This one stock will reflect the state of US-Mexico relations

If you want to know how the market feels about US-Mexico relations, just watch shares of Kansas City Southern (KSU).

The railroad major, which has a market cap of around $9 billion, has 48% of its revenue directly exposed to Mexico, by far the most among members of the S&P 500.

Shares of the company are down about 7% since the election. Though in 2017 the stock has been flat despite continued headlines suggesting the future of US-Mexico economic relations remains murky at best.

And if we want to take the market’s pricing of the stock here as a signal for how investors view the potential progress of US-Mexico trade relations, Kansas City Southern’s stock endured a sharp one-day drop after Donald Trump’s election win and since then hasn’t done much.

In the fourth quarter, Kansas City Southern reported revenues of $599 million, the same as the prior year quarter. Excluding the impact from the Mexican peso, revenues would’ve increased 3%.

Kansas City Southern CEO Patrick Ottensmeyer said in the company’s earnings statement that it is, “aware of both economic and political uncertainty.”

On the company’s earnings conference call, Ottensmeyer added that, “I believe that any modification in NAFTA can and will be done in a rational way that will likely strengthen North America’s economy and KCS future. Mexico is our neighbor and our third largest trading partner. Our economies in our societies are inextricably connected.”

And while the CEO of any company with exposure to Mexico is likely to tout their belief that the long-standing economic, and ever-lasting geographical, relationship between the countries will keep things amicable, the company’s export volume also likely provides investors with some bullishness about the future.

The border tax adjustment “just a concept” for now

Currently, markets expect that some version of the “border tax adjustment” outlined in the House Republican tax plan first proposed last year will make its way into any final piece of legislation. (Trump, however, has decried this as “too complicated.”) A border tax adjustment would be aimed at threading the needle between a value-added-tax and a tariff, and seek to basically incentivize US companies to produce goods domestically either for exports or consumption.

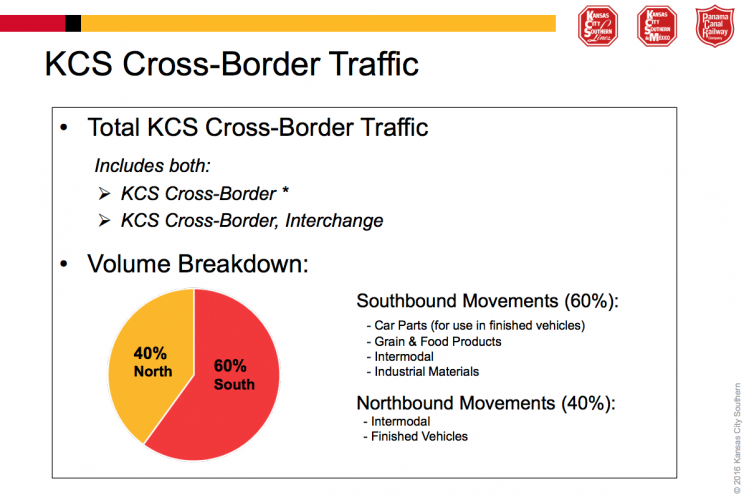

And on this front, Kansas City Southern could see a positive development given that 60% of their carloads are goods heading from the US to Mexico, which would likely be tax-advantaged under some version of a border tax adjustment.

Kansas City Southern CFO Mike Upchurch said on the company’s conference call that a border tax adjustment is, at this point, “just a concept.”

Upchurch added that, “our view of that is, it would certainly make customers of ours produce less if they’re importing into the U.S. And in general that concept is to tax imports and have a tax-free environment for export.”

And overall, despite the southbound traffic comprising more than half the company’s traffic, Upchurch added that a border tax, “would clearly be a negative if that were to occur.”

Adding, “I think the challenge with that concept becomes, take the auto industry, as an example. How many parts go southbound? How many materials like chemicals and steel and plastics and get assembled and then back North? And certainly, the President-Elect made some comments about that being too complicated. But that would be our initial sense of the border tax.”

Markets broadly have yet to react significantly

It is notable, however, that though Kansas City Southern’s fourth quarter report was released on January 20, nothing substantive has changed on the issue of US-Mexico trade relations. And I think an additional signal we can take from the market’s relative complacency on shares of Kansas City Southern is more or less in step with a growing idea that markets are, for the moment, seemingly uninterested in reacting to moves out of the Trump administration.

Alternatively, there hasn’t been a ton of substance since the election for markets to react to. Trump’s immigration initiatives, for example, certainly matter for corporate culture, employee morale, and the broader business environment, but any potential impact to bottom-line results is unclear at best.

“Markets seem to be in a relatively complacent mood going into the New Year,” wrote Bank of America Merrill Lynch economist Ethan Harris in a note on Tuesday.

“The VIX and other measures of volatility are near record lows. This may reflect reduced risk taking in the markets and confidence in a go-slow Fed, but it seems inconsistent with the high level of policy risk in the coming months.”

Harris added, “For tax policy, investors should keep a close eye on: (1) whether border adjustability is retained or dropped, (2) progress on developing a tax plan in the Senate, and (3) how disciplined the process is in debating and marking up a specific tax bill.

“Tax reform is very hard legislation to pass because it impacts different people and companies. It is particularly vulnerable to a slippery slope where some loopholes are reintroduced, making it harder to cut the tax rate, incentivizing even more aggressive special interest pleading. We could learn a lot in the next few months.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: