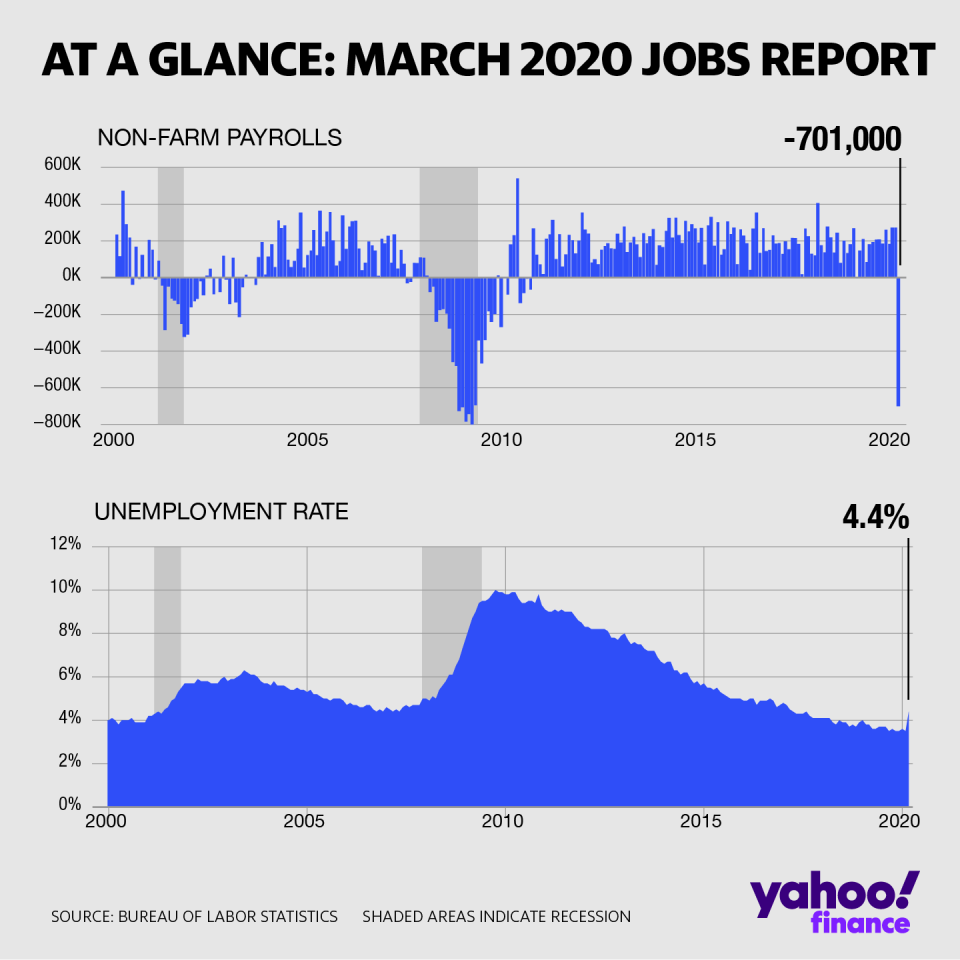

March jobs report: U.S. economy loses 701,000 payrolls, unemployment rate jumps to 4.4%

The U.S. economy shed jobs for the first time in a decade in March and the unemployment rate rose more than expected, as the coronavirus pandemic began to erode domestic economic activity.

The Department of Labor released its monthly jobs report at 8:30 a.m. ET Friday. Here were the main metrics from the report, compared to consensus data compiled by Bloomberg:

Change in non-farm payrolls, March: -701,000 vs. -100,000 expected and +275,000 in February

Unemployment rate, March: 4.4% vs. 3.8% expected and 3.5% in February

Average hourly earnings, month on month: 0.4% vs. 0.2% expected and 0.3% in February

Average hourly earnings, year on year: 3.1% vs. +3.0% expected and +3.0% in February

The reference period for the March jobs report extended through the 12th of the month, meaning that the data was captured before much of the country went on lockdown in response to the coronavirus pandemic. Namely, this jobs report excludes the two-week period at the end of March that saw new unemployment claims skyrocket to a combined 9.9 million.

“Given the timing of the report, our sense is that layoffs were not the main driver of the weakness in this report,” Neil Dutta, head of economics for Renaissance Macro Research, said in an email. “Indeed, jobless claims did not rise that much, at least during the payroll survey week. Instead, the drop came as hiring plans were put on ice.”

Even in the early stages of the outbreak, the economy already began shedding huge numbers of jobs, the Labor Department report showed. Non-farm payrolls fell by 701,000 in March for the first decline since September 2010, and far exceeded the number of job losses anticipated. The magnitude of the drop was the largest since March 2009.

And March’s drop in non-farm payrolls was the eighth largest decline on record, based on data going back to the late 1930s.

[See Also: How to file for unemployment insurance]

That marked a stunning reversal after the economy grew payrolls in both February and January of this year by 214,000 and 275,000, respectively. And the unemployment rate jumped from February’s 50-year low of 3.5% to 4.4% in March, the highest level since August 2017.

“March data from the establishment and household surveys broadly reflect some of the early effects of the coronavirus (COVID-19) pandemic on the labor market,” the Labor Department said in a statement. “We cannot precisely quantify the effects of the pandemic on the job market in March. However, it is clear that the decrease in employment and hours and the increase in unemployment can be ascribed to effects of the illness and efforts to contain the virus.”

The services sector led job losses in March, in-line with recent news of companies from restaurants to travel-related corporations shutting down operations amid the outbreak. Service-related industries lost a net 659,000.

Within the services sector, leisure and hospitality lost 459,000 payrolls in March, after gaining 44,000 in February. Education and health services industries followed by a wide margin, losing 76,000 jobs in March. Professional and business services lost 52,000 payrolls.

The smaller goods-producing sector lost 54,000 payrolls in March, led by a decline of 29,000 in construction. Manufacturing industries lost 18,000 payrolls, or more than consensus expectations for a drop of 10,000.

While March’s jobs report was already much weaker than expected, most economists believe worse still is yet to come. In a report Thursday, the Congressional Budget Office said it expected the unemployment rate to top 10% in the second quarter, reflecting the recent historic surge in new jobless claims. And Bank of America economists said Thursday they expected as many as 20 million jobs will be cut in the coming couple of months amid the outbreak, leading to a peak unemployment rate of 15.6%.

At the height of the global financial crisis, the unemployment rate reached as high as 10% in October 2009.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Nike 3Q revenue tops expectations as surge in China digital sales helps offset store closures

Credit Suisse cuts 2020 S&P 500 outlook, but sees rebound in 2021

Markit U.S. PMI report signals 'steepest downturn since 2009 in March'

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news