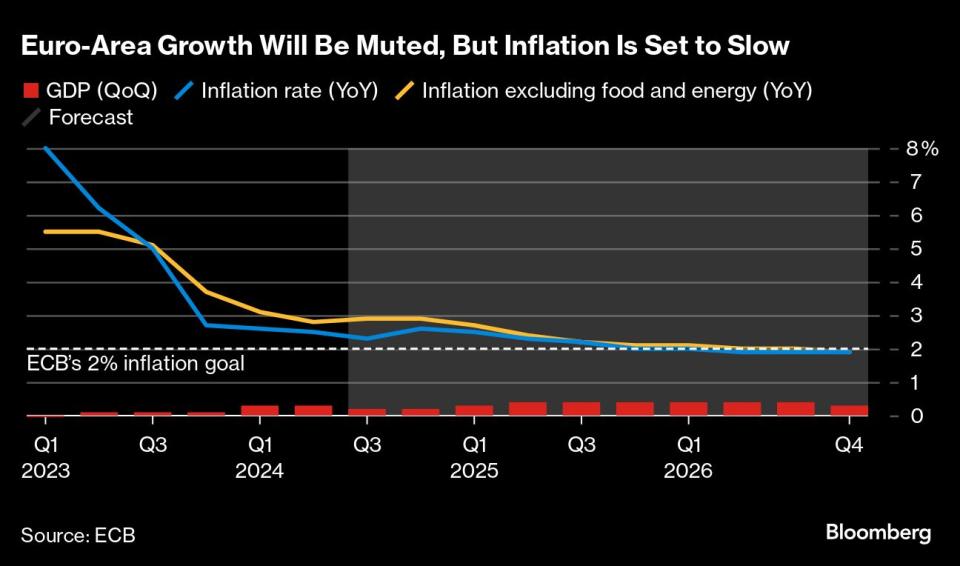

(Bloomberg) -- European Central Bank policymakers must remain on alert even with consumer-price growth on track to slow to 2% by the end of next year, Bundesbank President Joachim Nagel said.

Most Read from Bloomberg

-

Housing’s Worst Crisis in Decades Reverberates Through 2024 Race

-

An Affordable Nomadic Home Design Struggles to Adapt to Urban Life

-

The Hague Is World’s First City to Ban Oil and Air Travel Ads

“If we look at the inflation picture for this year and next year, we assume that we will reach our target by the end of 2025 at the latest,” he said at his institution’s open day in Frankfurt on Saturday. “But I also know — unfortunately, that’s the way with inflation — that we have to stay focused because as a central bank there are many things, such as energy prices, that we can’t control.”

The German central banker spoke after the ECB cut interest rates for a second time since June and confirmed economic projections which see consumer-price growth averaging 2.2% next year and 1.9% in 2026.

He reaffirmed that outlook on Sunday, saying he’s “fairly sure” that 2% will be achievable by the end of next year, adding that it was “consistent” with that view to lower borrowing costs on Sept. 12.

Still, on inflation “we’re not yet there, where we want to be,” he said.

Nagel, who is among the more hawkish members of the ECB Governing Council, said inflation had been a “greedy beast” in the past, but now no longer can be described in such a way.

(Updates with comments on Sunday in fourth paragraph)

Most Read from Bloomberg Businessweek

-

College Football Players Learn an Ugly Truth About Getting Paid

-

EV Leases Go as Low as $20 a Month to Help Dealers Clear Their Lots

-

The Vegas Sphere’s First Live Sporting Event Will Be an Expensive One

?2024 Bloomberg L.P.