Malaysia Bonds to Gain Most in EM Asia From Treasury Rally

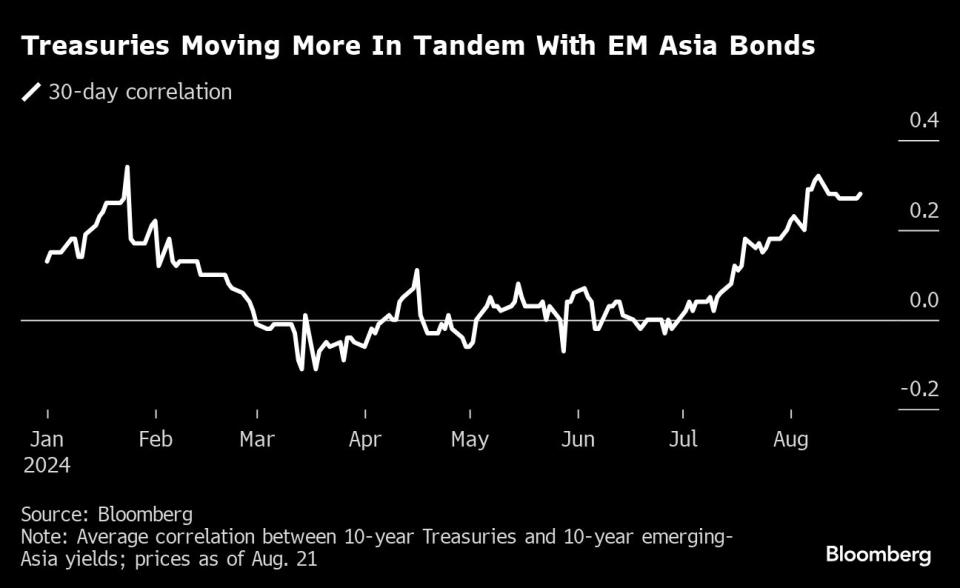

(Bloomberg) -- The sensitivity of emerging Asian bonds to Treasuries is climbing back toward its 2024 peak, with Malaysia’s debt set to be the biggest beneficiary.

Most Read from Bloomberg

The 30-day correlation between EM Asia bonds and 10-year US yields has risen to around 0.29 from zero at the end of June, close to the highest in seven months. Malaysian bonds have a correlation of 0.53 — the most in the region — suggesting they will gain more than their peers amid bets on Federal Reserve interest-rate cuts.

EM Asia bonds have moved more in lockstep with Treasuries this quarter as the dollar tumbled, luring foreign investors to the region and boosting local currencies. A rally in the ringgit attracted global funds to buy more of the nation’s debt. Malaysian bonds have returned 8.3% to dollar-based investors this year, making them the top performer in the region.

“The current macro settings with expectations of Fed rate cuts but no major economic downturn are conducive to foreign demand for local debt including ringgit bonds,” said Winson Phoon, head of fixed-income research at Maybank Securities Pte. There has been strong buying of Malaysian bonds in July and August so far, he said.

Thailand and South Korea are among other regional bond markets most exposed to gyrations in Treasuries, with correlations of 0.45 and 0.35, respectively. The linkages will likely remain elevated if dovish signals from the Fed support an eventual easing cycle from regional central banks.

Bangko Sentral ng Pilipinas kick-started its rate-easing cycle last week, while Bank of Thailand and Bank Indonesia kept rates unchanged Wednesday. Bank of Korea held borrowing costs on Thursday even as policymakers signaled dovish forward guidance, while Bank Negara Malaysia is likely to keep a status quo next month.

The increased correlation between Asian sovereign debt and Treasuries has also increased the vulnerability of regional bonds to higher US yields and a rebound in the dollar. The Bloomberg Dollar Spot Index snapped a three-day decline Wednesday as traders awaited Fed Chair Jerome Powell’s speech at Jackson Hole later this week for clues on the central bank’s policy outlook.

“The bigger risk lies in a potential rebound in the dollar, as current dollar weakness has provided a huge tailwind for EM assets so far,” said Eugene Leow, a fixed-income strategist at DBS Bank in Singapore.

(Updates with Bank of Korea decision in sixth paragraph)

Most Read from Bloomberg Businessweek

‘I’m So Scared’: NFL Players on How Betting Changes the Sport

The Little-Known Company That Caught Basketball’s Big Betting Scandal

?2024 Bloomberg L.P.