Past performance is not an indicator of future outcomes for 92.7% of mutual funds

“Past performance is not an indicator of future outcomes.”

That’s a variation of a disclaimer you’ll see in mutual fund marketing materials.

“Yet, due to either force of habit or conviction, investors and advisors consider past performance and related metrics to be important factors in fund selection,” S&P’s Aye Soe writes.

Specifically, investors will often find themselves attracted to the funds with the best track records, believing that there is some magic touch there that’ll result in persistent riches.

Unfortunately, data shows that the exact opposite is true.

92.7% of top performers fail to remain top performers after two years

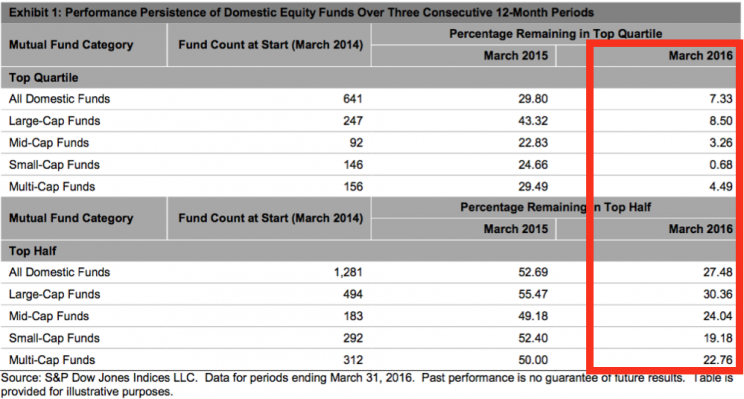

Soe analyzed the performance of 641 actively managed domestic equity mutual funds, and she found some very unflattering stats.

Of the funds boasting top-quartile annual returns through March 2014, just 7.3% of those funds stayed in the top quartile in March 2016. To put it another way, 92.7% of the top-performing funds in 2014 failed to deliver top returns two years later.

“Furthermore, 8.5% of the large-cap funds, 3.26% of the mid-cap funds, and 0.68% of the small-cap funds remained in the top quartile.”

When you broaden it a bit to include the top half of performers, still just 27.4% stay in the top half after two years.

Just 0.3% of funds stay winners after five years

Soe’s analysis goes even further to see how the top performers of 2012 did through 2016.

Just 0.3% of those funds stayed in the top quartile in March 2016. To put it another way, 99.7% of the top-performing funds in 2012 failed to deliver top returns four years later.

Like the literature says: “Past performance is not an indicator of future outcomes.”

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

David Rosenberg nails the stock market in a perfect sentence

The stock market is making no sense for a lot of investors

How history’s most successful investors think about wild market swings

Here’s the irony of trying to predict the next stock market crash

An overwhelming majority of Wall St. pros who try to beat the market fail