Juniper Networks, Inc. (JNPR): A Networking Powerhouse for Retirement Portfolios

We recently published a list of Retirement Stock Portfolio: 12 Safe Tech Stocks To Consider. In this article, we are going to take a look at where Juniper Networks, Inc. (NYSE:JNPR) stands against other safe tech stocks in retirement portfolio.

In the past, retirees could rely on bonds to provide steady income, with 10-year Treasury yields around 6.50% in the late 1990s. However, current rates are significantly lower, resulting in a major impact over time. For instance, a $1 million investment in 10-year Treasuries now yields over $1 million less than it would have 20 years ago. Adding to this concern, today’s retirees are increasingly uncertain about the future of Social Security. According to a survey by investment manager Schroders, Americans with employer-provided retirement plans estimate they’ll need $1.2 million to retire comfortably. However, nearly half expect to have less than $500,000 saved. Another study by Transamerica Institute shows that only 1 in 5 middle-class individuals feel confident in their ability to retire or maintain a comfortable lifestyle during retirement. Many of these anxious pre-retirees plan to start Social Security benefits before age 67, even though waiting until at least age 70 would maximize their monthly payments for life. Overall, pre-retirement anxiety appears to be widespread.

That said, the retirement realm may not be as bleak as it appears at first. According to this year’s survey by the Employee Benefit Research Institute (EBRI) and Greenwald Research, nearly 80% of retirees feel they can spend money as they wish, and an even higher percentage believe they are living the retirement lifestyle they envisioned. In addition to managing their current expenses, over half of retirees are still saving for the future. Key factors contributing to this success include planning—such as deciding when to claim Social Security, preparing for emergencies, estimating retirement duration, and periodically reviewing and rebalancing asset allocations to stay on track during market fluctuations.

Additionally, inflation slowed down to its weakest pace in over three years last month, as price increases continued to ease from their generational highs. With concerns about the rising cost of living playing a central role in the presidential election campaign, the Bureau of Labor Statistics released its final inflation report before voters head to the polls. The consumer price index rose 2.4% year-over-year in September, slightly above economists’ expectations of 2.3% but down from 2.5% in August. The “core” index, excluding volatile food and energy prices, climbed 3.3% annually. On a monthly basis, prices increased by 0.2%. Meanwhile, the broader U.S. economy remains strong, with employers adding 254,000 jobs in September, countering fears of a labor market slowdown.

That said, during economic challenges, investors—especially those focused on securing their retirement—often gravitate toward low-risk stocks that offer steady returns amidst uncertainty. Healthcare and consumer stocks are typically favored in such conditions, but tech stocks can also be a smart investment if chosen wisely. Tech stocks have consistently outperformed the broader market for several years and now make up over 30% of the market’s total holdings.

Our Methodology

For our list of the 12 best safe stocks for a retirement portfolio, we used stock screeners, ETFs, and online rankings to identify mega-cap tech stocks with low beta values, a track record of consistent dividend payments, and well-established businesses. These stocks were then ranked based on hedge fund sentiment, as reported in Insider Monkey’s Q2 2024 database.

At Insider Monkey we are obsessed with the stocks that hedge funds pile into. The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

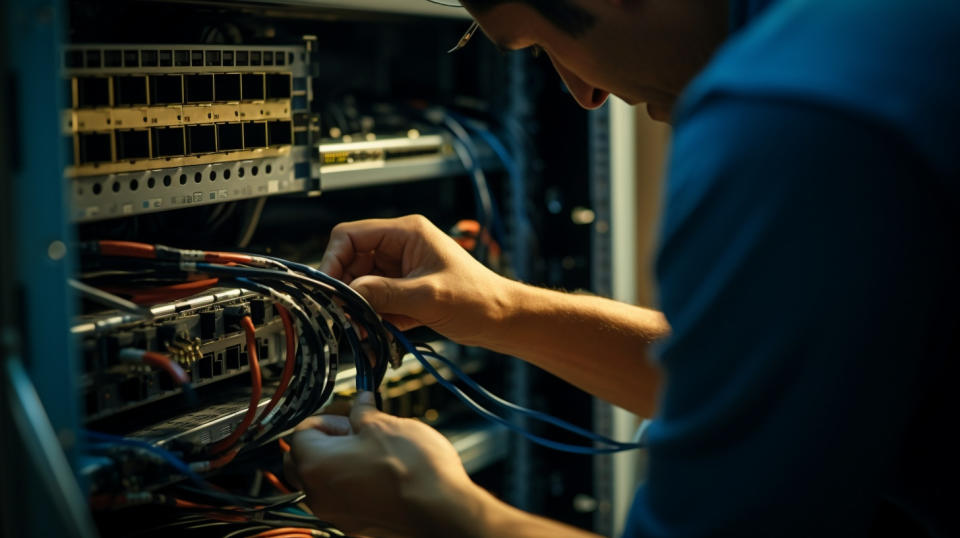

A close-up on a technician's hands adjusting the knobs of a router in a sophisticated server room.

Juniper Networks, Inc. (NYSE:JNPR)

Beta Value: 0.92

Dividend Yield: 2.27%

Number of Hedge Fund Holders: 45

Juniper Networks, Inc. (NYSE:JNPR), headquartered in California, is a global networking company specializing in the development and marketing of networking products, including routers, switches, network management tools, security solutions, and software-defined networking technologies.

Citi recently resumed coverage on Juniper Networks, Inc. (NYSE:JNPR) with a Neutral rating and a price target of $40.00, following a break in coverage and a review of the company’s Q3 2024 financial results. Citi has revised its financial model, forecasting a 12% year-over-year sales decline for FY 2024, followed by a 3% increase in FY 2025. These estimates differ slightly from consensus expectations of a 10% decrease and a 4% increase, respectively. Additionally, Citi’s analysis includes the potential effects of Juniper Networks’ planned $14 billion acquisition by Hewlett Packard Enterprise, which is expected to close between late 2024 and early 2025.

Juniper Networks, Inc. (NYSE:JNPR) has also made strides in AI-Native Networking, enhancing its data center solutions to improve network visibility, analytics, and automation. These updates are aimed at reducing deployment times and operational costs. The company has also invested in Quantum Bridge Technologies to strengthen defenses against quantum computing threats.

In Q2 2024, 45 hedge funds held positions in Juniper Networks, Inc. (NYSE:JNPR), with total holdings valued at $1.114 billion. Pentwater Capital Management is the largest shareholder, with 8.875 million shares valued at $323.582 million as of June 30.

Overall, JNPR ranks 6th on our list of safe tech stocks to consider in retirement portfolio. While we acknowledge the potential of JNPR as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than JNPR but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article is originally published at Insider Monkey.