'Once-in-a-century disruption' reverberates across global supply chains

When Resilinc CEO Bindiya Vakil first got word of coronavirus cases out of Wuhan in January, she mobilized her clients, Fortune 500 companies, to seek back-up suppliers right away. They scoured the radius around the epicenter of Hubei Province, identified all the parts that were sourced from there, and mapped out possible alternatives.

Early action by the supply chain risk management firm allowed Resilinc’s customers, which include IBM (IBM) and Micron (MU), to continue with fewer disruptions out of China. But with the virus since spreading well beyond Asia and crippling critical factories, firms are finding it increasingly challenging to find workarounds to keep their businesses operating as usual.

“They had already begun discussions by mid-January with those suppliers to get capacity at the backup site. Wuhan didn’t even get knocked down until the 22nd, so our customers had a real head start,” Vakil said in an interview with Yahoo Finance.

Factory closures are limiting access to key components, while airline groundings are delaying shipments, and border closures are forcing companies to reroute their cargo, reducing margins.

“China was the first one to be disrupted but then Malaysia shut down, Thailand shut down, most of Europe shut down,” Vakil said. “Many of our customers took advantage of backup sites, but obviously in the coming weeks, the backup sites went down too.”

Disruptions and diversification

Nick Vyas, executive director of the Center for Global Supply Chain Management at the University of Southern California, said the effects of the contagion are far-reaching. “I would call this a once-in-a-century disruption that we’re facing,” he said. “What makes it even more unique is that the disruptions aren’t happening all at the same time. It’s moving from country to country, continent to continent.”

The disruptions have hit nearly every sector. Closures in Chinese factories prompted Apple (AAPL) to warn investors the company would fall short of its revenue target. Major carmakers in North America and Europe suspended operations to halt the spread of the virus, and order cancellations from European fashion brands have reverberated to manufacturers in Bangladesh, leading to significant job losses.

In a recent survey by S&P Global Market Intelligence, 79% of companies said the coronavirus had a negative impact on business, citing disruptions to organizational supply chains as a key concern.

The economic shock stemming from virus-related closures are likely to accelerate the localization of supply chains that began with U.S.-China trade war, according to Vyas. While tariffs forced some companies to shift hardcore manufacturing out of China, component manufacturing and raw materials still remain largely reliant on the country. Instead of low costs, Vyas sees a shift to regional supply chain networks tied to customer demand leading to decentralization and a “decoupling” out of traditional manufacturing hubs.

“So, if I'm catering for example to the Latin American population and North America, my supply chain network would be heavily focused out of Mexico,” Vyas said. “It may be a little bit more expensive in some regions, but we will then become much more diversified.”

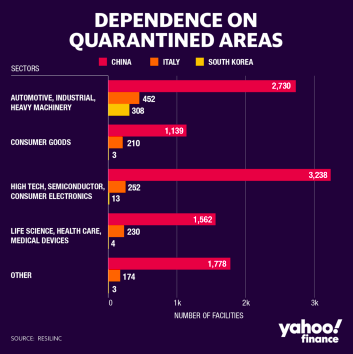

Still, data from Resilinc suggests an over reliance on China in the short-term, especially as it relates to critical medical supplies. An overview of supply chains attached to the world’s 1,000 largest companies or their suppliers, shows more than 1,500 facilities tied to China’s most heavily quarantined areas, compared to just 230 in Italy, and 3 in South Korea.

In fact, Vyas argues the surge in demand for these medical supplies globally has already started to fuel China’s bounce-back.

“From the Chinese government standpoint, I think they’re using this as an opportunity to create this superiority status symbol to assure the world that China is back on its feet,” Vyas said.

Akiko Fujita is an anchor and reporter for Yahoo Finance. Follow her on Twitter @AkikoFujita