JetBlue Airways Corp (JBLU) Reports Fourth Quarter Loss, Beats Revenue and Cost Expectations

Net Loss: Reported a GAAP net loss of $104 million, or $(0.31) per share, and an adjusted net loss of $63 million, or $(0.19) per share.

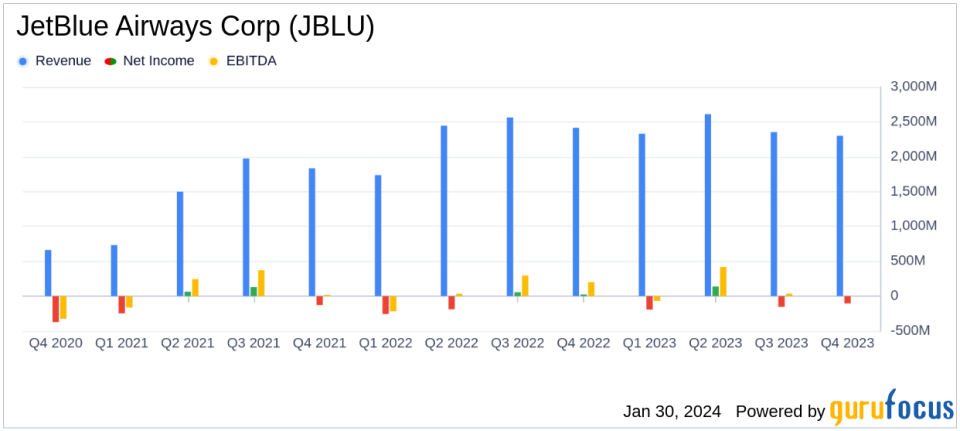

Operating Revenue: Decreased by 3.7% year-over-year to $2.3 billion in Q4 2023.

Cost Savings: Achieved $70 million in cost savings under the structural cost program in 2023, on track for $175-$200 million by end of 2024.

Capacity: Increased by 3.3% year-over-year in Q4 2023.

CASM ex-Fuel: Increased by 7.6% year-over-year in Q4 2023.

Fuel Price: Average fuel price of $3.08 per gallon in Q4 2023, including hedges.

Liquidity: Ended Q4 with $1.7 billion in unrestricted cash, cash equivalents, short-term investments, and long-term marketable securities.

On January 30, 2024, JetBlue Airways Corp (NASDAQ:JBLU) released its 8-K filing, announcing its financial results for the fourth quarter of 2023. The low-cost airline, known for its high-quality service and extensive network across the United States, Latin America, the Caribbean, Canada, and Europe, reported a net loss for the quarter but exceeded expectations in terms of revenue and costs.

JetBlue operates a fleet of Airbus A321, Airbus A320, Airbus A321neo, and Embraer E190 aircraft and focuses on three main operating segments: Domestic & Canada, Caribbean & Latin America, and Atlantic, with the majority of its revenue generated from the Domestic & Canada segment.

Financial Performance and Challenges

JetBlue's fourth quarter saw a net loss under GAAP of $104 million or $(0.31) per share. When adjusted for special items, the net loss was $63 million or $(0.19) per share. The company's operating revenue for the quarter was $2.3 billion, a decrease of 3.7% year-over-year. Despite the loss, JetBlue's operating expense per available seat mile (CASM) decreased by 2.4% year-over-year, reflecting effective cost management.

However, the company faced challenges as CASM excluding fuel and other items increased by 7.6% compared to the previous year. The airline's average fuel price for the quarter was $3.08 per gallon, including hedges. JetBlue's performance is critical as it reflects the airline's ability to navigate the volatile aviation industry, particularly in the face of fluctuating fuel prices and competitive pressures.

Strategic Initiatives and Financial Achievements

JetBlue has initiated strategic changes to its network, focusing on leisure and VFR (Visiting Friends and Relatives) routes, and resizing its presence at LaGuardia Airport. The company has also expanded service to the Caribbean and added new transatlantic destinations. These network optimizations are part of JetBlue's broader strategy to enhance profitability.

The airline has also made significant strides in its cost-saving initiatives, achieving $70 million in savings under its structural cost program in 2023, and is on track to reach $175-$200 million in savings by the end of 2024. Additionally, JetBlue has deferred approximately $2.5 billion of planned aircraft capital expenditures, smoothing out its aircraft delivery schedule through the end of the decade, which is expected to provide financial flexibility.

Outlook and Management Commentary

Looking ahead to 2024, JetBlue's management is optimistic about revenue growth, with strong demand during peak periods and a focus on refining the network and product offerings. The company plans to launch $300 million of revenue initiatives to return to profitability. JetBlue's President and COO, Joanna Geraghty, emphasized the company's aggressive actions to restore profitability and deliver shareholder value.

"2024 is an important year of change for JetBlue and we are taking aggressive action, including launching $300 million of revenue initiatives, to return to profitability and deliver value for our shareholders," said Joanna Geraghty, JetBlues president and chief operating officer.

JetBlue's CFO, Ursula Hurley, also highlighted the company's focus on cost management and network evolution to re-establish profitability and restore historical earnings power.

"We remain intensely focused on restoring profitability, taking steps to ensure every dollar we invest is making an impact," said Ursula Hurley, JetBlues chief financial officer.

For the first quarter of 2024, JetBlue expects available seat miles (ASMs) to decrease by 6.0% to 3.0%, with revenue projected to be down by 9.0% to 5.0%. CASM Ex-Fuel is expected to increase by 9.0% to 11.0%, and the company is approaching breakeven adjusted operating margin for the full year.

JetBlue's earnings report is a testament to the airline's resilience and strategic planning in a challenging industry. Value investors and potential GuruFocus.com members may find JetBlue's commitment to cost control and profitability, along with its strategic network adjustments, an interesting case study in effective airline management.

For more detailed information, please refer to the full earnings presentation and financial statements available on JetBlue's investor relations website.

For inquiries, contact JetBlue Investor Relations at [email protected] or JetBlue Corporate Communications at [email protected].

Explore the complete 8-K earnings release (here) from JetBlue Airways Corp for further details.

This article first appeared on GuruFocus.