KPIT Technologies And 2 Other High Growth Tech Stocks in India

In the last week, the Indian market has stayed flat while the Information Technology sector gained 5.2%, contributing to a 44% increase over the past year with earnings expected to grow by 17% per annum over the next few years. In this promising environment, identifying high-growth tech stocks like KPIT Technologies and others becomes crucial for investors looking to capitalize on robust sector performance and future growth potential.

Top 10 High Growth Tech Companies In India

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Tips Industries | 24.69% | 24.16% | ★★★★★★ |

Newgen Software Technologies | 21.83% | 22.72% | ★★★★★★ |

Sonata Software | 13.15% | 30.01% | ★★★★★☆ |

Happiest Minds Technologies | 21.99% | 21.80% | ★★★★★★ |

C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

Avalon Technologies | 20.10% | 41.52% | ★★★★★☆ |

INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

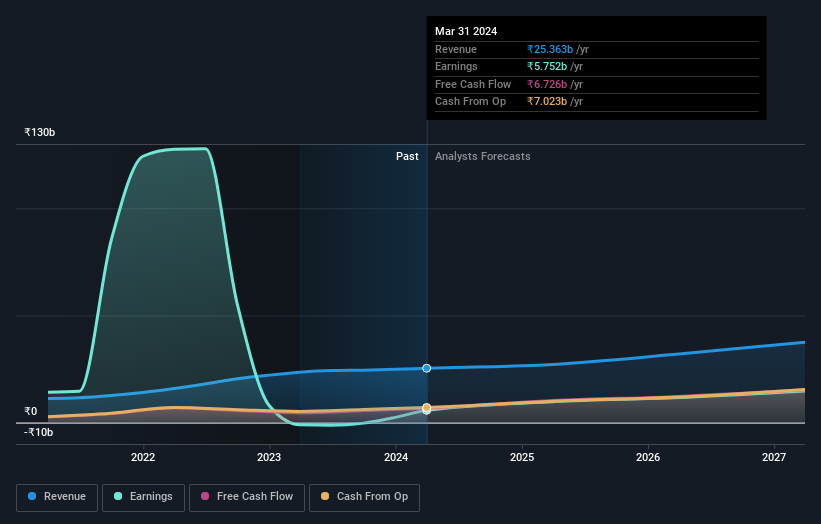

KPIT Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KPIT Technologies Limited offers embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector across the Americas, the United Kingdom, Europe, and globally with a market cap of ?495.74 billion.

Operations: KPIT Technologies Limited generates revenue primarily from embedded software, artificial intelligence, and digital solutions tailored for the automobile and mobility sector. With a market cap of ?495.74 billion, it serves clients across the Americas, the United Kingdom, Europe, and globally.

KPIT Technologies has shown significant growth, with revenue increasing from ?11.19 billion to ?14.19 billion and net income rising from ?1.34 billion to ?2.04 billion in the past year. The company’s R&D expenses have been a key driver, reflecting their commitment to innovation in automotive middleware through ventures like Qorix GmbH with ZF Friedrichshafen AG, where ZF invested EUR 1.35 million initially and plans an additional EUR 13.65 million for share premium and IP contributions. Earnings are expected to grow at 19% annually, outpacing the Indian market's average of 16.9%, positioning KPIT as a notable player in high-growth tech sectors within India.

Info Edge (India)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally with a market cap of ?954.69 billion.

Operations: The company generates revenue primarily from recruitment solutions (?19.05 billion) and real estate services (?3.67 billion). The recruitment segment is the largest contributor to its revenue streams.

Info Edge (India) has demonstrated robust growth with first-quarter revenue rising to ?8.28 billion from ?6.90 billion year-over-year and net income increasing to ?2.33 billion from ?1.59 billion. The company's R&D expenses are strategically allocated, supporting advancements in its core segments like Naukri.com, which is expected to grow earnings at 23.6% annually over the next three years, outpacing the Indian market's average of 16.9%. Recent executive appointments such as Mr. Aayush Rathi as Senior Vice President for Revenue Growth Strategy underscore a commitment to leveraging data-driven insights for sustainable growth.

Dive into the specifics of Info Edge (India) here with our thorough health report.

Assess Info Edge (India)'s past performance with our detailed historical performance reports.

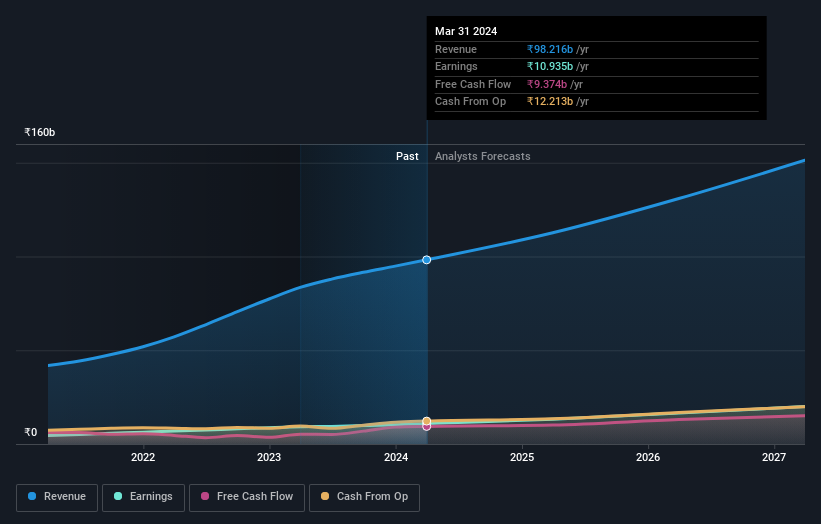

Persistent Systems

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited provides software products, services, and technology solutions in India, North America, and internationally with a market cap of ?716.06 billion.

Operations: The company generates revenue from three primary segments: Healthcare & Life Sciences (?23.88 billion), Software, Hi-Tech and Emerging Industries (?46.41 billion), and Banking, Financial Services and Insurance (BFSI) (?32.08 billion).

Persistent Systems has seen its earnings grow by 24.8% over the past year, outpacing the IT industry’s 15.8% growth rate. The company's revenue is forecasted to grow at 13.5% per year, faster than India's market average of 10%. With R&D expenses strategically allocated, Persistent continues to innovate in AI and software services; their recent launch of GenAI Hub exemplifies this commitment. Earnings are projected to increase by 19.2% annually, reflecting strong future prospects in digital transformation services and data security solutions through partnerships like Mage Data?.

Delve into the full analysis health report here for a deeper understanding of Persistent Systems.

Explore historical data to track Persistent Systems' performance over time in our Past section.

Where To Now?

Navigate through the entire inventory of 38 Indian High Growth Tech and AI Stocks here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:KPITTECH NSEI:NAUKRI and NSEI:PERSISTENT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]