One of Trump's top picks to replace Janet Yellen could be a headache for markets

President Donald Trump’s search to find the next chair of the Federal Reserve appears to be winding down.

On Wednesday, Bloomberg reported that Gary Cohn, his chief economic advisor and the former president of Goldman Sachs (GS) would not get the nod. On Thursday, Ben White at Politico reported that one White House source said neither current Fed chair Janet Yellen nor former Fed governor Kevin Warsh would get the job.

This leaves Jerome Powell, current Fed governor, and Stanford economist John Taylor as the only two finalists. And while White cited another source who said Trump “changes his mind about [the Fed nomination] every day,” betting markets on Thursday morning saw Powell and Taylor as the two most likely candidates.

And on this backdrop, at least two Wall Street economists have published notes in the last week highlighting the risks that a Taylor-run Fed pose to markets.

John Taylor and his “rule”

Taylor has made his name in the economics field by developing the “Taylor rule,” which is essentially a formula for where benchmark interest rates ought to be based on how the economy is performing. (For more color on the Taylor rule, read former Fed chair Ben Bernanke.)

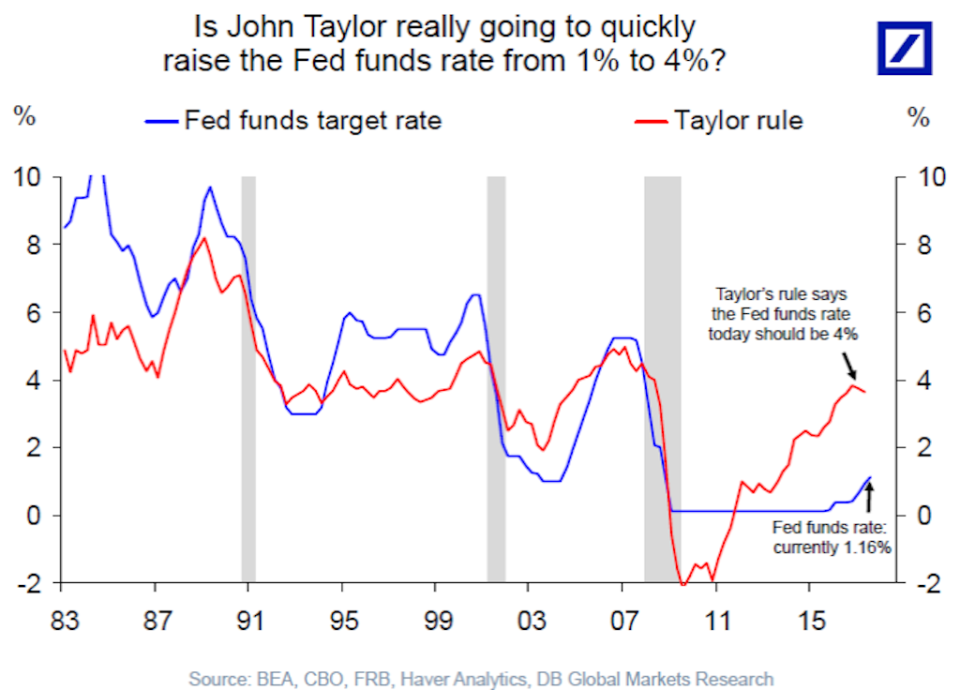

Torsten Sl?k, an economist at Deutsche Bank, noted in an email on Thursday that this rule says the Fed Funds rate should by around 4% right now, well above the 1.16% that the Fed’s benchmark rate is at right now.

Earlier this week, Chris Condon and Matt Boesler at Bloomberg sketched out how Taylor could impact the Fed and noted that earlier this month, Taylor spoke at the Boston Fed and said his rule is a “guideline.”

Taylor added that he, “made no suggestion that the rule should be written into law, or even that it be used to monitor policy, or hold central banks accountable… the objective was to help central bankers make their interest rate decisions in a less discretionary and more rule-like manner.”

Sl?k says, however, that one of the most influential ideas in monetary policy being named for the sitting Fed chair would create a communication headache for a Taylor-led Fed.

“The biggest challenge for John Taylor is to explain whether he wants to follow his own Taylor rule or not,” Sl?k wrote in an email on Thursday. “He is likely to be asked about this at most, if not all, of his future press conferences and Congress hearings.

“If he says no, then he will be asked about the reasons why he wants to deviate substantially from his own rule, and markets will be very interested in understanding if his reasons are politically motivated or based on economic fundamentals, because his answers will have a significant impact on inflation expectations and the long end of the yield curve. This will be a big potential challenge for Fed communication.”

At Capital Economics, Andrew Hunter writes that while markets don’t appear to be concerned with the possibility of Taylor getting the nomination, “there is clearly a risk of a more hawkish Fed under Taylor’s leadership.”

And while some experts have said that the Fed staff drives a lot of the thinking at the central bank — thus limiting the impact that one chair can have on policy over the long term — Hunter sees a more hawkish bent emerging with Taylor at the helm of the central bank.

“Although Taylor would only have one vote on the FOMC, he would still exert a significant influence on Fed policy as Chair,” Hunter writes. “The Chair plays a key role in shaping the Fed’s policy debates and communication.”

Given, however, Trump’s previous statements that he likes low interest rates — and on that basis said he likes Janet Yellen — markets have been more or less lined up against the idea that Taylor will get the nomination.

It seems likely, however, that he will have some role at the Fed, perhaps as vice chair, a position currently open after Stanley Fischer stepped down, which Hunter says “would be another reason to expect interest rates to rise faster next year.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: