An 'ominous’ report reminds us the U.S. economy is far from OK: Morning Brief

Friday, September 25, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

Jobless claims remain troublingly high

On the one hand, we should be encouraged by how much the economy has improved since the most intense days of the Covid-19 pandemic.

On the other hand, the economy is far from fully recovered and some growth engines appear to be losing momentum.

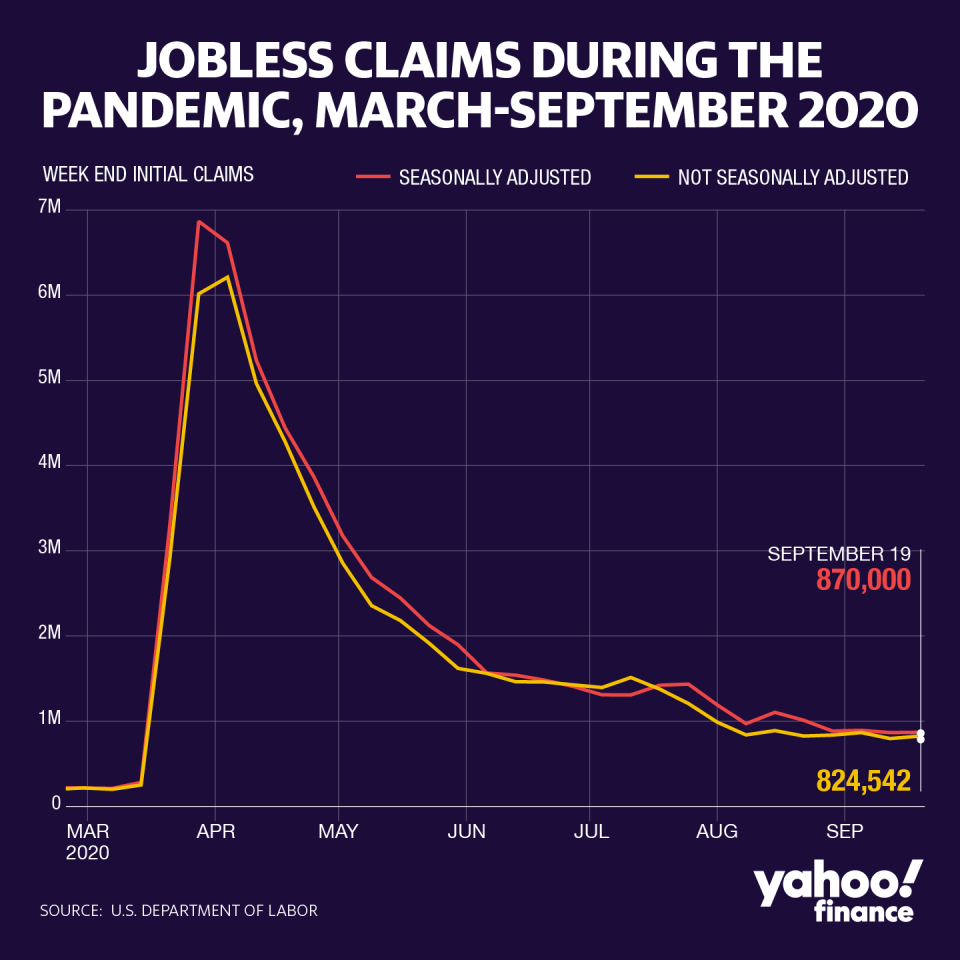

Yesterday, we learned that 870,000 American workers filed new unemployment claims last week. The good news is that this was the fourth consecutive week the number was below 1 million.

The bad news?

“Remember that the peak in initial claims during the Global Financial Crisis was 665k the week of March 27, 2009,” ING economist James Knightley noted. “So we are still 200k above that.”

In the words of my colleague Myles Udland, “Things could be worse, but this doesn’t make them good.“

Ian Shepherdson at Pantheon Macroeconomics also didn’t think the claims report was something to celebrate.

“In one line: Disappointing and ominous,“ Sheperdson said in an email.

Many folks note that the numbers in the weekly jobless claims report can be noisy due to various challenges including each states’ capacity to process paperwork. Furthermore, the Department of Labor recently updated how it calculates seasonal adjustments, making newer numbers less comparable than older numbers.

However, both Knightley and Shepherdson noted that small business employment data from Homebase confirmed that new hiring activity is leveling off in the U.S. labor market.

“[A]nd with Covid-19 cases picking up again, there are also worries about the reintroduction of new containment measures, similar to what we are now seeing again in Europe,” Knightley added.

On top of all this, there’s the fact that enhanced unemployment benefits have expired meaning that those filing for claims are getting less aid, which is yet to catch up to the spending data.

“Consumers’ spending — nearly 70% of the economy — can’t continue to increase at its recent pace in the aftermath of the ending of enhanced unemployment benefits,” Shepherdson said, adding “and the latest upturn in Covid cases and hospitalizations — up [on Wednesday] for the third straight day — threatens to trigger renewed restrictions on economic activity, while inducing people to reduce their social interactions irrespective of state government action.

“Against this backdrop, the need for further fiscal action is obvious, but we no longer expect any meaningful relief bill until February.”

And so it’d be a mistake for investors, policymakers and everyone in between to get complacent as activity slows.

“Given Covid-19 is far from beaten plus the fact that the supportive impact from the fiscal stimulus is fading, caution remains warranted,” Knightley said.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

8:30 a.m. ET: Durable goods orders, August preliminary (1.3% expected, 11.4% in July)

8:30 a.m. ET: Durable good excluding transportation orders, August preliminary (1.1% expected, 2.6% in July)

8:30 a.m. ET: Non-defense capital goods orders excluding aircraft, August preliminary (1.0% expected, 1.9% in July)

8:30 a.m. ET: Non-defense capital goods shipments excluding aircraft, August preliminary (0.8% expected, 2.4% in July)

From Yahoo Finance UK

Top News

Markets mixed as recovery fears offset US fiscal stimulus hopes [Yahoo Finance UK]

Palantir expected to be valued at almost $22 billion: Dow Jones [Bloomberg]

Buffett-following investment trust to list in London [Reuters]

Costco posts 27% rise in quarterly profit [Reuters]

YAHOO FINANCE HIGHLIGHTS

Amazon launches Luna cloud gaming service competing with Microsoft and Google

California Governor Gavin Newsom's ban on new gas cars in 2035 may wallop drivers' wallets: analyst

Jessica Alba: Companies don’t need a ‘cut-throat white middle-aged guy’ to succeed

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay