The No. 1 concern for companies during this earnings season

There seems to be no shortage of risks out there that could threaten a company’s earnings. The uncertain U.S. policy outlook and the uncertain geopolitical risk environment are notable.

However, most companies are being vocal about one particular risk: the prospects for a stronger dollar.

According to FactSet, 14 of the 23 S&P 500 companies that have reported second quarter earnings already cited the US Dollar as a factor that had a negative impact on earnings or revenues in the quarter.

This could be a preview of what’s to come as earnings season kicks off in earnest this week.

The movement of exchange rates is critical as S&P companies already draw almost half of their business from overseas. And worries over a rising dollar are likely to persist, particularly if the Fed turns more hawkish (i.e. aggressive with monetary policy and raising interest rates) than its global central bank peers like European Central Bank (ECB).

Companies with exposure to Mexico and England, like McCormick (MKC) and Costco (COST), reported pressure in their recent second quarter reports because of relative weakness of the peso and pound.

Meanwhile, analysts are saying an important source of earnings growth at this point in the cycle is overseas demand, which further puts the spotlight on foreign exchange.

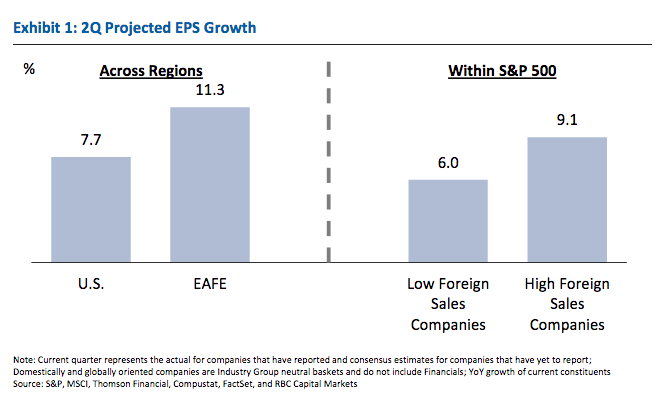

“Economic projections point to a pickup in nominal GDP on a global basis. Given their greater economic sensitivity, non-U.S. companies are forecast to grow faster than those in the US for 2Q and full-year 2017,” according to RBC’s Jonathan Golub. “Within the S&P 500, more export-driven businesses are expected to out-earn their more domestically-oriented peers.”

Expectations for second quarter earnings growth stands at 6.5%. This comes following first quarter earnings growth of 14%, which some analysts have argued was peak growth.

—

Nicole Sinclair is markets correspondent for Yahoo Finance.

Please also see:

Market guru Gina Martin Adams explained why a strong dollar is actually good for stocks

Retail dwarfs coal, and yet Trump has said little about massive job losses

The opioid crisis is hurting prospects for the US labor market

Fed sees easing financial conditions despite tightening

Tech stocks are not behaving like tech stocks

The US bond sell-off originated in Europe