The one stat in the jobs report everyone is obsessing over

The September jobs report came with the first negative payroll growth number since 2010. But that was not the focus of economists, who cast it aside given hurricane related distortions.

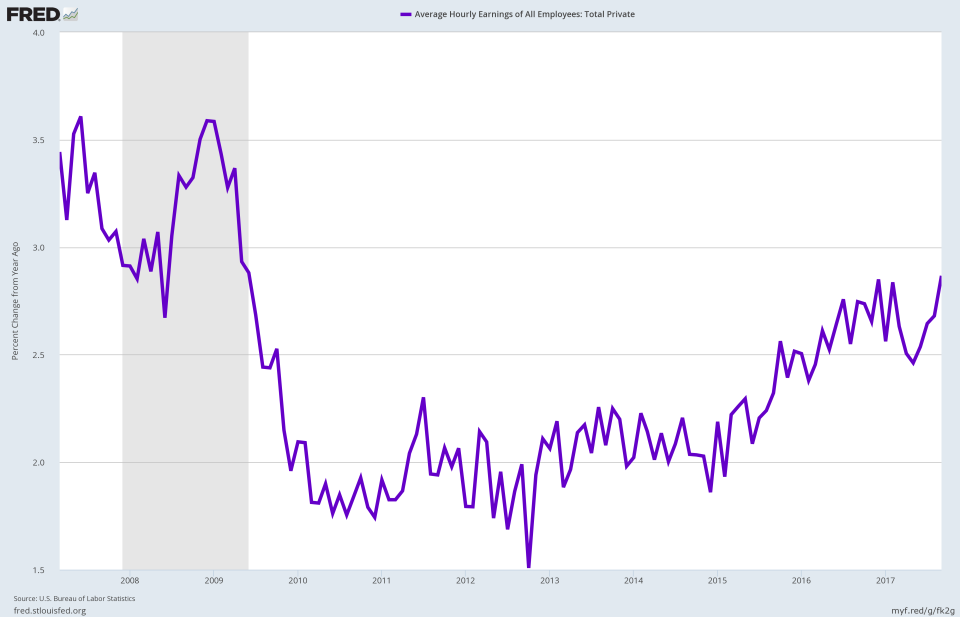

Instead, all eyes were in the sharp rise in average hourly earnings (AHE), which jumped 2.9% year-over-year. This was the strongest growth since 2009.

This indicator of inflation emboldens the Federal Reserve as it tightens monetary policy. In fact, markets reacted sending December rate hike expectations odds to above 90% from 77% on Thursday and 40% a month ago. Expectations for higher rates contributed to the rise in the U.S. dollar and 10-year treasury yields, which spiked to 2.4%.

While weather related distortions surely had an impact on the way wages were measured, Deutsche Bank’s Torsten Slok said it nevertheless speaks to strong trends in the labor market.

“The bottom line is that wage growth is accelerating and that is consistent with what we are seeing in the macro data and hearing in the anecdotes from the labor market,” Slok said.

Plus, the rise in wages was also accompanied by other positive factors. The labor force participation rate increased to 63.1% from 62.9% in August, marking its highest level since March 2014. And contrasting with the establishment survey, which showed payrolls fell by 33,000, the household survey reported 906,000 additional workers were employed in September, the largest since November 2013 and the second highest this cycle.

How the hurricanes distorted the average hourly earnings measure

That said, it’s worth better understanding how the hurricanes may have artificially boosted the wage growth figure.

“Hourly earnings rose sharply, probably because the people who temporarily dropped off payrolls are lower paid than average,” according to Pantheon Macro’s Ian Shepherdson. “In order to fall off the numbers, you have to do zero paid work in the pay period which includes the 12th, so part-timers and weekly-paid people are much more likely to be affected than monthly/semi-monthly paid people. The AHE data are not mix-adjusted so when lower-paid people leave the sample, AHE rises more quickly. A similar effect was visible in the data after Katrina.”

The chart below shows that the hit to payrolls and the boost to AHE from the hurricanes is in line with other incidences.

In the end, this report might not be enough of a determinant for the December rate hike decision, according to TD Securities.

“For the Fed, this is an extremely difficult report to read, and more policymakers are likely to be data dependent and wait for the October and November reports before making a decision whether to hike at the December FOMC meeting,” according to TD Securities.

On Friday, stock markets sold off slightly. And if the Fed’s more hawkish stance on the pace of recovery is appreciated by the market, there could be more turbulence ahead, according to Slok.

“The Fed currently expects 7 hikes by the end of 2020 and the market expects 2 over the same period,” Slok said. “So if the market suddenly wakes up to the Fed being right, and then begins to price in say 4 or 5 hikes instead of 2 then it will likely be associated with turbulence in markets including in US equities.”

Nicole Sinclair is markets correspondent at Yahoo Finance

Please also see:

Netflix price hikes won’t hurt subscriber growth

Why UPS and FedEx shouldn’t fear an Amazon delivery service

Pepsi has a 200-employee division that it runs like a tech company

Paychex CEO reveals a sign that regulations are actually on the rise

Procter & Gamble CEO: Why activist investor Nelson Peltz is wrong for our board