Bullishness among traders has hit a disturbing 3-year high

There’s been an eery calm in the financial markets. The S&P 500 (^GSPC) hasn’t seen an up or down move of greater than 1% in 36 trading sessions.

Wall Street strategists warn that markets aren’t pricing in the slew of uncertainties that lie just beyond the horizon. Catalysts for volatility include the US presidential election, the next Fed rate hike, the evolving Brexit narrative in Europe, etc.

Gluskin Sheff’s David Rosenberg points to a variable in the derivatives markets that may make the stock market more sensitive and vulnerable should things go south.

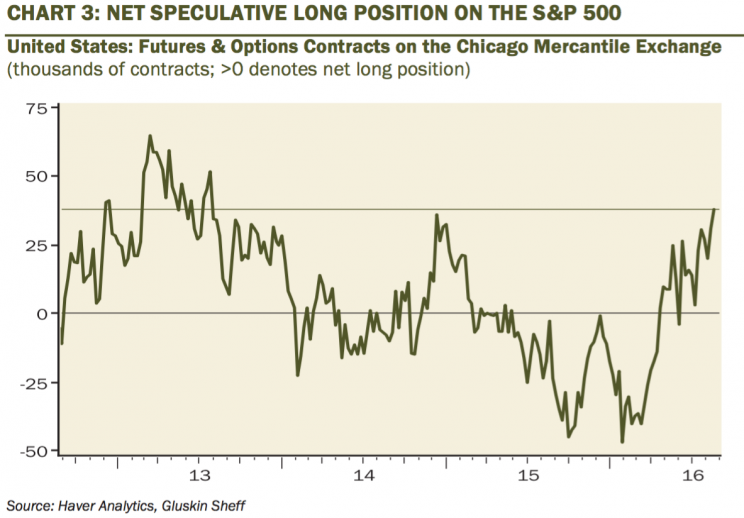

“The net speculative position on the CME as far as SPX contracts are concerned have ballooned nearly 70% since mid-July to 38,083 net longs, a bullish bet we have not seen since June 2013, and this is one vivid sign of just how complacent the masses are,” Rosenberg wrote on Wednesday.

Traders and sophisticated investors use derivatives such as options and futures contracts to adjust their exposures to stock markets, largely because it’s cheaper and more tax-efficient.

“The buyers look to have exhausted themselves at this point,” he said.

Elsewhere in the derivatives markets is the CBOE Volatility Index (^VIX). VIX measures the premium people are willing to pay to protect themselves from price volatility. And lately, it’s been way below average.

Rosenberg argues that the low VIX and elevated valuations have been unfavorable for the market’s bulls. And it all speaks to the same theme of complacency and perennial bullishness as the stock market continues to trade near all-time highs.

“As per Bob Farrell and his Rule #5, ‘the general public buys the most at the top and the least at the bottom’,” he warned.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Don’t be fooled by the calm in the markets

The stage is set for the next 10% plunge in stocks

The peculiar pattern of S&P 500 earnings surprises

David Rosenberg nails the stock market in a perfect sentence