Markets shouldn't worry about 'President Pence'

It’s still unlikely President Trump will resign or be forced from office before his first term ends in 2021. But the odds have risen, given the recent guilty plea by his former lawyer, Michael Cohen, and a guilty verdict in the trial of his former campaign manager, Paul Manafort.

Cohen may pose the larger risk to Trump, since he knows the inner workings of the family firm, the Trump Organization, along with many details relating to the 2016 Trump campaign. Manafort is further from Trump’s inner circle, but he did run the presidential campaign for five months, including the period of time when Trump’s son and others met with representatives of the Russian government. It’s not clear either man will dish dirt to special prosecutor Robert Mueller, who’s investigating possible crimes related to the 2016 election. But the risk to Trump has intensified nonetheless.

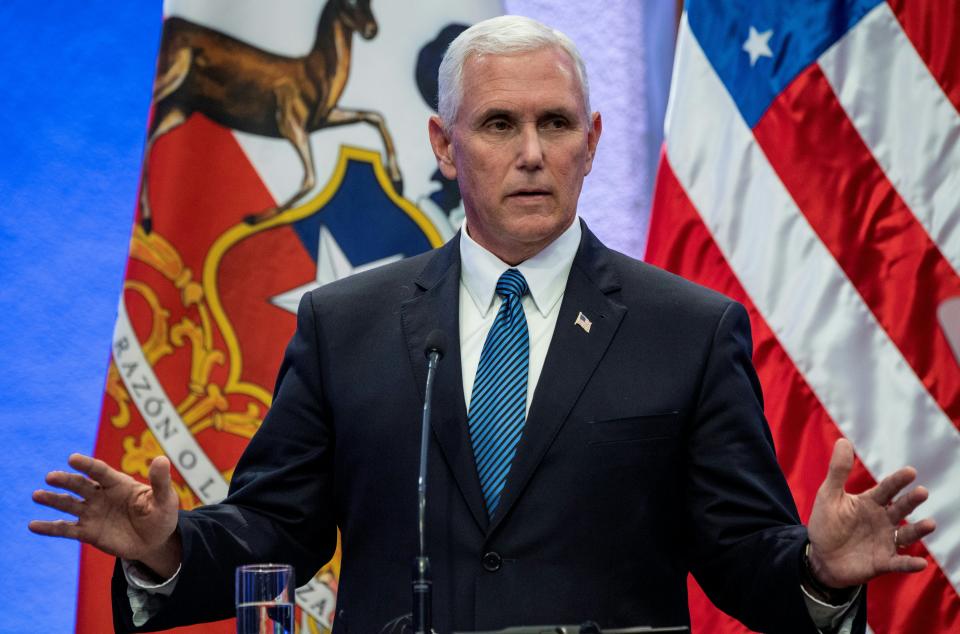

So what if Trump leaves office, and Vice President Mike Pence takes his place? That would obviously be a tumultuous political development. But once the dust settles, Pence could turn out to be better for markets and the economy than Trump.

If Trump leaves office abruptly, it would probably push markets down. “The initial impact of that hypothetical would be a fairly significant hard stop on the psychology behind the rally we’ve seen in U.S. equities,” says Peter Kenny, senior market strategist for Global Markets Advisory Group.

But an initial pullback might be the worst of it, as long as the economy remains strong – and markets would probably find their footing quickly. Pence might even be a more stabilizing economic force than Trump, because he favors conventional policies rather than the economic nationalism that has become a Trump hallmark.

Pence is more of an establishment Republican

Pence is more of an establishment Republican than Trump. “He would align more with free trade groups, like the Chamber of Commerce Republicans,” says Greg Valliere of Horizon Investments. “He’d cool off the Trump trade wars.” Pence would probably make nice with Canada and Mexico, quickly wrapping up renegotiations of the North American Free Trade Agreement.

He’d probably bury the hatchet with Europe as well, perhaps modifying or ending altogether the new tariffs on steel and aluminum imports Trump has imposed. If that happened, several foreign countries that have imposed retaliatory tariffs on U.S. exports would rescind those, too. Firms such as Harley-Davidson and Caterpillar, which are vulnerable to Trump’s trade wars, would benefit, as would many smaller operators.

China is a different story. There’s more agreement among business groups and both political parties that China cheats on trade, steals other nations’ intellectual property and imposes unfair barriers to keep foreign firms on a tight leash in China. Pence might continue Trump’s hard line on China, but not necessarily with tariffs that raise prices here in America and threaten damage to the U.S. economy. Another way to confront China would be to push for changes at the World Trade Organization that would give the global trade regulator more leverage to penalize China for cheating.

Pence, like Trump, favors pro-business policies such as lower taxes and lighter regulation. As governor of Indiana, Pence handed out copies of the business bible “Good to Great,” by Jim Collins, which describes how the world’s best companies reach the top. Pence cut taxes as governor and presided over economic performance that was among the best in the region.

What makes Pence controversial is his strict, and some would say extreme, stance on social issues such as gay marriage and abortion. But those wouldn’t necessarily be business issues at the national level. In Indiana, Pence did face a revolt in 2015, when he signed a law called the Religious Freedom Restoration Act, which would have allowed businesses to refuse to serve customers whose social or religious views they oppose. Prominent businesses threatened to leave the state, and Pence quickly signed a modified law rolling back the most objectionable parts of the law.

Whether Pence would be an effective president is another matter. As a former member of Congress, he’s well-versed in the ways of Washington and knowledgeable about how to get things done. But he’s never demonstrated Reaganesque charisma or particular grace under stress, and he’d become the leader of a Republican party greatly damaged by Trump’s scandals.

But markets might not care. “As we have repeatedly seen, markets are only influenced by the president to a limited amount,” says Erin Gibbs, portfolio manager for S&P Investment Advisory Services. “Ultimately, profits and growth are what investors are seeking.” If President Pence stayed out of the way, markets might even applaud.

Editor’s note: Yahoo Finance published an earlier version of this story on December 1, 2017.

Confidential tip line: [email protected]. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn