Low interest rates are giving the housing market a boost

The housing market is getting a much-needed lift from plunging long-term interest rates. But low rates may only be a temporary and artificial boost to the housing market.

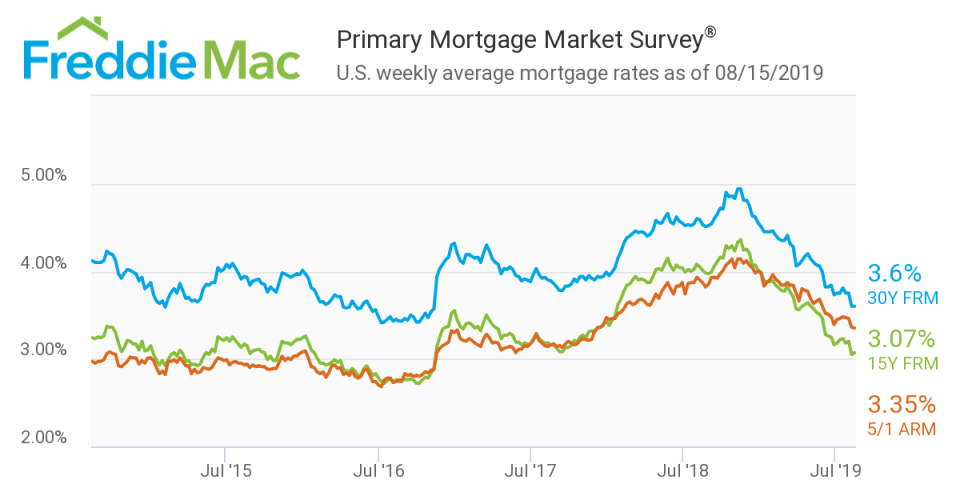

As recession concerns loom, interest rates have fallen to a level that’s now stimulative for the U.S. housing sector. The average 30-year mortgage rate is around 3.6%, according to Freddie Mac data. This is the lowest level since November 2016.

“We do expect lower rates to positively affect housing activity in the quarters ahead. Some leading indicators for housing, such as builder and consumer sentiment, have improved recently,” Credit Suisse wrote in a recent research note. ”We expect an imminent return to moderate but positive growth in the housing market. A recovery in housing is likely to provide a welcome boost to growth amid a global manufacturing slump.”

Since 2018, the 30-year mortgage rate has fallen more than 100 basis points. Credit Suisse estimates the recent move in rates would increase home sales by at least 5.0% in the next few months, pushing sales to 5.5 million — the highest since the first quarter of 2018.

“We expect the second half of year will be notably better than the first half in terms of home sales, mainly because of lower mortgage rates,” said Lawrence Yun, chief economist at the National Association of Realtors (NAR), in an email.

On Wednesday, the NAR reported that existing home sales rose 2.5% and 0.6% in July from a month earlier and same time a year ago, respectively. A reversal from a month earlier when sales declined. The positive results followed a bump in pending home sales, also a proxy for the future health of the housing market, which was up 1.6% in June, reversing a 17-month streak of annual decreases, according to the NAR. Pending home sales rose 2.8% in June from a month earlier, the second consecutive month of growth. The latest figures mark “the start of a positive trend for home sales,” the NAR said.

On top of that, the Fannie Mae Home Purchase Sentiment Index reached a new survey high in July, increasing 2.2 points to 93.7. According to that survey, folks are feeling more confident in buying and believe mortgage rates will continue to fall. Even homebuilders are feeling a little bit better about things. The National Association of Home Builders/Wells Fargo Housing Market recent measures of current sales and buyer traffic hit its highest levels since October.

And despite what appeared to be weak new construction results for July, another leading indicator for the housing market — building permits — looks pretty promising. Total building permits rose 8.4% to a 1.34 million rate, beating analysts’ estimates. The monthly increase was the largest in more than two years. Single-family permits rose for the third straight month in July and reached its highest level since November 2018.

“To assure home price rise does not perk up too fast, a boost in new single family home construction is needed and welcomed in the current housing shortage environment,” said Yun.

Inventory and labor shortage persists

While things are looking up for the housing market by some measures, there’s reason to be a bit skeptical about a recovery.

Despite a deceleration in annual home price growth for the 14 months “prices have been reaching new heights” a trend that will likely continue from increased demand due to the ongoing shortage of inventory, particularly in the “starter” home category for first-time homebuyers, said Yun. Earlier this month, Realtor.com said the number of newly listed entry-level homes, priced below $200,000, fell 9.9% in July from the same month a year ago.

We’re not seeing enough housing being built in the starter market because “economics don’t work,” said Jonathan Miller, CEO and founder of real estate appraisal firm Miller Samuel Inc., referring to high land costs and an ongoing construction labor shortage.

“Although builder confidence is high, the number of open construction jobs is also high, and the lack of skilled labor continues to be a constraint on the overall pace of building,” said Mike Fratantoni, a senior vice president and chief economist at Mortgage Bankers Association (MBA), in a recent statement.

Credit Suisse’s recent note highlighted that a slowdown in immigration, a key source of labor for the construction industry, is also exacerbating the problem. Immigrants represent 17% of the U.S. labor force, but almost a quarter of construction workers, according to the National Association of Home Builders (NAHB). The tight construction labor market has been holding back inventory and lengthening the average time for construction of homes (with at least two units), from start to finish, to about 14 months — its highest level since 1971, according to Credit Suisse.

“Lower rates are certainly helpful in the short-term but it doesn’t truly address the affordability challenge,” Miller said, adding that the low rates are helping existing homeowners reduce housing costs, which is reflected in an uptick in refinancing applications. According to new MBA data released Wednesday, homeowner refinancing activity reached a three-year high for the week ending August 16. “It’s a short-term stimulus,” Miller added.

Amanda Fung is an editor at Yahoo Finance.

Read more

US home price growth slows for the 14th straight month; pending home sales climb

Here are 10 U.S. cities where homebuyers have an advantage over sellers

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.