Netflix is 'owned by passionate idiots': Analyst

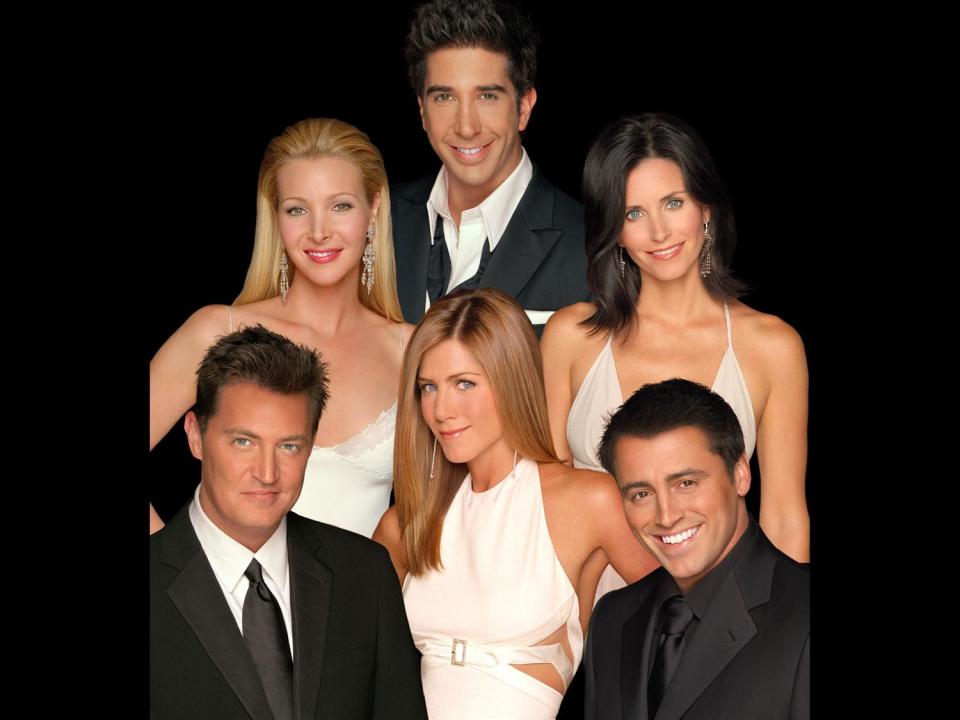

News of Netflix (NFLX) losing its top two most-watched shows – “Friends” (to WarnerMedia’s HBO Max in 2020) and “The Office” (to NBCUniversal’s service in 2021) – doesn’t mean the demise of the leading streaming service. At least not yet.

“It’s probably not as fatal to Netflix as the headlines may appear,” Wedbush analyst Michael Pachter tells Yahoo Finance’s “The First Trade.” “I don’t think it’s good for Netflix, but I don’t think they’re going to lose a ton of subscribers immediately.”

Instead, Pachter sees a “slow bleed” ahead for the streaming giant. “If Disney, Comcast and Warner pull all their content [off the platform], Netflix is going to lose about 60% of its content,” and Pachter says that spells bad news for Netflix over the next four to five years.

‘Stranger Things’ to the rescue

The prospect of networks pulling back their top titles is no surprise to Netflix. The streaming service, which boasts 148 million paid subscribers globally, has been anticipating the move. It’s one of the reasons why the company is spending feverishly to attract and keep subscribers.

That investment appears to be paying off when it comes to the supernatural thriller “Stranger Things.”

On Monday, Netflix tweeted that 40.7 million accounts have watched the show since its July 4 debut. That’s a record for any film or TV series in its first four days on the platform.

In addition, a survey by Wall Street firm Cowen & Co., found about 51% of current Netflix users plan to watch “Stranger Things 3.” Nearly 5% of consumers who aren’t current Netflix subscribers plan to sign up for the service to watch the show, while 13% of former Netflix members plan to re-subscribe in order to watch the show’s third season.

“We view these figures as notably positive given the potential to drive gross [subscription] additions both at the end of 2Q19 and into 3Q19 on the back of arguably NFLX’s highest-profile show,” Cowen & Co. analyst John Blackledge wrote in a research note Tuesday.

Cash burn is a ‘serious problem’

Still, there is that “serious problem” of cash burn, according to Pachter.

The self-proclaimed resident Netflix bear says the stock is “owned by passionate idiots” and believes shares are worth about half what they’re trading at now. His price target for Netflix is $183. Shares were trading above $379 Wednesday afternoon.

“My price target is based on an honest and ethical view of what their cash flow is likely to look like in the future, but I still value them at $100 billion. I think the open question is how do some of these clowns on Wall Street value this thing at $450-$500, which is way north of $200 billion in value. I think that’s crazy talk.”

Netflix currently burns through roughly $3 billion a year in cash as it spends big on original content. Analysts project Netflix will spend $15 billion on new programming this year, up from $12 billion in 2018.

Pachter says the only way Netflix can get to a $200 billion market cap is to turn its annual negative cash flow into a positive $10 billion cash flow.

“You can’t get to positive $10 billion without a meaningful price increase and a meaningful increase in subscribers,” he says.

Pachter believes it’s hard to envision that kind of growth for Netflix, especially with so much competition waiting in the wings from the likes of Disney (DIS), Comcast’s NBC Universal (CMCSA) and AT&T’s (T) WarnerMedia.

Alexis Christoforous is co-anchor of Yahoo Finance’s “The First Trade.” Follow her on Twitter @AlexisTVNews.

Read more:

Deutsche Bank 'buried their head in the sand': Analyst

Is an earnings recession on the horizon?

Gold at $1,400 per ounce is 'overbought': Strategist

Google is worth 50% more broken up: Analyst

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.