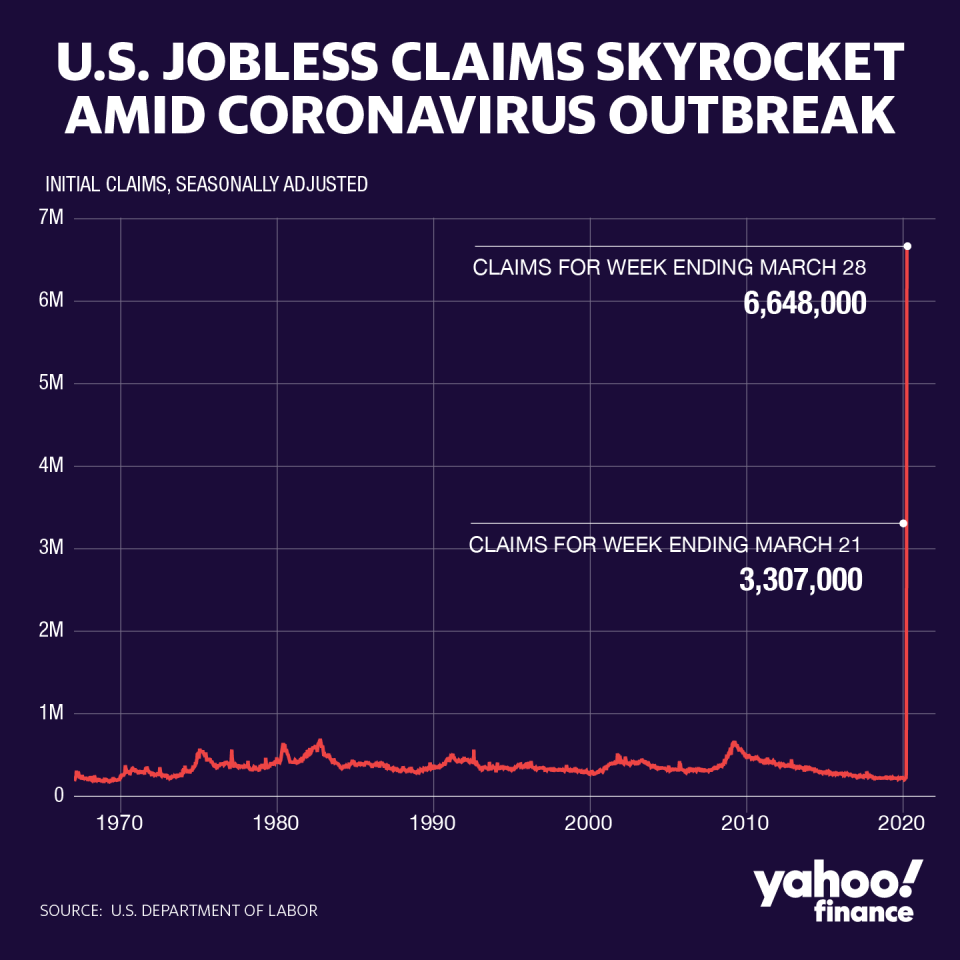

At the moment, Handler has a lot of empathy for young people who might be scared about their future because of COVID-19's devastation on the economy.

"It is very natural,” he said. “I graduated from business school in 1987, and the stock market crashed. I joined Jefferies in 1990 because Drexel Burnham went bankrupt when the savings and loans and high yield market crashed.”

Handler became CEO right after the dot-com bubble burst, then navigated the 2008 financial crisis and a short seller's attack during the 2011 sovereign debt collapse. Now he's providing perspective from the thick of the COVID-19 pandemic.

"The very definition of a crisis implies something horrible that you feel you might not survive,” he said. “Unfortunately, I've been through many of them, which only means I'm getting old. This one feels the most scary because it has the added dimension of health combined with the broadest economic harm I have ever seen. People and companies don't feel safe. That is a scary combination.”

'Lightspeed change'

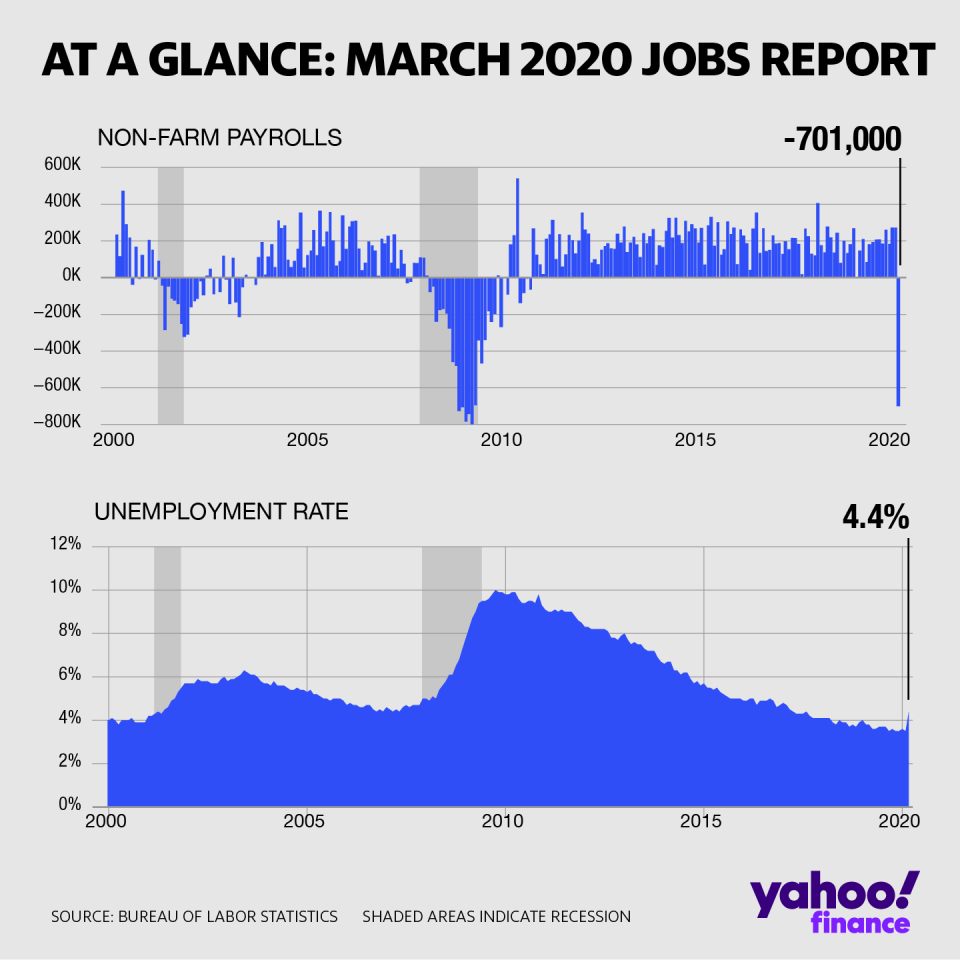

Heading into this crisis, the broader financial sector, including Jefferies, "has never entered a crisis from a position of greater strength," he explained. What's more, the economy was "incredibly solid" just a month ago, driven by strong consumer confidence and record low unemployment, interest rates, and inflation.

Jefferies, often considered a bellwether for the banks as it reports earnings on a slightly different fiscal calendar, reported record first-quarter results on March 26, which is now "all but ancient history, given the recent lightspeed change in the economy and financial markets."

"Our latest earnings report showed that virtually every area of the firm was doing well enough to allow us to establish an all-time quarterly record as recently as February 28. It is a whole new world today that everyone is dealing with, including ourselves," he told Yahoo Finance.

That said, like many of the bulge bracket banks, Handler said Jefferies has "not considered layoffs aside from the few underperformers," and the firm is "actively continuing to recruit."

His message to the younger generations is that these cycles are unfortunately part of life. That said, they usher in opportunities and a chance to "learn, re-evaluate, and grow."

"Worrying about things you can't control does you no good. Have your eyes wide open, talk to everyone smart, read everything, ask questions and fully engage and this will be the best learning experience you can have," Handler said.

With college and university campuses closed and classes and graduation now being held online, students are questioning what that means for their summer internship or a new job offer in this new work-from-home world.

"Every company, including ours, desperately wants our summer interns and new recruits to start on time. It is possible that the programs are shorter, or the dates may change, or there will be more 'online' and virtual experiences. All of this is possible. If this takes longer than any of us think and we cannot go back to our offices, each company will have to decide what is best and realistic for their people and their programs," Handler said.

'You cannot overcommunicate'

Like many companies, Jefferies and its 4,000 employees around the world — from its investment bankers, analysts, traders, risk managers, tech support staff — are working remotely. Approximately 97% of the employees at Jefferies are work-from-home, and no one has to be in the office.

"We now know the business world can function in a virtual manner. This will have major implications for every industry, including finance," he said.

Even working remotely, Handler's job as CEO is around the clock, and he's regularly communicating with employees and clients.

"In times like this, you cannot overcommunicate. I am talking continually to clients, employees, health providers, people related to the government, and literally every other smart person I know. I personally like writing and sharing as it allows me to synthesize my thoughts and share them broadly in an efficient and semi cathartic way. The job today is seven days a week, and no time off in the evenings," he said.

In this market environment, the firm is taking a "more defensive" approach and using its capital to provide liquidity for clients. He doesn't sugarcoat the situation either.

"We expect to be in this tough period for the quarter, and perhaps two. There are things that could improve this outlook, and while we are hoping for them, we are not counting on them," Handler said of the market.

From his vantage point, Handler is keenly aware of the economic pain experienced by businesses because of the virus. That's because Jefferies' investment banking clients, which mostly consist of mid-sized public and private companies across industries, represent what he calls "a true cross-section of the economy." While the epicenter of the last crisis was the big banks that required bailouts in 2008, this time, it's the broader business community that's at the heart of this crisis.

In his conversations with clients, he hears that they all want "to extend their runway to be in a satisfactory spot once the pandemic passes."

"All conversations are about this issue. All these companies were healthy four weeks ago. None of them, nor their people did anything wrong. We need to help all of these companies survive this incredibly difficult period. We also need to help all the workers survive. Then, the workers can go back to their companies, and the economy can restart," he said.

'The sun will shine again'

He described the historic $2 trillion emergency stimulus package, the CARES Act, as "a good start," but "there's much more that needs to be done."

"Fortunately, our government 'gets it' and understands that we have no choice but to fire every bazooka we have at the problems, and they have a lot of ammo. We need to help the world pause for a few months or quarters and protect our people and our companies," he added.

Before the historic stimulus package passed, he proposed that the government create a "job protection package" in the form of a new lending program to help companies pay their employees contingent upon keeping them on the payroll. On Friday afternoon, he released another memo making a case that the "next big hole" for the government to address are companies with more than 500 employees that are also below investment grade, which make up a "massive portion of the economy."

In the meantime, Handler applauded the dedication of those working in the healthcare community. He remains optimistic that they will find therapeutics that minimizes the death rate from the virus.

"That will be a game-changer," he said. "Ultimately, a vaccine will take time, but I bet on the ingenuity of our medical profession over this virus any day. We need to remain as calm as possible, stay in our homes, let the stimulus flow to the people and companies, and let the doctors do their work. It may get worse before it gets better, but we will come out the other side, and the sun will shine again."

And for Handler and the Jefferies team, COVID-19 is deeply personal, having claimed the life of the firm's long-time chief financial officer, Peg Broadbent.

"We have not fully processed the loss of Peg Broadbent,” he said. “We feel terrible for his family, and we can barely talk about it ourselves. We are distracted helping our other employees-partners, our clients, and our family and friends right now, but our organization will have a time to properly grieve for this loss. It is horribly sad, and unfortunately, one that is shared by many other companies and people all around the globe."

At the end of this, he's hopeful that there will be "an even greater appreciation of our fellow humans. We will all look at our friends and loved ones very differently when we get to embrace them once again."

Julia La Roche is a Correspondent at Yahoo Finance. Follow her on Twitter.

Read more:

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.