This midterm election outcome could derail Trump’s corporate tax cuts

There is a scenario from the midterm elections that could jeopardize the future of President Trump’s tax cuts, which have emerged as a boon to corporate earnings this year.

If Democrats take control of the House and Senate, expect significant modifications to the Tax Cuts and Jobs Act, passed in late 2017. The Democrats would likely push to raise the corporate tax rate to 25% from 21%, which is still significantly lower than the 35% rate in place prior to the legislation. A repeal of the state and local tax deductions could also be explored.

That’s the assessment from Nicole Kaeding, director of federal projects at the Tax Foundation, based in Washington, DC.

“I’m not sure about an outright appeal of the tax bill,” she told Yahoo Finance. “That would raise taxes on large number of individuals.”

Kaeding thinks Democratic control of the House of Representatives, the current consensus, would not be enough to see major changes in the tax bill. The Democrats would also need to control the Senate, she said.

But Democratic momentum alone may not be a problem for the tax cuts. Analysts say it’s important to dig deeper and keep an eye on which Democrats gain steam.

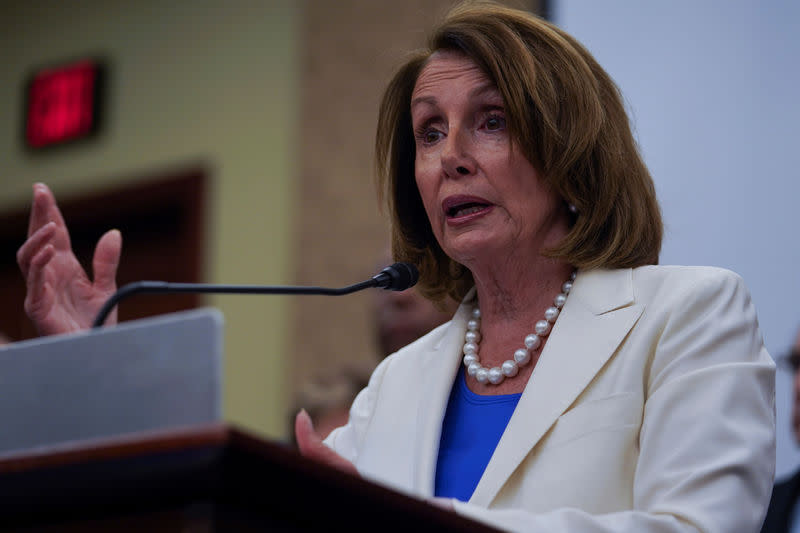

Robert Hockett, Edward Cornell Professor of Law at Cornell Law School said the ultra progressive Democrats would likely take an addition strategy vs. a subtraction strategy when it comes to the tax cuts— compared to their more traditional Democratic counterparts, such as Rep. Nancy Pelosi (D-CA).

“The progressive wing of the party, which has all the momentum, is not as concerned about the deficits,” he said. “They would look to keep the corporate tax cuts (instead of repealing them), but also add tax cuts for the middle class and those who need it the most.”

This actually may help corporations, Hockett said, as most corporations benefit when the middle class does well and has additional purchasing power.

But Hockett said corporations should be concerned if the Democrats win the House, and Pelosi becomes majority leader. “[With Pelosi], I think there’s more of a likelihood of trying to repeal the 2018 tax cuts,” he said, referring to Pelosi’s support of the pay-as-you-go rule, which requires new federal spending to be funded by tax increases.

Hockett said new federal spending could be funded by issuing more Treasury securities. “There seems to be an endless market for them,” he said, referring to investor appetite for Treasuries.

For progressive Democrats, Hockett says he could see them raising taxes in a more targeted way if the tax cuts (the existing corporate ones and the possible addition of steeper middle class cuts) spark too much inflation.

An example of a targeted tax increase would be a hike to the capital gains tax, which may help remove excess from the economy and especially financial markets, Hockett said.

He believes the stock market may be able to withstand a rise in the capital gains tax, which would only impact financial services firms.

Scott Gamm is a reporter at Yahoo Finance. Follow him on Twitter @ScottGamm.

More from Scott Gamm: