How baseball's tech arm got so big that Disney had to have a piece

When Disney (DIS) reported its third-quarter earnings this month, it also shared that the company has taken a 33% equity stake in something called BAM Tech. The reveal was unsurprising to baseball fans and to anyone who follows the business of technology. But to outsiders, it may have been mystifying: What exactly is BAM Tech?

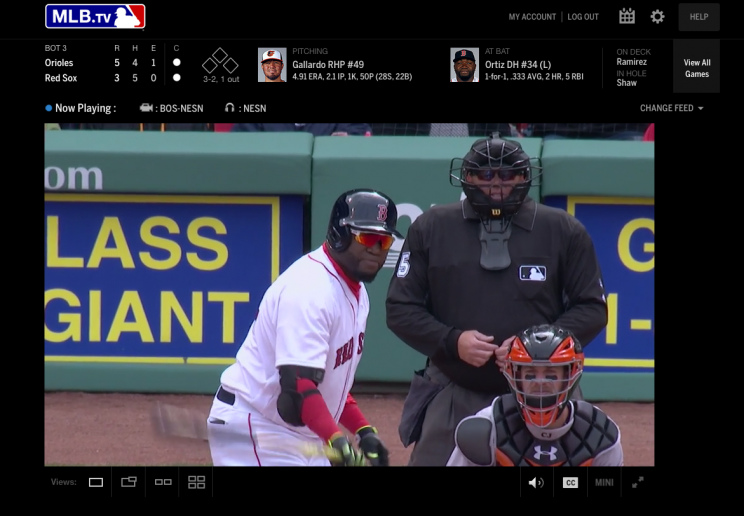

The answer is not simple. Major League Baseball Advanced Media (nicknamed “Bam”), once described as simply “baseball’s technology arm,” is now a complex operation that handles live video-streaming, ticket sales, and media rights for the sport, as well as streaming video for many organizations beyond baseball. BAM Tech, the newly spun-off video unit, is thought by most to be the No. 1 most innovative digital video company in sports right now.

At $1 billion for a 33% stake, Disney may have gotten a steal.

BAM first launched in 2000, when Bud Selig was baseball commissioner, as a separately run tech startup, equally owned by the 30 teams. The initial investment committed by the 30 teams: $120 million total ($1 million annually from each team for the first four years). It operates out of Chelsea Market in Manhattan, and many a magazine has taken a trip to its buzzing little headquarters, full of enough control rooms, switchboards, and walls of screens that it looks more like the offices of a Silicon Valley startup.

Live-streaming a baseball game for the first time

The first major milestone (or pivot, by some definitions) came 14 years ago, in August 2002, when BAM live-streamed a game for the first time: a New York Yankees home game against the Texas Rangers. It was so long ago now that Alex Rodriguez, at the time, was still playing for the Rangers. The only other player in that game who is still in the league today is current Toronto Blue Jays pitcher Joaquin Benoit.

“The media player was the size of a postage stamp compared to what we do today,” says MLB.com communications chief Matt Gould, who has been with BAM since the beginning. “The only platform we could stream to was PC. Think about not being able to do something on an Apple product in 2016, that would be unthinkable. [BAM added streaming for Mac in 2006.] And it was an out-of-market game, so we also had to figure out a geolocation technology part to figure out where you were watching from.”

The stream did not look good. It appeared in a tiny window. It loaded slowly. But none of the other three major American sports leagues had tried this before; there was no YouTube yet (2005) or Facebook (2004). BAM was way, way ahead of the curve on video.

That September, toward the end of the regular season, BAM scrambled to offer up a streaming package of nine games, all pennant-race matchups, for $4.95—charmingly cheap compared to now. In the postseason, it sold a package of all games to fans outside the US for $19.95. (It couldn’t do so in the US due to broadcast rights.)

For the next year, it offered a full-season streaming package for all 30 teams, with an annual option, monthly option, or $2.95-per-game option. It never looked back. Now all of the major sports offer some form of streaming subscription, but MLB is renowned for its MLB.tv package, which was first and, arguably, still best.

Going all in on mobile

The next major milestone came in 2005 when Bob Bowman, the former COO of industrial manufacturer ITT whom MLB brought on to run BAM, turned his eyes toward mobile. At a time when most people had flip phones that couldn’t access the Internet, two years before the iPhone, three years before the iOS App Store, Bowman hired two new people to focus on mobile. Their mandate was to optimize all of MLB’s web sites for a mobile phone. Then BAM quickly built a larger mobile team.

By the time Steve Jobs was on stage in June 2008 announcing the iOS App Store, two MLBAM developers were on stage with him, demonstrating MLB’s At Bat app. The wildly successful, long-running app has been featured on stage at Apple events many times since then.

In 2006, organizations other than baseball came looking for BAM to handle their video streaming for them: first CBS (for March Madness basketball) and then ESPN (for what would become its streaming network, ESPN3, now called WatchESPN).

Becoming a white-label streaming machine

How had BAM become so good at streaming video? The onus of showing 15 different live baseball games on a typical night helped run its operation through the gauntlet. A live-streamed baseball game always carries the possibility of a sudden abrupt spike in viewership: a pitcher has a no-hitter going into the 8th inning, say, or two teams are having a slug-fest of home runs. Add to all of that the requirement that the video be behind a paywall, where many people need to be able to sign in quickly and access high-quality video, and you can see the extent of the work.

For ESPN, BAM merely provides a white-label service, like any outside vendor. It powers the video, but didn’t build ESPN’s streaming product. For other clients that came along, BAM began building their entire product, end to end, including their app, user interface, and infrastructure. BAM did that for World Wrestling Entertainment (WWE), and Glenn Beck’s streaming network TheBlaze, and then, most famously, for HBO’s standalone product HBO Now. HBO Go, the streaming app for HBO television subscribers, was built by HBO itself and was known to have quality issues and interruptions. BAM built out HBO Now in just three and a half months.

Powering video for those clients also meant powering vast libraries of content. WWE, for example, had 30 years of video content, and you never know when a fan might want to fire up the first ever WrestleMania, and when that fan does, it needs to work smoothly. It’s a different technical challenge than live games.

In 2014, in seven ballparks, MLBAM rolled out “Statcast,” its revolutionary tracking tech that caters to stat-heads, a growing, vocal, nerdy subset of sports fans that love to quantify athletes with granular data points. The hardware—tracking radar and cameras—produces massive amounts of data, stored by cloud giant Amazon Web Services, that can tell fans something as wonky as the exit velocity at which a hit ball took off from a bat, or the speed at which a runner stole a base. It has had an immeasurable influence on the other major pro sports leagues. Last year it went live to all 30 ballparks.

Buying digital rights to hockey games

One year ago came the next major shift in the BAM business story. MLB cut an unprecedented deal with the National Hockey League in which BAM paid for digital rights for the first time. (Normally, clients pay BAM.) It was also a historic decisions by two commissioners—MLB’s Rob Manfred and NHL’s Gary Bettman announced the deal together in person—for one league to buy another’s media rights.

BAM agreed to pay $100 million annually to run all of hockey’s digital presence (not just video) and to distribute hockey games and sell ads against them, the same way it monetizes streams on MLB.tv. NHL Network relocated to MLB Network’s facility in Secaucus, NJ. The NHL got a 9% stake in BAM Tech.

The fact that pro hockey wanted pro baseball to run all its tech says everything you need to know about BAM’s sterling reputation.

Selling Disney an equity stake

And now comes the Disney stake. BAM Tech officially spun off from MLBAM this month, and it now has three stakeholders: MLB owns 58%, Disney owns 33%, and NHL owns 9%. In four years, Disney has the option to buy another third from MLB.

When news first broke, over a year ago, that BAM would spin off BAM Tech, many wondered if BAM Tech would go public. The Disney stake ends that possibility, and it reportedly values BAM Tech at more than $3 billion (yup, it’s a “unicorn”).

Separately, main MLBAM is still equally owned by the 30 MLB teams, and is still the bigger money-maker, but probably not for long. MLBAM says it expects to bring in around $1.2 billion in revenue this year, and BAM Tech $250 million. But BAM Tech, with its video primacy, is the future gem. “Their technical chops are the best, bar none,” Dan Rayburn, EVP of StreamingMedia.com, told The Verge. “They set the standard.”

BAM Tech now powers the largest streaming video on demand (SVOD) library in the world—its library is bigger than Netflix’s, Hulu’s, and Amazon Prime’s, combined.

Now Disney gets a foot in the door of BAM Tech, and can leverage it for its massive universe of entertainment content. The obvious first play is with ESPN, but BAM Tech could do something with the “Star Wars” franchise, or Marvel, or any of Disney’s films—the possibilities boggle.

First up: an ESPN over-the-top streaming product build and powered by BAM Tech. Disney’s press release says it will be “a new ESPN-branded multisport subscription streaming service,” but that, “current content on ESPN’s linear networks will not appear.” In other words, ESPN isn’t ready to go fully digital a la HBO Go just yet. But you can imagine that BAM Tech will hold its hand and help guide it there.

—

Daniel Roberts is a writer at Yahoo Finance, covering sports business and technology. Follow him on Twitter at @readDanwrite. Sportsbook is our recurring sports business video series.

Read more:

ESPN must evolve beyond TV, and still has time to do it

BuzzFeed reorganizes for second time this year, focuses on video

Facebook’s live video plan should scare Twitter, Snapchat, Periscope

Mobile sports video app Fancred gets resurrected by Football Nation