Wall St. is betting on earnings growth in the second half of 2016

Will earnings growth return?

That’s the most important question in the stock market (^GSPC) right now. After all, in the long-run stocks are fundamentally driven by earnings and expectations for earnings growth.

Currently, analysts estimate that S&P 500 earnings fell by 5.3% year-over-year in Q2, marking five consecutive quarters of earnings declines since the financial crisis. While this is a dismal trend, it’s backward-looking. Investors and traders want to know what’s going to happen next. What happens next is what will move stock prices.

“Earnings estimates and revision momentum have been improving in recent weeks, as the bottom in commodity prices in Q1 appears to be offering some much needed support to the earnings stream,” Wells Fargo’s Gina Martin Adams observed on Tuesday. Along with the rest of the consensus, Adams expects earnings growth to pick up in the second half of the year.

Earnings growth is critical when valuations are this stretched

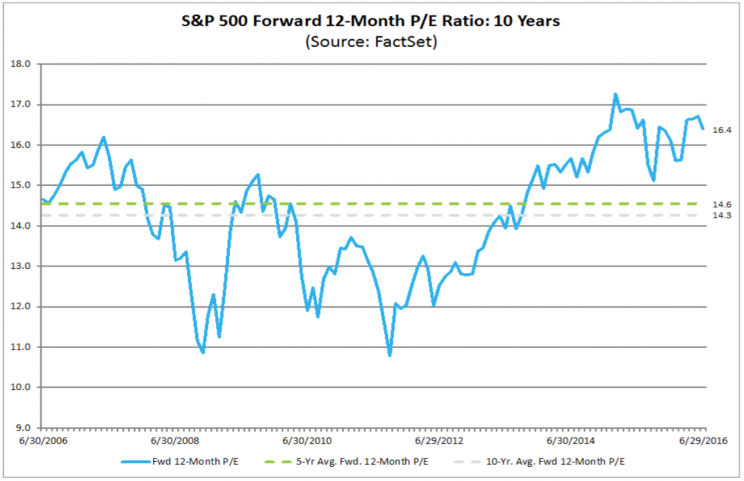

Stock market bears are quick to point to stretched valuations in the stock market. According to FactSet, the forward 12-month price/earnings ratio is 16.4, which is well above the 5-year average of 14.6 and the 10-year average of 14.3.

However, stock market guru Richard Bernstein recently argued that we are entering an earnings-driven bull market, in which stock prices can continue to rally while P/Es contract because earnings growth picks up.

Importantly, earnings growth acceleration is expected following long periods of lackluster earnings, like that which we have been experiencing.

“Earnings-driven bull markets seem to be the norm during the year following a profits recession trough,” Bernstein observed. “Typically, the market advances about 13-15% and multiples contract about 1-2 multiple points.”

But the path to earnings growth isn’t clear

As earnings season kicks off next week, investors and analysts will be reading earnings releases and listening to conference calls for clues as to what management expects to happen next.

“We will be watching closely to see if expectations for a near term trough stick or are pushed out, as has been the case over the last few quarters,” Credit Suisse’s Lori Calvasina said on Wednesday. “We continue to believe that any second half 2016/early 2017 recovery in EPS growth hinges on the outlook for global IP and the US Dollar, as using our calculation, EPS growth has been positively correlated with global IP momentum and inversely correlated with the US Dollar in small, mid and large cap over time.”

Wall Street’s strategists have become increasingly cautious given the elevated uncertainty in the wake of the recent Brexit vote.

“Few corporates appeared worried about Brexit: we found just 29 mentions of the EU Referendum or ‘Brexit’ in 1Q earnings transcripts,” Bank of America Merrill Lynch’s Savita Subramanian said on Wednesday. “Now that Brexit is a reality, companies with European/UK exposure might guide down on expectations of weaker European growth, a stronger US dollar and overall uncertainty, and capex guidance may similarly falter. Stocks with high European exposure may be particularly vulnerable to bad news given how overweight fund managers had grown in this pocket of the market ahead of the vote.”

As some experts suggest clients wait and see, others think it’s more prudent to think much more cautiously.

“While we are comfortable with the positive trajectory of earnings for 2H16 and 2017, we view indirect effects of Brexit and uncertainty related to US election (i.e., a pause in activity as companies wait and respond to the outcome) as potential downside risks for growth outlook,” JPMorgan’s Dubravko Lakos-Bujas said on Thursday. “With this in mind, management guidance during this earnings season will be instrumental in determining the magnitude of negative revisions to current aggressive forward estimates.”

“As investors we have been taught by experience that it’s in this process where the risks as well as the opportunities lie,” Oppenheimer’s John Stoltzfus said.

But some bulls charge on

Veteran bulls argue that it’s during these times of uncertainty and discomfort that the best investing opportunities reveal themselves.

FundStrat Global Advisors’ Tom Lee recently outlined multiple reasons why the market could extend its post-Brexit rally. Importantly, he pointed to signs that earnings growth is coming back.

“The drivers for the higher EPS estimates have been the weaker USD and the improvement in commodity prices (especially oil),” Lee said on Tuesday. “[T]he upturn in Energy EPS estimates does not yet fully reflect the higher strip prices for oil (futures). We are encouraged that EPS revisions are moving up for several groups, including Energy, Materials and Industrials. The broader implication is that improving estimates argue that the earnings recession looks to be ending.”

For the bulls, all this means new highs in stocks.

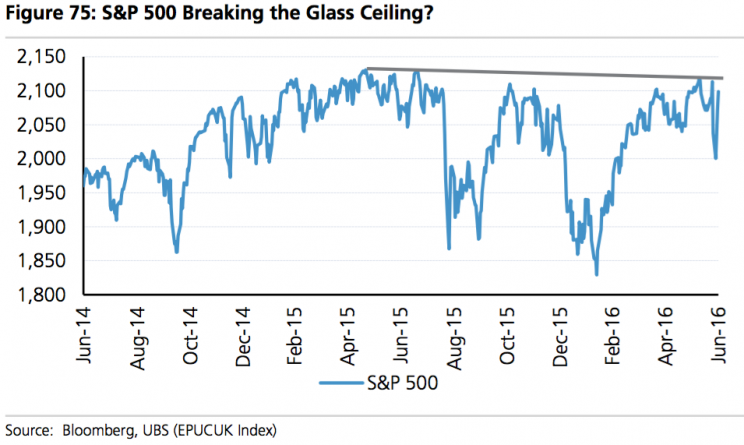

“Low rates, historic caution from overhedged and underexposed investors, a solid economy, an earnings recovery with stable FX and oil, and valuations that are not excessive by historical standards. … We expect the ceiling to be shattered in Q3,” UBS’s Julian Emanuel said.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Here’s the irony of trying to predict the next stock market crash

A single word explains why financial markets everywhere are nosediving

The dumbest math mistake investors make in the stock market

The not-so-secret way millionaire investors get way richer

Gutsy Wall Street analyst dares to debunk a sacred truism about the stock market