What the IPO market is telling us about the stock market

Some of the hottest private companies are finally going public, a dynamic that speaks to the optimism about the broader stock market, according to experts.

This is a stark contrast from just three months ago when the stock market fell to its lowest level in almost two years and a government shutdown delayed the IPO regulatory process amid staff shortages at the Securities and Exchange Commission.

“You wouldn’t bring your company public if there wasn’t demand from investors,” said JJ Kinahan, chief market strategist at TD Ameritrade.

On Friday, ride-sharing giant Lyft (LYFT) opened for trading on the Nasdaq (^IXIC) at $87.24 a share, up from the $72 its IPO priced at on Thursday evening. Prior to the IPO, bankers had been raising their price range for the offering, a sign of healthy demand.

“In the near-term, the Lyft deal and [upward] revisions to the price range is supportive of stocks,” said Nick Colas, co-founder of DataTrek Research. “It means there is still interest in equities and buying brand new companies that don’t make money — that’s good.”

A ‘vote of confidence’

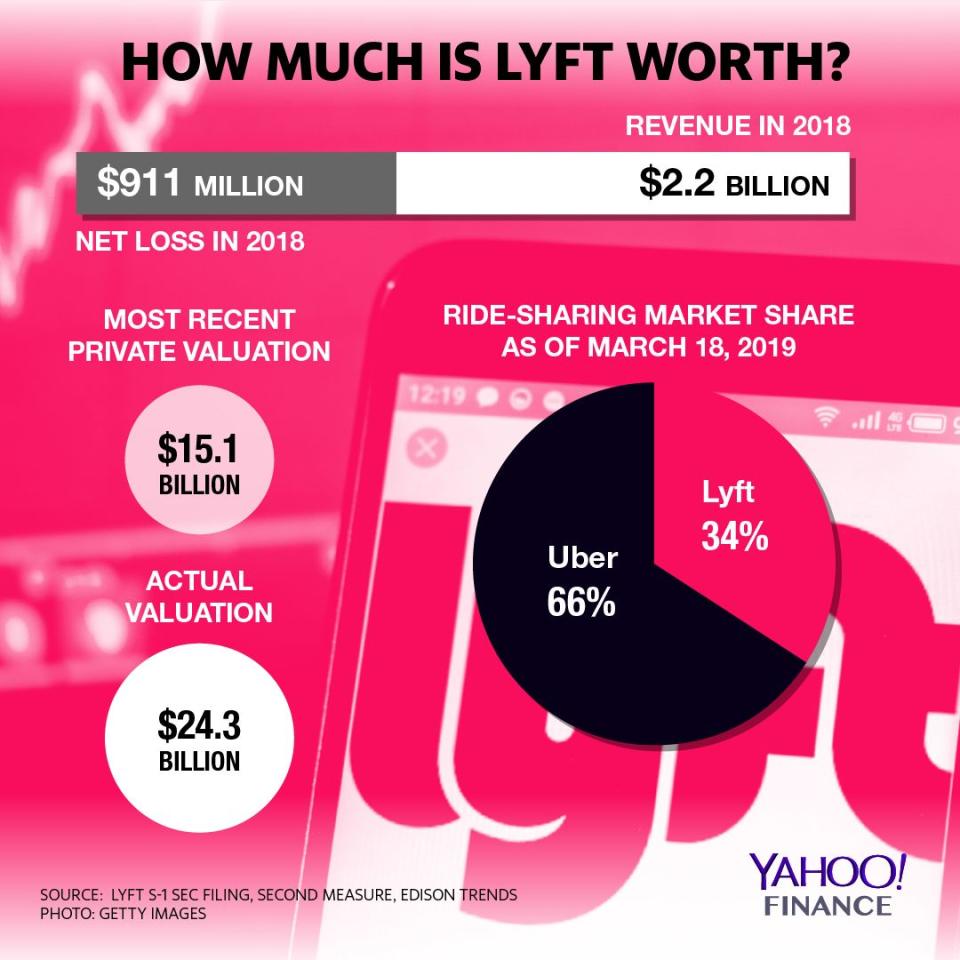

Lyft — which lost $911 million in 2018 — is among a number of startups slated for IPOs that have had major losses, including WeWork and Uber. Pinterest and video conferencing service Zoom are also reportedly set to descend on the public markets in the near term.

And iconic denim maker Levi’s (LEVI) debuted on the New York Stock Exchange on March 21. The stock surged over 30% in its first trading day. The next day, the broader stock market suffered its worst day since early January amid weak economic data out of Germany and the inversion of the yield curve, which hasn’t happened since 2007. Still, Levi’s stock remained resilient, falling only 1%. This was the company’s second go around as a public company, after being taken private decades ago.

“I don’t think there’s any greater vote of confidence [in the stock market] than when the IPO market is active,” Kinahan said.

That said, the optimism from IPOs shouldn’t lead investors to lose focus on the many worries plaguing the stock market, according to Kinahan.

“IPO optimism shouldn’t outweigh what you’re concerned about,” Kinahan said, adding that until a trade deal is set between the U.S. and China, it will be hard for the broader stock market to break out of its recent narrow trading range.

For investors looking to put new money to work right now, Kinahan suggests steering clear of the IPO euphoria.

“Let things settle in,” he said. “See where some of the financials are before you commit a lot of money to it.”

Aside from IPOs, Kinahan and Colas are cautious on the financials sector given the inverted yield curve worries. Banks make money when the yield curve is steepening.

Kinahan continues to be bullish on the technology sector, which is the best performing S&P 500 (^GSPC) sector so far in 2019.

NOTE: A version of this story was first published on March 28, 2019.

—

Scott Gamm is a reporter at Yahoo Finance. Follow him on Twitter @ScottGamm.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Scott:

The market is starting to overreact to very specific economic data points

2019 may be the year of tariffs against European auto imports

The world is on an 'irreversible path to an economic downturn': Nomura