Meet some people getting rich from bitcoin

For Eddy Zillan’s bar mitzvah in 2012, his parents gave him $5,000 to start an investment fund. They expected him to start dabbling in stocks. Instead, he began buying cryptocurrencies like bitcoin and ethereum.

Eddy saved up another $7,000 from summers spent working at a tennis club and other jobs, adding that to his investment fund for a total $12,000 in principal.

Anybody who has been following cryptocurrencies knows where this story is going: Eddy’s $12,000 investment is now worth well over $500,000, a return exceeding 4,100% in just a few years.

“I don’t know if he’s a prodigy, but he’s close,” says Eddy’s father, Gary Zillan. Eddy, now 18, is a high school senior in Orange, Ohio, near Cleveland. He hopes to study dentistry next year at Case Western Reserve University. But if that doesn’t work out, he has a Plan B, since he just launched a company that provides tutorials and insights on cryptocurrencies. “Hopefully he’ll be a multimillionaire by the time he’s my age,” says his father, who is 46.

Bitcoin and other cryptocurrencies are suddenly the hottest investment since the dot-com bubble, after a stunning surge in value during the last year.

The price of bitcoin, the most well-known cryptocurrency, has soared by more than 700% in 2017. Ethereum is up a mind-boggling 3,900% — and early purchasers are suddenly watching the zeroes multiply on their accounts. Many crypto investors are reluctant to talk about their holdings, since alt-currencies are still associated with illicit activity, and they tend to appeal to non-traditionalists in the first place. But we found some willing to tell us their experiences. There are also plenty of detractors who insist cryptocurrencies are Ponzi schemes or worse. Yet regulators may soon bestow validity on cryptocurrencies by allowing broader investments, such as exchange-traded funds (ETFs), to track their value.

The origins of bitcoin

Bitcoin is a digital payment system launched in 2009 by a person or group using the name Satoshi Nakamoto. A network of coders with powerful computers has slowly “mined” more bitcoin since then by running complex computations that adhere to a set of founding principles, making bitcoin a kind of crowd-sourced currency. The market value of all bitcoin in the world is around $132 billion at current prices, roughly comparable to the current value of McDonald’s (MCD).

Other cryptocurrencies, sometimes referred to as “altcoins,” have emerged as well, including ether, the token of the blockchain network ethereum ($32 billion in market cap), ripple ($9 billion), litecoin ($3.7 billion) and dash ($3.3 billion).

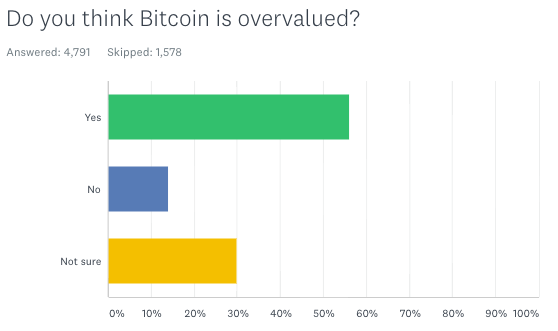

In a recent Yahoo Finance survey, 77% of respondents told us they have never purchased bitcoin — but of those, 11% said they’re planning to, and 38% said they’re thinking about it. As more people buy in, that interest alone could send the crypto rally even higher.

[See the full results of our bitcoin survey, conducted online Nov. 10-13.]

Ordinary people can buy cryptocurrencies through services like Coinbase, SpectroCoin or Kraken, usually by linking a bank account or credit card and following simple instructions. (Disclosure: I own a small amount of bitcoin.)

Critics such as JPMorgan Chase CEO Jamie Dimon and hedge-fund titan Ray Dalio see cryptocurrencies as a craze that will eventually implode, akin to tulips or Enron. But Bill Gates, Richard Branson, and Mark Cuban are believers, and many investors think bitcoin and other digital currencies are like the Internet in 1995 — a transformative technology about to erupt.

The money is certainly real.

Bitcoin as currency

Peter Saddington of Atlanta first read about bitcoin in 2011, and bought some for less than $3 per coin. With bitcoin now trading at around $7,500, the return on those early investments is around 250,000%. “I’ve never seen anything like this,” says Saddington, 35, an entrepreneur who has a bachelor’s degree in computer science and three master’s degrees. “What solidified my confidence that this is worth investing in is that the code is based on math. It can’t really be turned off.”

[Had a wild experience with cryptocurrencies? Let us know! Email us at [email protected].]

In October, Saddington cashed out 45 bitcoins to buy a 2015 Lamborghini Huracán, for the equivalent of about $238,000. He and the seller made the transaction in bitcoin, without using a traditional bank. The transaction fees totaled $7.50.

Saddington, who runs a cryptocurrency social network called TheBitcoin.pub, deliberately sought a supercar he could purchase with bitcoin in order to tout the credibility of the currency. “Buying the Lambo with bitcoin is proof it can be used for real transactions, buying really cool stuff,” he says. “It’s not only used by criminals.”

As for how much bitcoin he still holds, he says: “That’s for me to know and you to wonder about.”

A California wine executive we interviewed also tried to buy a fancy car with bitcoin — and he’s grateful the transaction fell through.

The 55-year-old saw a friend ask about bitcoin in a Facebook post a few years ago. He researched it and began buying a few coins per month, at prices ranging from $225 to $800, until he accumulated about 80 bitcoins. The wine executive had always wanted an Audi A8L, and in 2016 he saw a slightly used model advertised for $50,000. Since bitcoin had fallen to around $600, that was almost exactly how much bitcoin he had. He sold all his coins to finance the car.

The owner, however, refused to make any concession on price, which scotched the deal. So, what to do with the $50,000? He decided to put it back into bitcoin, even though the price had risen to $900 by then. At that price, he ended up with just 60 bitcoins — but that’s now worth more than $450,000.

“I’m more than $120,000 short because I wanted that stupid car,” the wine executive says. “But by not buying that car, I made almost half a million in profit.”

[Editor's note: This story originally identified the wine executive. We removed identifying information in April 2023 after he received threats and demands to turn over his bitcoin to a criminal enterprise.]

Others have invested in cryptocurrencies far more aggressively — with some paying a steep price. When the Mt. Gox digital exchange collapsed in 2014, more than 24,000 customers lost essentially all their holdings. Some customers had dozens or hundreds of bitcoin stored at Mt. Gox, with losses approaching $1 million or more at today’s value.

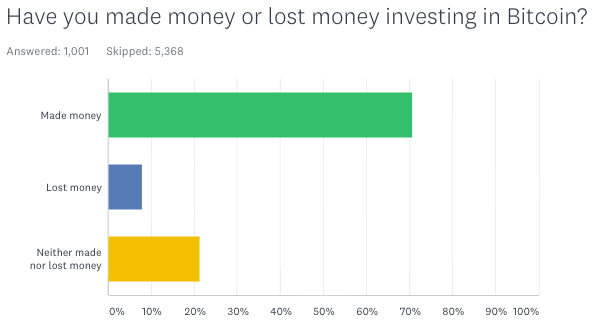

In our Yahoo Finance survey, 71% of bitcoin buyers said they’ve made money on their investment. But 8% said they had lost money. The median amount of the loss was $500, but some listed five- and six-digit losses. Of those who have made money on bitcoin, the median gain was $3,000, with a few reporting seven-figure hauls.

The obvious question now is whether the value of bitcoin will continue going up, or whether a speculative bubble is about to burst.

Counting on bitcoin

Many early buyers think bitcoin is only getting started, and at some point will become a mainstream currency used routinely. “It’s like the early 1990s, when people were asking, ‘where is this internet thing going to go?’” says a New York bitcoin investor who asked we identify him by his nickname, Duke. “We’re still in the early lunatic adopter phase, slowly shifting to the early adopter phase.”

Duke, who teaches technology at a high school, first tried to buy bitcoin in 2011, but a snafu with a PayPal transaction prevented the transaction. The 30-year-old figured he’d get to it later, but the price jumped to more than $1,000 per coin and he assumed he missed the boat. The price came back down, however, and he eventually bought 21 bitcoins, at prices as low as $200.

At one point, he spent an entire paycheck buying bitcoin.

Now, with a portfolio worth nearly $160,000, he’s reluctant to cash out even a tiny fraction of coin, for fear of missing out on even bigger gains in the future. “A lot of bitcoin holders are kind of afraid to spend it,” he says. “You could end up spending the equivalent of $2 million on a couple of pizzas. Twenty or thirty years from now, if I have grandkids, maybe I’ll be able to pay for their colleges.”

By then, maybe schools will even accept tuition payments in bitcoin.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman