October 2024 UK Stocks Estimated Below Intrinsic Value

Over the last 7 days, the United Kingdom market has remained flat, but it is up 8.8% over the past year with earnings forecast to grow by 14% annually. In this context of steady growth and positive earnings outlook, identifying stocks estimated below their intrinsic value can be a strategic approach for investors seeking potential opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

Triple Point Social Housing REIT (LSE:SOHO) | £0.659 | £1.31 | 49.8% |

GlobalData (AIM:DATA) | £1.935 | £3.72 | 47.9% |

On the Beach Group (LSE:OTB) | £1.538 | £3.06 | 49.7% |

S&U (LSE:SUS) | £19.50 | £36.54 | 46.6% |

Informa (LSE:INF) | £8.092 | £15.70 | 48.5% |

Redcentric (AIM:RCN) | £1.23 | £2.41 | 48.9% |

Gulf Keystone Petroleum (LSE:GKP) | £1.319 | £2.49 | 47% |

Mpac Group (AIM:MPAC) | £4.75 | £9.02 | 47.3% |

Loungers (AIM:LGRS) | £2.68 | £5.34 | 49.8% |

Genel Energy (LSE:GENL) | £0.793 | £1.51 | 47.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Bridgepoint Group

Overview: Bridgepoint Group plc is a private equity and private credit firm focusing on middle market and small cap investments, with a market capitalization of approximately £2.74 billion.

Operations: The company's revenue segments include Private Credit generating £74.50 million and Private Equity contributing £285.60 million.

Estimated Discount To Fair Value: 11.1%

Bridgepoint Group is trading at £3.33, below its estimated fair value of £3.74, suggesting it may be undervalued based on cash flows. Despite a lower profit margin this year, earnings and revenue are forecast to grow significantly faster than the UK market. However, recent shareholder dilution and dividends not fully covered by earnings pose concerns. The company has completed a share buyback and is rumored to consider acquiring Esker SA, indicating strategic growth initiatives amidst ongoing executive changes.

Phoenix Group Holdings

Overview: Phoenix Group Holdings plc operates in the long-term savings and retirement business in Europe, with a market cap of £5.25 billion.

Operations: The company's revenue segments include Retirement Solutions at £2.01 billion, with negative contributions from With-profits at -£1.56 billion, Europe & Other at -£0.89 billion, and Pensions & Savings at -£0.42 billion.

Estimated Discount To Fair Value: 18.8%

Phoenix Group Holdings is trading at £5.26, below its estimated fair value of £6.47, indicating potential undervaluation based on cash flows. Despite a forecasted revenue decline of 27.6% annually over the next three years, earnings are expected to grow significantly above market rates. However, the dividend yield of 10.13% is not well covered by earnings, and recent net losses raise concerns about financial stability despite strategic growth plans through M&A and internal asset optimization efforts.

Rank Group

Overview: The Rank Group Plc, with a market cap of £413.15 million, operates gaming services across Great Britain, Spain, and India through its subsidiaries.

Operations: The company's revenue segments include Digital (£226 million), Mecca Venues (£138.90 million), Enracha Venues (£38.50 million), and Grosvenor Venues (£331.30 million).

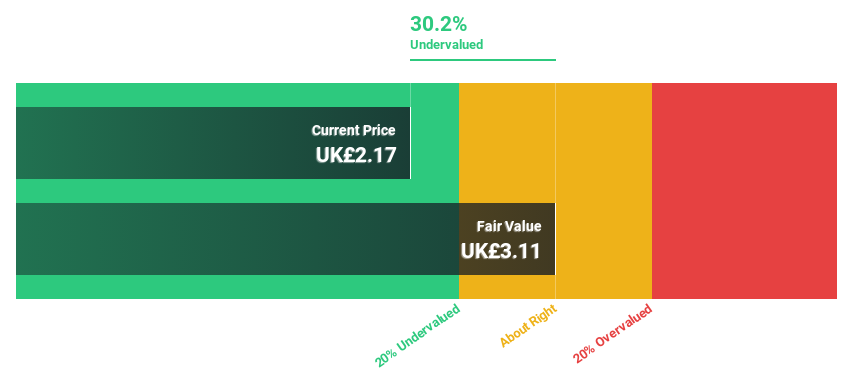

Estimated Discount To Fair Value: 35%

Rank Group is trading at £0.88, significantly below its estimated fair value of £1.36, highlighting potential undervaluation based on cash flows. The company recently turned profitable with net income of £12.5 million for the year ending June 30, 2024, compared to a net loss previously. Earnings are forecast to grow substantially at 35.7% annually over the next three years, outpacing UK market growth rates despite low projected return on equity and large one-off items affecting results.

The analysis detailed in our Rank Group growth report hints at robust future financial performance.

Unlock comprehensive insights into our analysis of Rank Group stock in this financial health report.

Turning Ideas Into Actions

Embark on your investment journey to our 59 Undervalued UK Stocks Based On Cash Flows selection here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BPT LSE:PHNX and LSE:RNK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]