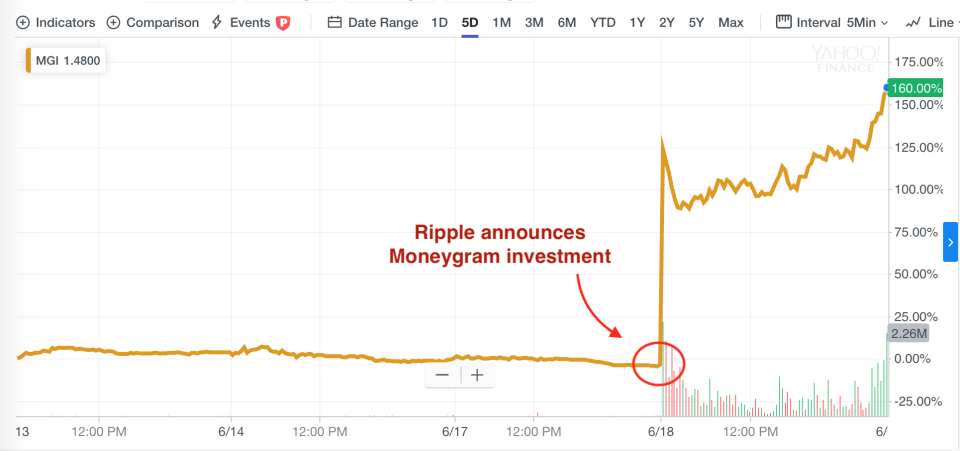

MoneyGram soars 168% from Ripple investment

On Tuesday, money-transfer company MoneyGram saw its stock soar an eye-popping 168% after banking software company Ripple announced it will buy $30 million of MoneyGram shares at a huge premium of $4.10 per share, with the option to buy another $20 million worth of shares over the next two years. In return, MoneyGram (MGI) has made Ripple its primary partner for cross-border payment settlement using digital assets.

Suddenly, crypto looks cool again.

After the massive run-up in price of all the top cryptocurrencies in 2017, including bitcoin (BTC), ether (ETH), and ripple (XRP), prices plunged across the board in 2018.

Now, halfway through 2019, coins are up and excitement is returning, although the top cryptocurrencies have also appeared to decouple more than in the past—bitcoin is up far more than anything else. Bitcoin is up 140% this year so far; ether is up 87%, and XRP is up 17%.

The fact that a partnership and investment from Ripple had the power to send MoneyGram up a staggering 168% on Tuesday is a sign of bullishness for the space. (By Wednesday morning in premarket, shares of MoneyGram were beginning to fall back to earth, but the point was made.)

And Ripple’s announcement of its MoneyGram deal came just one day before Facebook’s announcement of Calibra, its first crypto wallet, to store and send Libra, a new cryptocurrency supported by Facebook, Visa, MasterCard, PayPal, Stripe, Uber, Lyft, eBay, Spotify, and more.

It all adds up to hot crypto action involving publicly-traded, household-name companies, still a rare thing for an industry whose biggest players are private startups like Coinbase.

Ripple sells software to banks and financial institutions for faster settling of cross-border payments. Its two main products are called xCurrent and xRapid, and the xRapid product relies on the cryptocurrency XRP.

Ripple, the company, and XRP, the asset, are separate things, but they are often conflated, particularly since Ripple owns 60% of the supply of XRP tokens, which leads cryptocurrency purists to argue that XRP is not sufficiently decentralized as bitcoin is.

As a result, Ripple CEO Brad Garlinghouse told Yahoo Finance on stage at the All Markets Summit: Crypto last year, “There’s a lot of FUD about XRP.” (FUD is fear, uncertainty, and doubt.) Ripple’s former chief market strategist Cory Johnson also identified to Yahoo Finance last year the “religious-like fervor” around XRP.

Over the past couple years, Ripple has steadily added a large number of banking clients, but most are using xCurrent, not the product that runs on XRP. Last year, Western Union said it was testing out xRapid, which was taken as a big win for both Ripple and XRP.

The deal with MoneyGram will “focus” on xRapid, Ripple says. The company, in its announcement, is touting that XRP “remains the most efficient digital asset for settlement, with transaction fees at just fractions of a penny, compared to other digital asset fees of about $30 per transaction.”

—

Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

Facebook’s crypto play is called Calibra, will launch in 2020

Cryptocurrency CEO who paid $4.6M for lunch with Buffett: 'It might be unrealistic'

SEC lawsuit against Kik has major implications for crypto industry

Exclusive: SEC quietly widens its crackdown on ICOs

There are now two 2020 candidates accepting crypto donations

JPMorgan blockchain chief: Why we launched our own cryptocurrency

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.