NY Fed's Williams: There's still room for 'further gradual' rate increases

New York Fed President John Williams says the Fed still has room for “further gradual” rate increases to support a healthy economy.

At a press briefing Tuesday, Williams said the U.S. economy is strong but eased fears on an overshoot of inflation. He said that while he expects price inflation “to move a little bit above 2%,” he does not see “signs of greater inflationary pressures on the horizon.”

Williams said a continued path of gradual rate hikes should support the growing economy.

“The Federal Reserve has attained its dual mandate objectives of maximum employment and price stability about as well as it ever has, quite honestly,” Williams said.

Williams said he is still vigilant of possible risks in the future, and maintained a commitment to being “data dependent” on future policy decisions, as other Fed speakers have.

Asked about the 3- and 5-year yield curve inverting yesterday, Williams said financial conditions are “still overall pretty favorable to growth” but admitted that he is still attentive to “risks on the horizon.”

His remarks come less than a week after Fed Chair Jerome Powell said the economy is running “just below … estimates of the level that would be neutral for the economy,” leading some to interpret that as a sign that the Fed may be easing on its commitment to a path of gradual rate hikes.

Tight labor market

Williams said a tight labor market is a “pretty strong priority,” pointing to structural unemployment issues with workers not having not having the right skills for available jobs. In the New York Fed district — which covers the New York City metro area, New York state and Puerto Rico — it has been difficult for companies to find qualified workers from a shrinking labor force.

As a result, firms have had to pay more to attract talent.

The New York Fed released a report Tuesday showing that “exceptionally low” unemployment in its district is juicing wage growth. A survey of service firms in the region reported wage growth growing to 4.2% in November, up from 3.8% in February. A separate survey of manufacturers in New York state show wage growth picking up to 4.0% in November 2018, up from 3.4% in February.

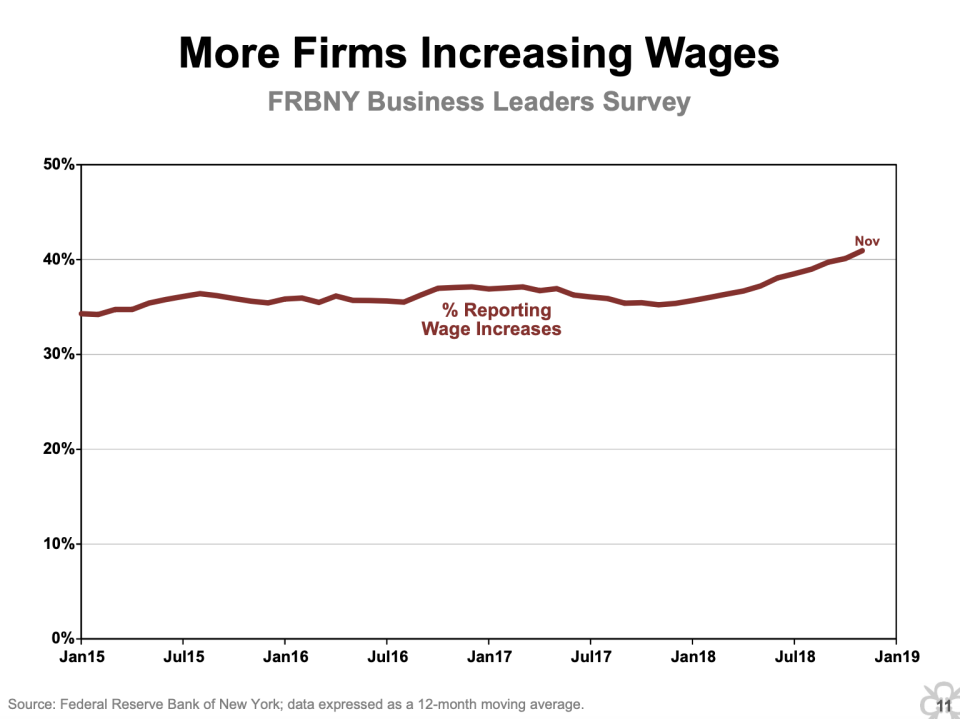

Year-to-date, the New York Fed says more and more firms have reported increasing wages. In recent months, the percentage of firms increasing wages edged up above 40%.

The report is in line with national trends on wage growth and, more broadly, inflation.

The October jobs report from the Bureau of Labor Statistics — the most recent reading — reported hourly earnings growing by 3.1% year-over-year.

Williams said he is not concerned with inflation picking up too quickly, insisting that wage growth close to 3% is consistent with his low and “stable” readings of inflation.

“Wage growth will pick up somewhat more, reflecting a strong economy,” Williams said, adding that he would be watching if wages end up accelerating sharply.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

FDIC chair: We need to be preparing for the next downturn

Atlanta Fed’s Bostic joins chorus of concern over leveraged lending

Fed’s Clarida: Central bank still looking for ‘ultimate destination’

There’s a 30% chance of a recession in 2020, Morgan Stanley says