Why Netflix is poised to survive the new ‘tv bubble’

The first golden age of television is generally considered to be from the mid-1940s until around 1960. TV shows were mostly live back then and included everything from “Peter Pan” to “Twelve Angry Men” — as well as Shakespeare, ballet, and classical music performances by the likes of Leonard Bernstein and Toscanini. That’s some serious high culture.

In the early 1960s, technology, in the form of videotape, which allowed producers to make movie-like shows easily and cheaply, swept across the business and effectively ended the era.

Today we’re in another golden age of TV, also brought on by new technology, in this case cable and now streaming. As was true 70 years ago, we’re also seeing some amazingly high-quality content. There’s also a massive quantity of shows being produced (more on that in a second) all of which has created a highly unsettled business environment for TV producers (positive for them) and TV distributors such as networks, cable companies, and streaming services (mixed for them).

There’s sure to be a shakeout, but for now the customers (this is us), are basking in the rays of endless, dare I say, peak content.

The new golden age of TV began some 20 years ago with the likes of HBO’s “Sex and the City,” (first broadcast in 1998) and “The Sopranos,” the following year. But streaming services by Netflix, Amazon, Hulu, and others have taken the quantity and quality to a whole other level. As IAC Chairman Barry Diller said to me recently, “...while there is more than you need...there's still an enormous amount of quality on television. I mean, consistent quality, far greater than movies by a zillion miles.”

There sure is a lot to see. It used to be that I’d at least heard of the shows people talked about in the office. Now it’s gotten to the point where there’s too much to keep track of, never mind watch.

‘TV is in deep, deep trouble’

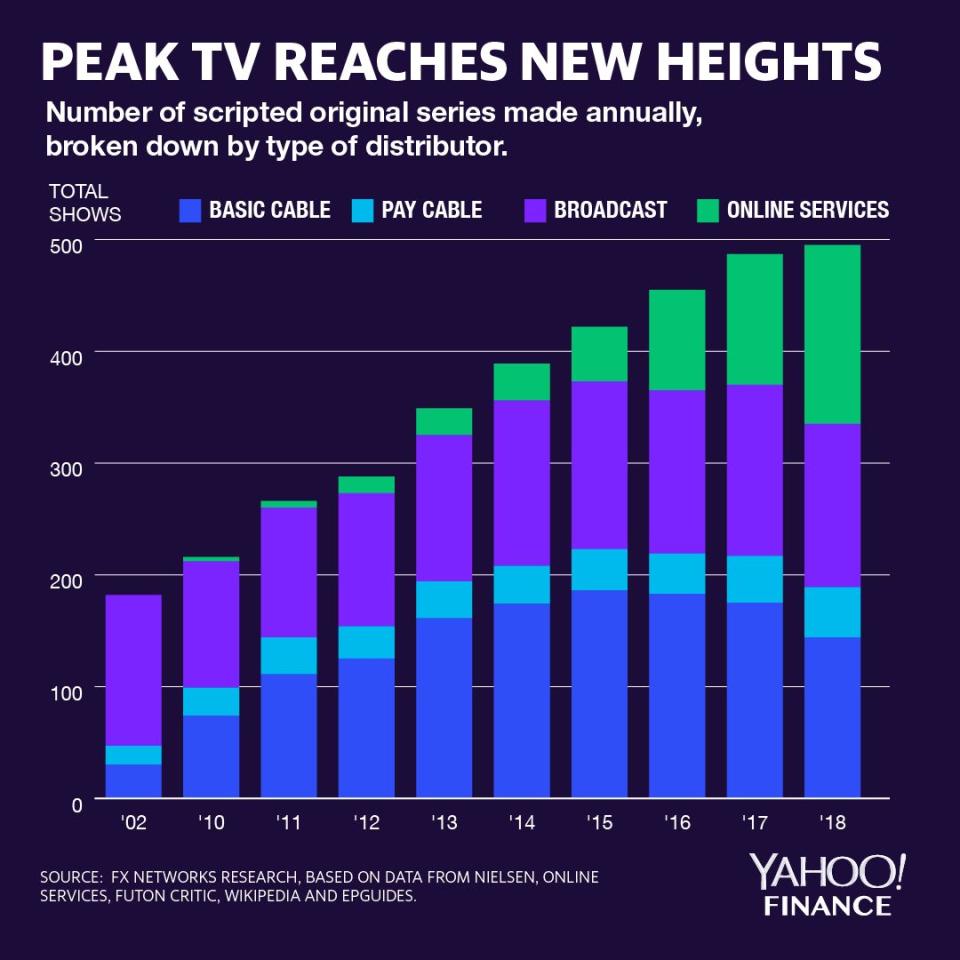

How much more? Analysis by the go-to guy for tracking this, FX Networks CEO John Landgraf, shows the number of scripted shows (no reality, sports, news, kids shows, etc), has climbed from 182 shows in 2002 (pre-streaming), to 216 in 2010, to a mind-boggling 495 shows last year, including 160 from streaming services, a tally that exceeded broadcast for the first time. Wow.

Netflix, the king of streaming, with some 700 shows on its platform (including non-English programs) now has a reputation of being so profligate with its billions of dollars of production spend, that it has been satirized on both “Saturday Night Live” and “South Park.”

I recently sent out an email to the Yahoo Finance newsroom asking folks about their favorite shows. The response was fast and furious, (like a sign-up for free tacos or some such) i.e., people really care about their TV shows! Fifty-seven people weighed in, naming 146 different shows. Of that total, 50 were from streaming services, 37 network, 34 cable, and 25 premium (like HBO.) Favorite shows: “Game of Thrones” (22 mentions), “Big Little Lies” (19), “The Crown” (10), and “Stranger Things” (10).

Of course, this is a tiny sample of a coastal media elite, but nonetheless, I find it eye-opening and a real power display by streaming, which bodes well for Netflix and Amazon, et al (even with HBO’s GOT at No. 1). Rich Greenfield, media analyst at BTIG, agrees. “Streaming is going to win, TV is going to lose. I think TV is in deep, deep trouble. [There is a] loss of advertising dollars, [and the] best content is not on TV. TV is for sports and people who can afford for it,” he says.

How long will the shift take? “It’s like the music industry. You see shift, shift, shift, shift, and then massive shift. These things usually happen slowly and then all at once,” says Greenfield. “The only question is how long until the advertising collapses.”

Traditional media companies are fighting back, of course. Hulu is a consortium of legacy media companies, and Disney, NBCU, and Time Warner have all announced streaming services to be launched soon.

‘Cord cutting has been fake news for a while’

And legacy companies still do have advantages. Deana Myers, research director at Media & Communications for S&P Global Intelligence (a “Game of Thrones” and “Ozark” fan) points out that unlike cable, which is difficult to cancel, it’s “really easy to cancel a streaming service these days.”

Alan Wolk, co-founder and lead analyst at TVREV, and author of “Over The Top: How The Internet Is (Slowly But Surely) Changing The Television Industry,” says longtime viewers will keep cable in business. “Cord cutting has been fake news for a while. If you look at the stats, it’s still less than one percent. The average age of viewer is over 50. Those people aren’t dying anytime soon,” he says.

But that doesn’t take into account “cable-never” consumers of which there are millions and growing. And as Wolk points out, “[What] Netflix has from a macro point of view is that its primary business is as a streaming video service where their competitors all have very different businesses they rely on. Warner, AT&T is a phone company. Apple [which is also apparently entering the streaming business] is a hardware manufacturer.”

I agree that despite Netflix’s slightly light earnings report, it’s hard to bet against it. International growth was strong and James Wang, research analyst at ARK Invest, told us he sees Netflix doubling its subscriber base to some 200 million in five years, (from around 140 million) which the company could do if it maintains its current growth rate. Later, Wang says when streaming growth slows, Netflix could perhaps move into gaming, sports, or news.

While Netflix could end up as the Sun King of the golden age, other companies will scale back.

Wolk sees it ending badly for some. “Peak TV is turning into the TV bubble. The tulip thing,” he says. “Even if they’re all really good, no one can possibly watch all those shows. There’s not enough time. Eventually they’re going to cut back. I don’t think they can all be that good. Only so many talented people, actors, directors, and producers so while they’re all going global and spending over $15 billion between all of them on new programming, a lot of it just is not going to be very good.”

Already there are signs the business is getting plenty filled up. Walmart has just decided not to launch a streaming service.

Not to worry though — you still have 495 shows to watch.

So enjoy the new golden age. Good luck keeping up.

Andy Serwer is editor-in-chief of Yahoo Finance.

Read more:

Netflix can 'continue to raise prices' amid new competition, says media mogul Barry Diller