Fed officials look to 1995 to guide them on next rate moves

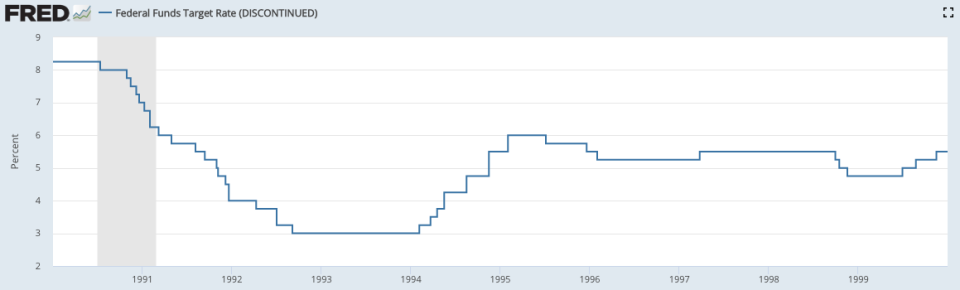

Markets are betting on another rate cut from the Federal Reserve on Wednesday, as policymakers attempt to engineer a soft landing for a U.S. economy trying to avoid a recession. The working model: the Fed’s 75 basis points of cuts in 1995 and 1996 to steer clear of a downturn.

If the Federal Open Market Committee delivers a 25 basis point cut at the conclusion of its meeting on Oct. 30, it will be the third consecutive reduction of the benchmark interest rate. With risks from trade and global concerns abroad continuing to weigh on the U.S. economy, the Fed faces questions about whether the Fed is on the path to further easing in the near-term.

Wall Street is projecting a rate cut at the conclusion of the FOMC meeting Wednesday, but analysts are split on whether the easing cycle will stop there, as what Goldman Sachs calls a “three and out.”

“Strong signaling from Fed leadership indicates that the modest trade war de-escalation since September has not deterred them from completing a 75 [basis point], 1990s-style ‘mid-cycle adjustment,’” Jan Hatzius at Goldman Sachs wrote Oct. 24.

Credit Suisse agrees with Goldman Sachs, but wrote Oct. 24 that they could see the Fed tolerating some market pricing for further easing.

Morgan Stanley similarly said they expect the Fed to “pause” on rate cuts after an expected 25 basis point cut on Wednesday, but said the pause “will not be signaled.”

Barclays, however, expects a fourth cut in December.

“Since shifting to slower U.S. growth earlier this year, our high conviction view was that the Fed would ultimately need to provide more accommodation than it expects to stabilize the outlook,” analysts at Barclays wrote Oct. 21.

With such a wide divergence of expectations on future moves, markets could be sensitive to the way Fed Chairman Jerome Powell messages policy in his scheduled press conference. Wells Fargo’s Sam Bullard wrote Oct. 28 that Powell will “walk a fine line” in communicating forward guidance.

As of Monday afternoon, Fed funds futures markets were pricing in a 95.1% chance of another 25 basis point cut at the conclusion of the Federal Open Market Committee meeting on October 30.

Back to 1995

There is historical precedent to asking if three 25 basis point rate cuts are the perfect defense against a recession.

That’s because three is the exact number of 25 basis point cuts that the Fed delivered on in the mid-1990s to avoid recession fears amid the Russian debt default and the near collapse of hedge fund Long Term Capital Management.

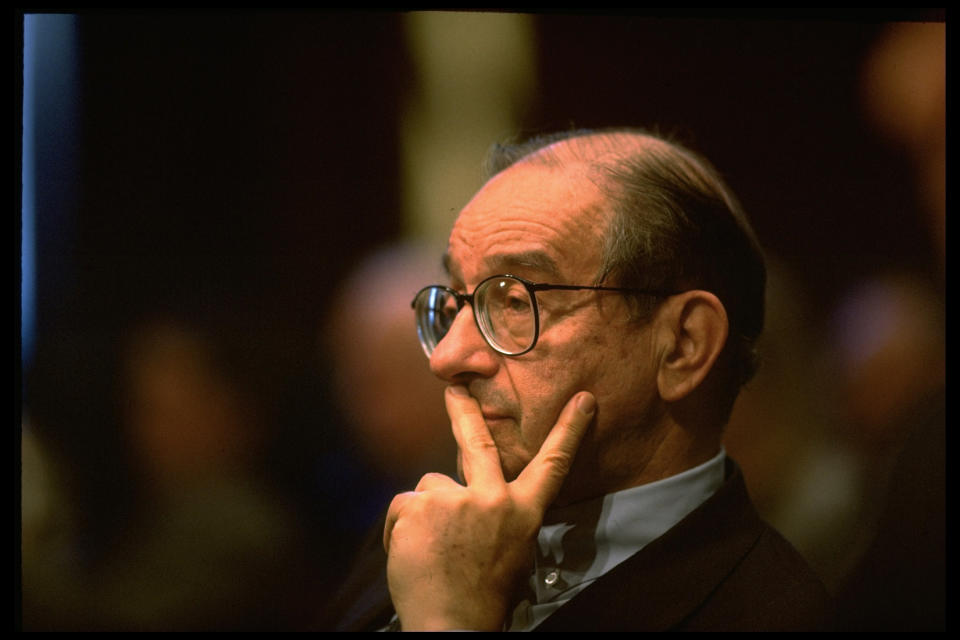

Between July 1995 and January 1996, the Alan Greenspan-led Fed cut rates three times, for a total of 75 basis points. Before delivering the first of those three cuts on July 6, 1995, Greenspan told FOMC participants that the risks were needed to help the economy work through uncertainty. But Greenspan said it was uncertainty that the economy could “work its way through.”

“As I saw it, virtually all of us were concerned about asymmetric risks on the downside, but no one thought the probability of a recession was better than 50/50,” Greenspan said, according to Fed transcripts of that FOMC meeting.

Several Fed speakers, including St. Louis Fed President Jim Bullard and Vice Chairman Richard Clarida, have pointed to the “insurance” cuts of 1995-1996 as a model for what the Fed is doing now.

But no comparisons are exactly alike. Before the Greenspan cuts in 1995 and 1996, the target federal funds rate was around 6%. The Powell-led Fed saw rates top out at a target range of between 2.25% to 2.5%. Concern is brewing within the Fed about whether easing policy would back the Fed up to zero rates, and by extension, to unconventional policy tools again.

Deutsche Bank wrote that the 1990s were also different because economic policy uncertainty related to trade policy appears to be “substantially higher” today than in the past.

“And recent Fed research suggests that the uncertainty to date will have a persistent negative impact on activity in the coming quarters,” DB wrote Oct. 24.

Worth Watching

Wall Street analysts say a 25 basis point cut on Wednesday could coincide with another round of dissents from Boston Fed President Eric Rosengren and Kansas City Fed President Esther George.

Rosengren told Yahoo Finance Oct. 7 that he would not “pre-commit” to policy but said if the health of the American consumer remained strong, there would not be “nearly as much of a need to do something.”

JPMorgan Chase wrote Oct. 24 that unlike the last Fed meeting, they do not expect dovish-leaning Bullard to dissent and call for a 50 basis point cut.

Powell will also have the opportunity to discuss the Oct. 11 decision to resume organic balance sheet growth, mainly to alleviate pressures in the overnight lending, or repo, market.

The Fed’s policy decision will be announced at 2 p.m. ET on Wednesday and will not come with a new round of economic projections. Powell’s press conference will begin at 2:30 p.m. ET.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

HUD Sec. Ben Carson announces initiative to push more bank-originated mortgages

'You don't need Libra': Central bankers skeptical of Facebook cryptocurrency

IMF: Trade resolution can only do so much to address 'synchronized slowdown'

Libra's co-founder: 'There is a chance' the cryptocurrency could present systemic risk

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.