Jobs Report: U.S. economy adds disappointing 75,000 jobs in May, unemployment rate holds at 3.6%

Job growth slowed more-than-expected in May, while the unemployment rate held at a near 50-year low, according to the Department of Labor’s Friday report.

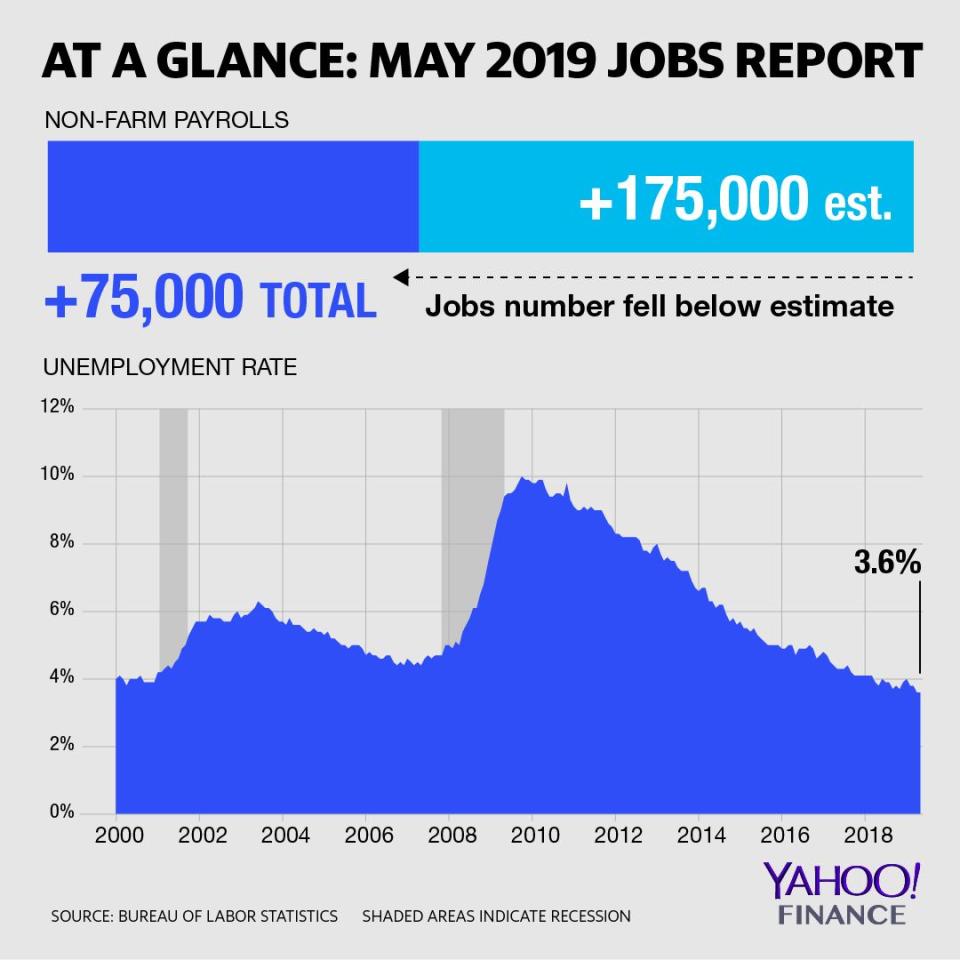

The U.S. economy added just 75,000 non-farm payrolls in May. This was below expectations for 175,000 non-farm payroll additions, based on Bloomberg-compiled estimates.

The previous two months’ payrolls figures were also downwardly revised. April’s change in non-farm payrolls positions was cut to 224,000 from 263,000, and March’s new figure was brought down to 153,000, from the 189,000 seen previously. Following the revisions, job gains averaged 151,000 per month over the past three months.

The unemployment rate held at a 49-year low of 3.6%, matching consensus estimates. The labor force participation also remained unchanged at 62.8%.

Average hourly earnings held at 0.2% month-over-month, versus the slight uptick to a 0.3% pace of gains expected. Average hourly wages rose 3.1% over last year, while consensus economists anticipated that rate to hold at 3.2% from April to May.

Within the private sector, retail trade, transportation and warehousing, information, non-durable goods and “other services” each saw payrolls drop in May. Retail trade led declines, losing 7,600 positions between April and May. But inclusive of all non-farm payrolls, government jobs headed declines and saw a reduction of 15,000 payrolls for the month.

Friday’s report was met with mixed reception from market pundits, with some taking the disappointing headline payrolls figure as another data point to suggest a decelerating domestic economy.

“Economic growth is clearly slowing, as indicated by the slower pace of job growth in May, downward revisions in prior months, and a leveling out of wage growth,” Mike Fratantoni, chief economist for the Mortgage Bankers Association, wrote in an email. “The job market remains tight, but this report, coupled with other recent data, shows a distinct cooling of the economy this spring.”

Others, however, were less concerned.

“While the slight decline in wage growth will support the Fed’s patient stance on rates, the average pace of job growth over the last 3 months (at 151,000) is hardly alarming,” Brian Coulton, chief economist at Fitch Ratings, wrote in an email. “It speaks to a slowdown in the domestic economy but there’s no suggestion of demand falling off a cliff.”

The latest assessment of the U.S. labor market comes against a backdrop of rising global trade tensions, some softening economic data and speculation that the Federal Reserve is teetering toward a cut to benchmark interest rates. Ahead of Friday’s report, investors were looking for signs that one of the stronger parts of the U.S. economy had held up despite a recent ramp-up in global risks.

Other recent data on the U.S. labor market had shown some signs of cracks. On Wednesday, ADP Research Institute and Moody’s Analytics reported that the domestic economy added just 27,000 private payrolls in May, coming in sharply below the 185,000 new positions expected and marking the lowest pace of job gains since 2010. ADP’s survey has not historically been a perfect indicator of the BLS payroll data, but the stark miss was taken by many economists as an augury for a disappointing report Friday.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Tech companies like Lyft want your money – not ‘your opinion’

Levi Strauss shares jump more than 30% above IPO price at open

Facebook sued by Trump administration for alleged ‘discriminatory’ ad practices

Boeing 737 Max groundings ‘pressure’ U.S. economic data: Wells Fargo

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.