Why Lyft's IPO may be more attractive than Uber's

This article was originally published on November 19, 2018 and has since been updated.

Of all the companies going public in 2019, no two are likely to be more closely watched and compared than Uber and Lyft.

Of course, for the two largest U.S. ride-sharing giants that have been battling each other for market share for years, that comparison is nothing new. But as the two companies near respective initial public offerings, the question posed to public investors will no longer be about which firm can deliver the better ride, but rather, which will deliver a stronger return.

Answering that question will ultimately depend on an array of factors, including the price at which each company begins trading. Lyft is expected to price its stock Thursday above its previously indicated range of $62 to $68 a share, according to the Wall Street Journal, which would indicate strong investor demand. But beyond price, there are a few important distinctions between the two ride-sharing giants investors should consider.

First off, Uber is a behemoth and dwarfs Lyft. Both underwriting proposals from Goldman Sachs and Morgan Stanley originally projected the 10-year-old startup could be valued at $120 billion when it goes public. At that valuation, Uber could top Alibaba’s (BABA) $25 billion IPO as the largest in history, if it offers up 21% of its shares in the public offering. That percentage would be higher than the historically low amount of shares tech companies have been listing. Lyft, meanwhile, is expected to go public at a valuation of around $23 billion.

Part of the discrepancy stems from the fact that Uber’s revenue from the 65 countries it operates in far outweigh that of its rival. Lyft, which operates in the U.S. and Canada, racked up over $2.1 billion in total revenue last year compared to Uber’s $7.4 billion in 2017, according to data compiled by EquityZen, a platform for trading shares in private companies.

Lyft is growing faster than Uber

However, Lyft’s revenue growth has outpaced Uber’s in recent years. From 2014 to 2017, Lyft has seen a compounded annual growth rate of an astounding 223% compared to Uber’s 146% clip over the same time period. Looking at 2018 specifically, Lyft’s annual revenue rose 100% year-over-year, compared to Uber’s 43% revenue jump.

That said, Lyft’s net loss widened 32% in 2018 compared to 2017, from a loss of $688 million to a loss of $911 million. Uber’s net loss shrunk in 2018, according to self-reported numbers provided to Barrons, down 15% from $2.2 billion to $1.8 billion. For now, Lyft’s losses would mark the largest by any U.S. company going public in history, according to data from S&P Capital IQ. Groupon and Snap lost $687 million and $515 million, respectively in the years leading up to their IPOs.

As Duncan Davidson, co-founder and general partner at venture firm Bullpen Capital, points out, investors tend to look for faster growth rather than profitability out of companies looking to go public. While Uber is technically closer to profitability, that might not matter as much as the rate at which Lyft is growing.

“In the long run, Uber might take the lion’s share of capital in the category,” Davidson told Yahoo Finance. “But if I was a normal investor I’d go into Lyft… there’s more upside being smaller.”

Davidson admits, however, that upside has now been limited for retail investors looking to get into each name since Lyft intends to price shares above its initial range.

“Relatively speaking, it’s gotten less interesting. Lyft at [a valuation of] $15 billion was a clear buy,” he said, adding that at a valuation of $23 billion there is relatively less value.

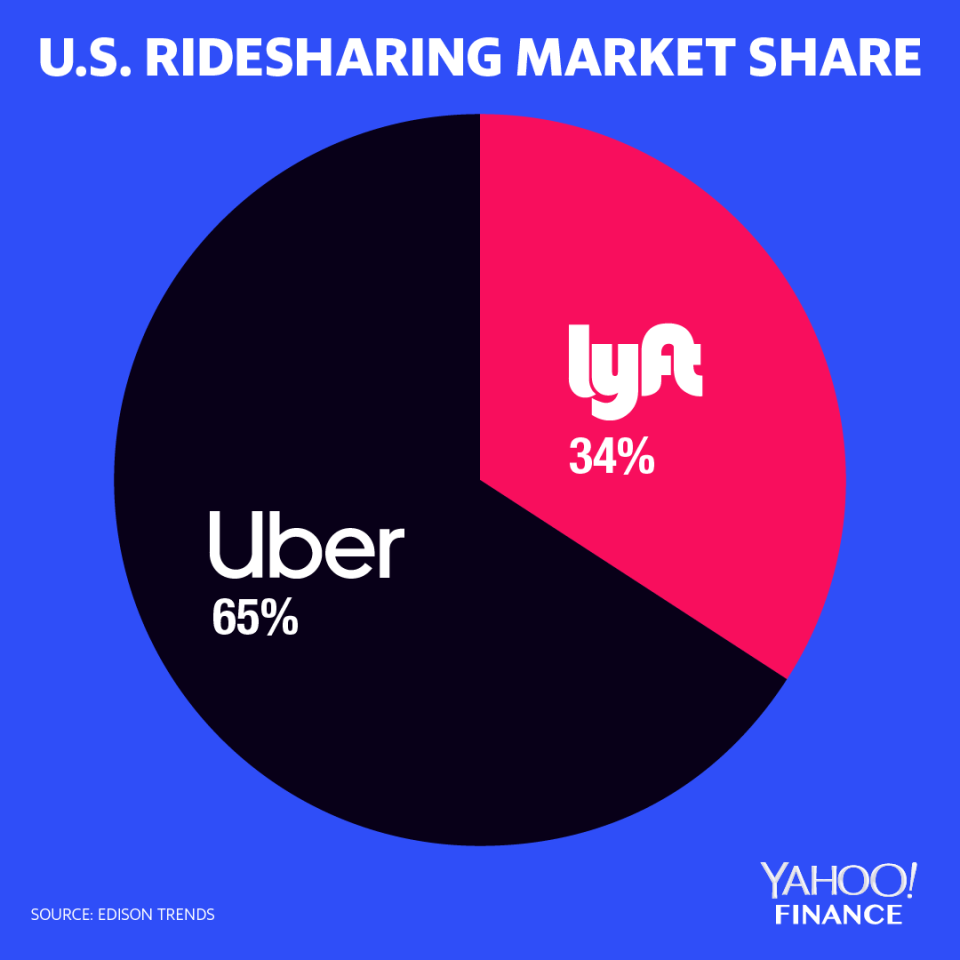

Lyft has also been growing its domestic market share. According to data from Edison Trends, Lyft now controls about 33% of total ride-share spend in the U.S. compared to the low-to-mid teens it saw in 2016. That’s a critical factor to consider, according to EquityZen co-founder Shriram Bhashyam.

“What typical growth investors will be looking at is who can gain market share,” he said. “You can tolerate [net] losses if there is high revenue growth and it speaks to the story of growth trajectory.”

Winning the race to an IPO

By going public first, Lyft may be able to lock up investor money that may have been desperately waiting to get into ride-sharing. That could detract from Uber’s offering should its IPO follow. On the flip side, Lyft could also be harmed by going public first if investors opt to wait for what will likely be a much larger offering from its rival.

That said, making use of a fresh injection of cash could set Lyft up for another spark to catch up to Uber, according to Davidson.

“They could probably use their public currency to make a relatively quick acquisition that might boost their overall offering,” he said.

Even if that possibility doesn’t play out, however, Davidson believes there is nothing holding back each company from seeing a pop in the first day of trading.

“This whole market has been hungry to buy into these stocks,” he said.

Lyft is expected to price shares Thursday ahead of listing on the Nasdaq Friday.

This was the second installment in a series looking at what to expect in the 2019 IPO market. Our first story highlighted the trends investors need to look out for.

Zack Guzman is a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Why 2019’s IPO outlook is bleaker than it should be

Where SoftBank’s Vision Fund is deploying its $100 billion

Juul surpasses Facebook as fastest startup to reach decacorn status