Kyle Bass warns the clock is ticking for China's banking system

Texan hedge fund manager J. Kyle Bass, the founder of Hayman Capital, reiterated his timeline for his big bet against the China’s “recklessly built” banking system.

“Sometime in the next 18 months you’re going to see a real banking crisis in China,” Bass said on Wednesday at the Vanity Fair New Establishment Summit. “Economic reality takes over.”

Back in February, Bass unveiled his case in an investor letter entitled “The $34 Trillion Experiment: China’s Banking System and the World’s Largest Macro Imbalance.”

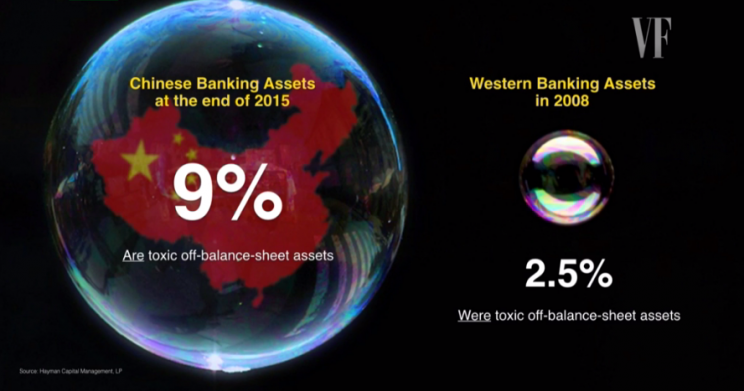

Bass, who gained notoriety for correctly betting against the US subprime crisis, wrote that similar to the US banking system, China’s banking system has “increasingly pursued excess leverage, regulatory arbitrage, and irresponsible risk taking.”

He believes that the Chinese banking system losses will be gargantuan.

“They’re four-times worse than we were at our peak in 2006,” he said during the panel.

One of the problems is that the numbers being reported by China’s government aren’t believable. In the February investor letter, Bass wrote that China’s foreign exchange reserves aren’t accurate, and that the country doesn’t have the required level of reserves needed to safely operate its financial system.

“If you just look at the facts, you wouldn’t invest in China today. All arguments I try to make are fact based, not just ‘believe in the government,” Bass said.

Bass has liquidated a majority of Hayman’s risk assets. He noted that a banking crisis is not going to be positive for anyone with their currencies pegged to the dollar and it’s also not for Southeast Asian countries.

He thinks that China is going to have to devalue its currency.

Timing, of course, is where things get difficult. Investors can have a very small attention span for their ability to stay with a manager.

—

Julia La Roche is a finance reporter at Yahoo Finance.

Read more:

A top central banker once told me something he’d never say publicly