Apple's earnings impressed, and it hinted at a big September iPhone launch (AAPL)

Getty

Apple reported strong earnings on Tuesday, beating expectations for both revenue and earnings per share.

The beat was partially powered by Apple's "services" business, which includes iCloud, Apple Music, and the App Store. All told, services revenue rose 31% year over year to $9.54 billion.

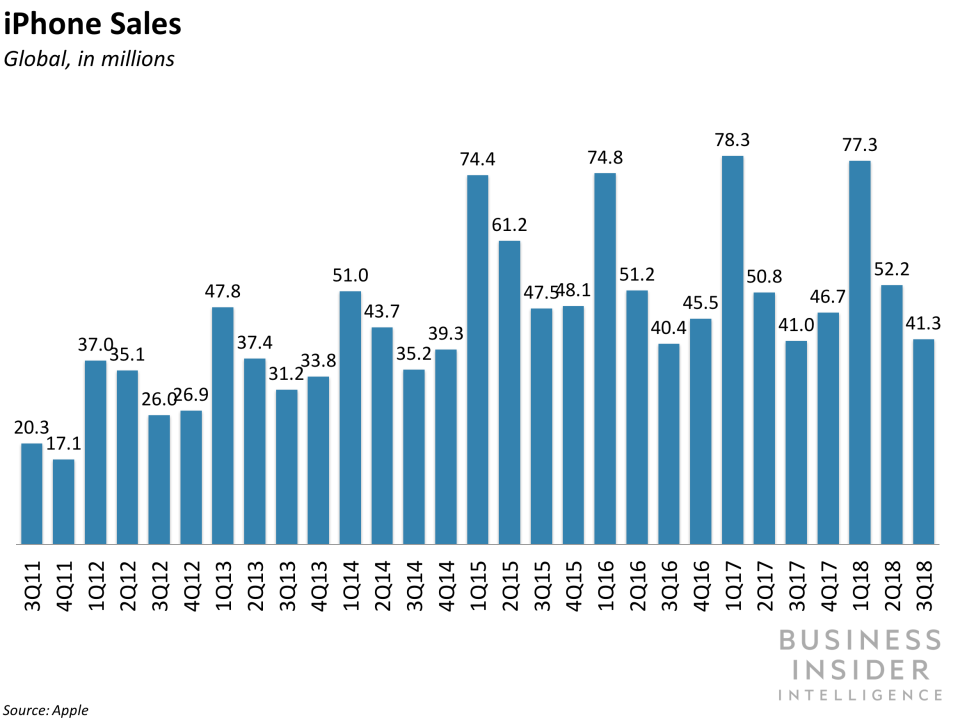

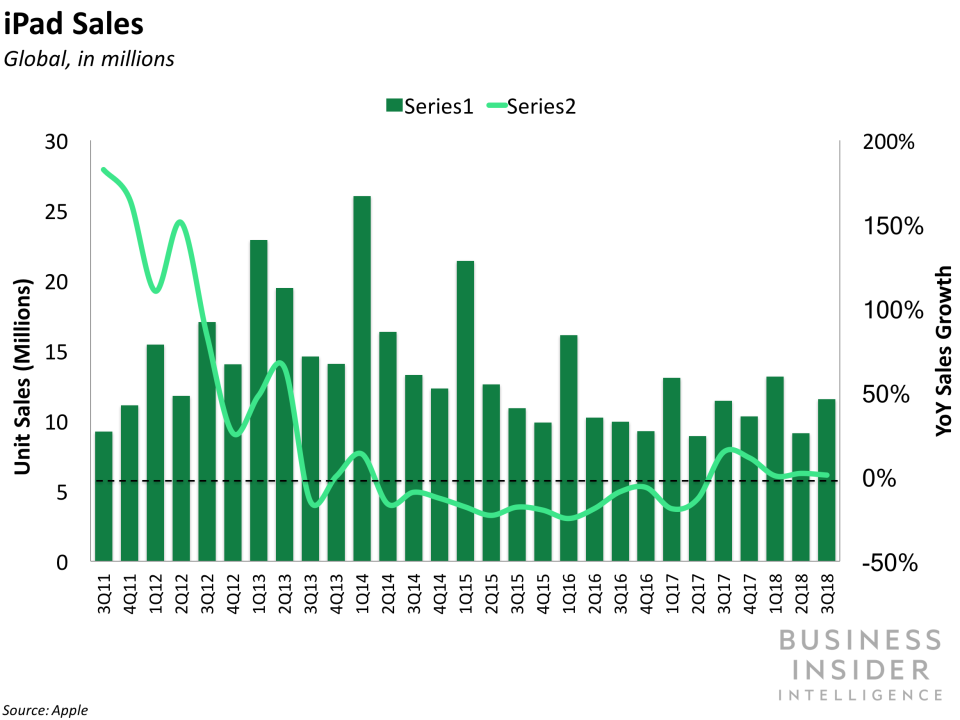

iPhone and iPad sales were mostly unchanged from last year.

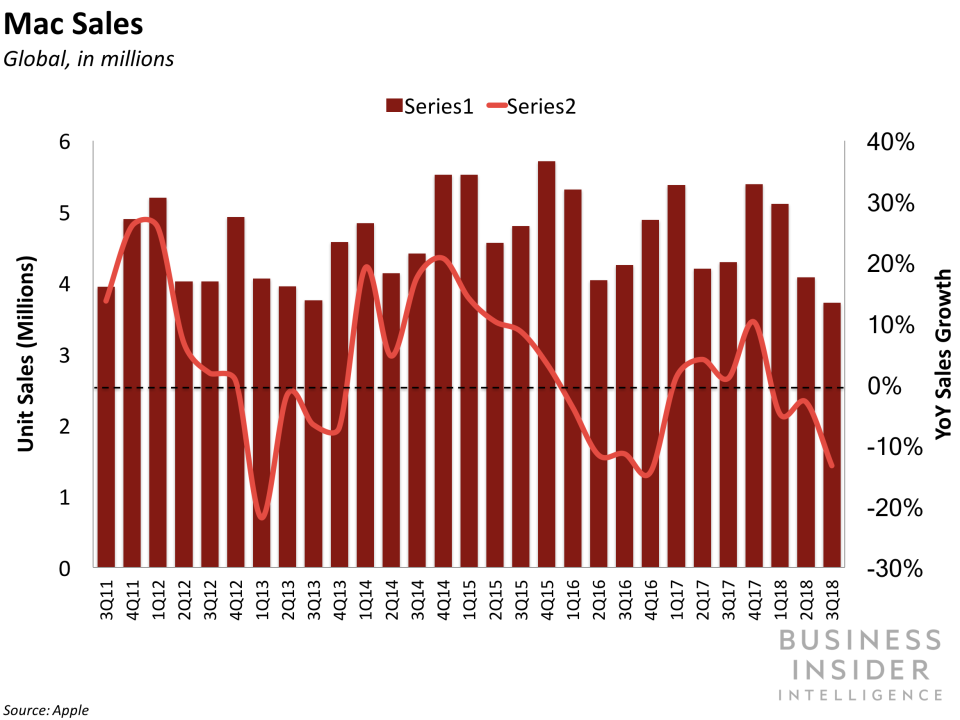

Mac sales were down 13% from the same period of 2017.

Typically, the three months ending in June are Apple's slowest in terms of iPhone sales and revenue. This year, though, Apple posted the strongest third quarter in company history, beating analyst expectations for earnings per share and revenue.

The beat drove the stock up over 3% in extended trading.

However, there were some signs of slowing growth in its key device businesses. iPhone and iPad sales were mostly unchanged from the same period last year. Mac sales were down 13%.

Apple also said that it expected revenue next quarter to be between $60 billion and $62 billion, ahead of Wall Street expectations, which at its midpoint would be a 15% year-over-year increase. The larger-than-expected figure is a strong hint that Apple will introduce a new iPhone in September.

Apple's "services" business, which includes iCloud, Apple Music, and App Store, rose 31% year over year to $9.54 billion.

Apple also declared a dividend of $0.73 per share. Apple CFO Luca Maestri said on a conference call that the company "returned almost $25 billion to investors through our capital return program during the quarter, including $20 billion in share repurchases.”

Notes from the call:

6:00: We're done here. Thanks for tuning in!

5:57: "We have never done an analysis internally about how many people got a lower price battery" instead of new phone, Apple says.

5:49: Revenues on Apple Music grew over 50% during the quarter, which Apple calls strong results.

5:46: "Cord cutting is only going to accelerate and accelerate at a faster rate than people thought," Cook said.

5:45: Apple Music question. "We're very excited to work with Oprah."

5:44: "We're hoping that calm heads prevail," Cook said.

5:42: "We'll be sharing our opinion with the administration" during the comment period on the latest wave of tariffs. Cook confirms that none of Apple's products have been impacted by the first three waves of tariffs.

5:38: First question about trade and tariffs. "Our view on tariffs is they show up as a tax on the consumer and wind up resulting in lower economic growth and sometimes can bring about significant risk of unintended consequences."

5:32: On to questions and answers. Cook: "Given the momentum we're seeing ... we feel great about our current services but we're also thrilled about our pipeline with new services in it as well."

5:22: Greater China, which includes Taiwan and Hong Kong, grew 19% year-over-year.

5:20: Maestri says Apple grew in each of its top 15 markets.

5:18: Now CFO Luca Maestri is talking.

5:15: Wow, Cook's opening remarks are much longer than normal.

5:10: 4 million people are running Apple's beta software. Also, soon you'll be able to play with your iPhone at CVS and 7-11.

5:09: AirPods, Apple Watch, and Beats headphones were up 60% year-over-year. Apple calls these "wearables."

5:07: Apple music grew 50%. AppleCare revenue grew the most in 18 quarters, Cook says. He's really spending a lot of time on services.

5:06: People are downloading more apps that ever before, Cook says. He's really emphasizing that the App Store creates jobs.

5:05: Cook says paid subscriptions from Apple and 3rd parties had passed 300 million. There are now 30,000 apps offering in-app subscriptions.

5:03: Apple CEO Tim Cook says this is the strongest rate of growth Apple has posted in 11 quarters.

Here are the key numbers from Apple:

EPS (diluted): $2.34, up 40% year-over-year, versus expectations of $2.18

Revenue: $53.3 billion, up 17% year-over-year, versus expectations of $52.42 billion

Gross margin: 38.3%, flat year-over-year, versus expectations of 38.3%.

iPhone unit sales: 41.3 million, flat year-over-year, versus expectations of 41.6 million

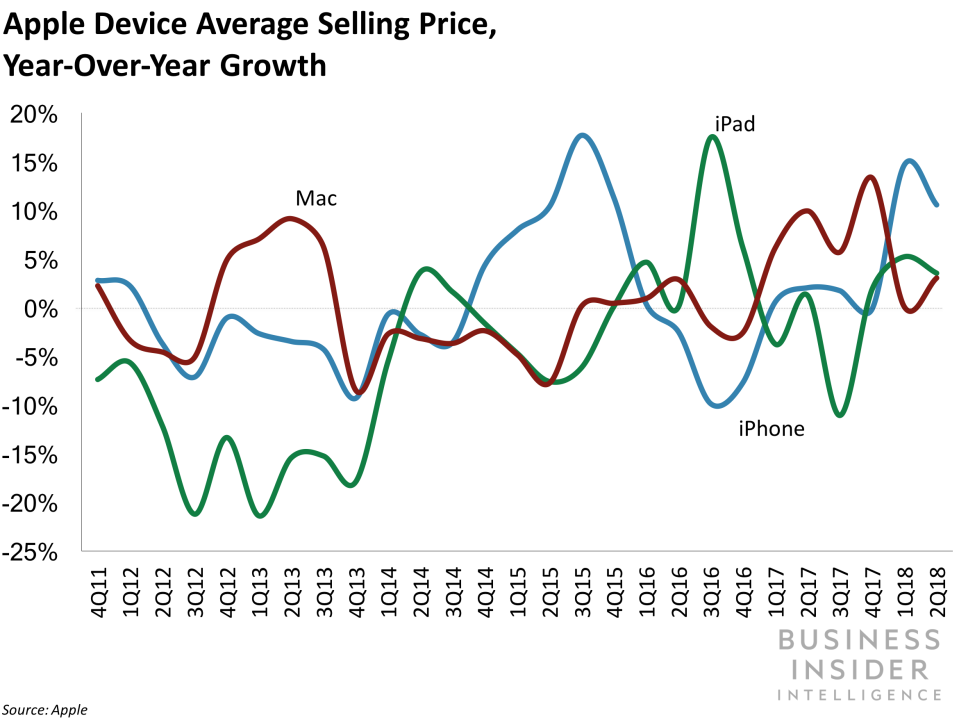

iPhone ASP: $724 versus expectations of $699

iPad unit sales: 11.5 million, flat year-over-year

Mac sales: 3.7 million, down 13% year-over-year

Services revenue: $9.54 billion, up 31% year-over-year, versus expectations of $9.22 billion

Here's a table with the key sales figures:

Apple

Charts:

BI Intelligence

BI Intelligence

BI Intelligence

BI Intelligence

NOW WATCH: Everything wrong with Android

See Also: