The market's verdict on Jeff Immelt is in

When Jeff Immelt became CEO of GE (GE) some 16 years ago, the big question was would he be able to fill the shoes of his legendary and crusty predecessor, Jack Welch.

To be sure, Immelt — a large, physical presence as Welch is almost impish — was a different CEO for a different time. Thrust into running one of the world’s biggest and most prominent companies, he was immediately hit with 9/11 and its aftermath. Immelt also had to manage GE through the 2009 financial crisis, a huge and wrenching time for the company as its financial arm GE Capital was not only a significant source of earnings for the company — it was known to be Welch’s black box in which he could dip into to find some more pennies of earnings if need be — but also very much wrapped up in the crisis itself. In the end Warren Buffett had to come to GE’s rescue.

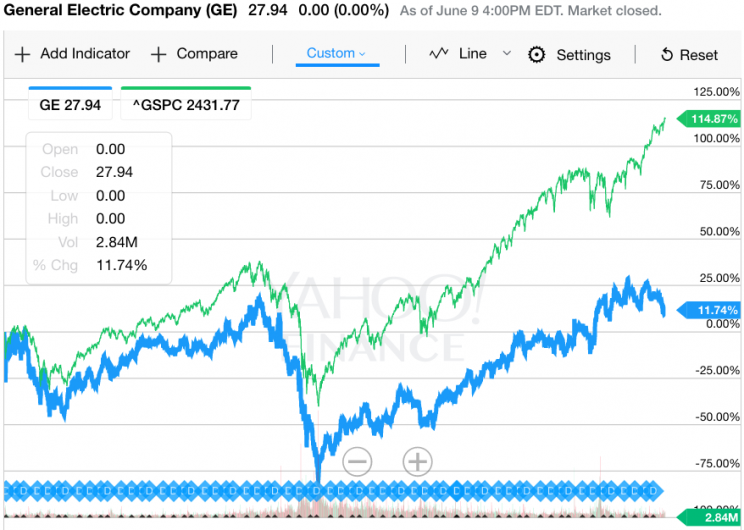

In the end there is the most important benchmark, one that GE would hold up for years during Jack Welch’s tenure. And that is stock price appreciation. And here is the bald and unhappy bottom line: During Immelt’s 16-year tenure, GE’s stock rose a paltry 11%, while the overall market (^GSPC) was up 114%. That is pretty damn devastating.

GE is famous for going its own way and the company has long suggested that giving a CEO plenty of time to prove himself was important. But it seems clear that GE gave Immelt time enough and then some. Why activist investors weren’t more active here is beyond me.

I’ve spent some time with Immelt over the years and he was genial, kind of like the big Mr. Nice Guy he must have been on the football team at Dartmouth. And despite making some nice moves when it came to GE making peace with the environment, Immelt did not get the job done.

And in another indictment by the market, GE’s stock was up after the company announced he was stepping down, suggesting investors were more than ready for a change.

—

Andy Serwer is Yahoo Finance Editor-in-Chief. Read more: