One-fifth of Americans missed rent payments in May

Over 33 million Americans have filed for unemployment since the novel coronavirus pandemic prompted mass layoffs beginning in mid-March — and landlords worried May would bring even more rent defaults than April. But new data may suggest these concerns may be overblown.

Some 19.8% of renters have not paid full or partial rent as of May 6, down from 22% for the first six days in April, according to the National Multifamily Housing Council’s (NMHC) rent tracker, which compiles statistics from major real estate data providers including Entrata, MRI Software, RealPage, ResMan, and Yardi. The NMHC revised April numbers to include a large uptick in payments on April 6.

"It is important to note that a large number of residents met their obligations despite unparalleled circumstances, and we will see that figure increase over the coming weeks," said Doug Bibby, president of NMHC.

Although most Americans are making payments they remain anxious. Preliminary studies show higher levels of concern over May rent than seen in April. Some 10.4% of renters expected not to make May rent, compared to only 8.8% in April, according to a survey of about 1,000 Americans by Volition Capital, a Boston-based growth equity firm.

Even among those who think they will pay rent, they are anxious about the future. On April 28, days before May rent was due, some 64% of renters were concerned about paying rent in the coming months as a result of the pandemic, compared to 40% the month prior, according to a survey of 1,000 renters by Clever, a St. Louis-based home buying and selling assistance website.

"We’re experiencing an economic event that defies comparison. The economy came to a screeching halt and everyone is struggling right now. As unemployment claims continue to rise, and Americans wait to receive relief benefits, more people will have greater difficulty paying their rent,” said Bob Pinnegar, president and CEO of the National Apartment Association.

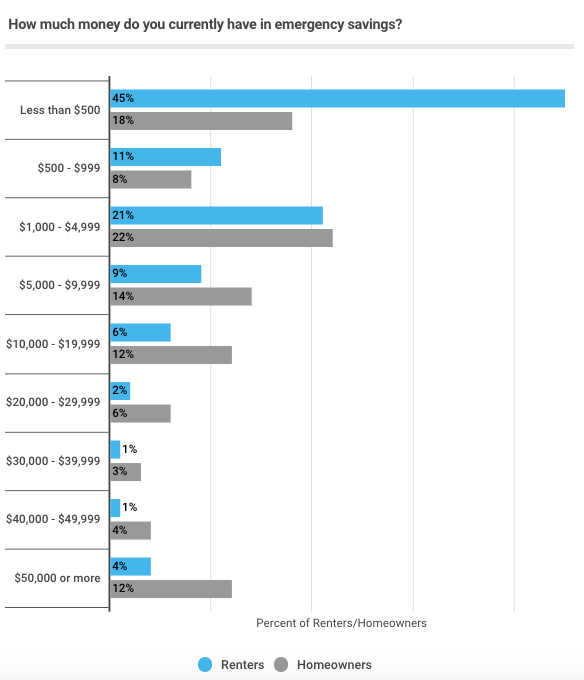

The pandemic has hit renters hard: Renters are 40% more likely than homeowners to have lost their job due to the pandemic, Clever’s survey found. The survey showed that in many cases, that causes immediate cash flow issues, since renters are 58% more likely than homeowners to live paycheck to paycheck, and less than half of all renters have at least $500 in emergency savings.

In response to economic turmoil, the U.S. government has issued a number of relief measures under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, including $1,200 stimulus checks to qualifying taxpayers and an extra $600 per week in unemployment benefits. Some 60% said they would use the stimulus check to pay May rent, according to a survey by Grace Hill, a South Carolina-based property management training company, which polled 25,000 renters from April 10 to April 16.

The last to get paid

Rent payment is also vital for landlords who operate on thin margins. On average, 39% of every rent payment goes toward mortgage payments, 27% goes to payroll, 14% goes to property taxes, and 10% goes toward major repairs, according to Pinnegar.

In fact, some 5.8% of multifamily commercial mortgage-backed securities loans were over 30 days late in April, up from 2.7% in March, according to Trepp LLC, a New York City-based data firm.

"Most people don’t realize landlords don’t get wealthy on rent, in fact they are the last to get paid,” said Pinnegar.

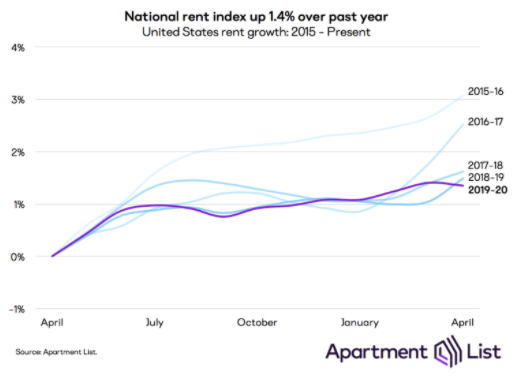

The coronavirus comes during a time of year when landlords usually expect an inflow of cash. Average rent prices rose 1.4% in April (inflation was 1.5%), its slowest rate in five years. Historically, April through July represent the steepest rent hikes, but experts expect not to see major increases this year, according to Apartment List, a San Francisco-based apartment listing website.

Working with landlords

But despite the gloomy predictions, April and May data prove how resilient renters are. Renters managed to work with their landlords to find a rent payment system that worked for them so by the end of April, 94.6% of rent payments had been made in part or in full, according to the NMHC, slightly down from the 97.7% in 2019.

Landlords and renters are leaning more on deferment and flexible payment plans moving forward, say experts. As of mid-April, some 40% of renters were already planning to ask for a deferment in May, compared to only 20% the month prior, according to the Grace Hill survey.

“It’s important to remember that more residents may have been able to pay their full rent on time in April because property managers successfully communicated to them and maintained service levels. That should continue. Payment plans, waving credit card fees and other tactics help,” Grace Hill advised clients in their report.

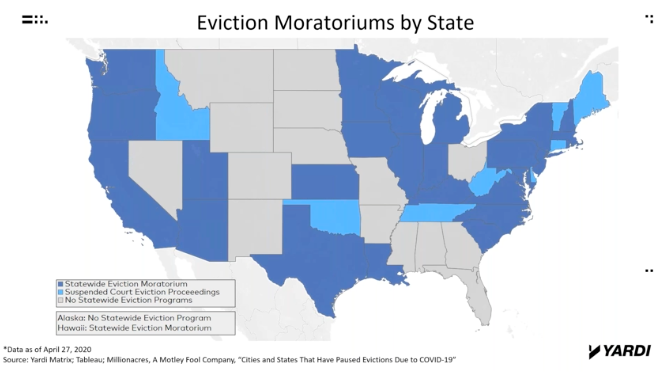

The CARES Act prohibits evictions and penalties for tenants in properties with federally-backed mortgages, and over 30 states have issued bans on evictions and penalties for not paying rent — which made April payments more possible.

“People really don’t have to pay [rent] unless they want to, but for April, they kind of did,” said vice president and president of Yardi Matrix Jeff Adler, in a recent Yardi webinar.

But for renters who live in privately-mortgaged apartments, especially those who do not live in states with additional requirements, eviction and credit penalties have put some tenants in tight financial situations.

"Renters should not have to worry about being evicted from their homes and building owners should not have to worry about losing their buildings due to COVID-19," said Richard Cupelli, president and founder of GoSection8.com, a listing site for affordable rentals. "We have been serving tenants, landlords and housing authorities since 2003 and we have never seen this level of concern."

Sarah Paynter is a reporter at Yahoo Finance. Follow her on Twitter @sarahapaynter

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

More from Sarah:

These cities have the most and least space to live during the coronavirus lockdown

Barbara Corcoran: Educated homebuyers can get the ‘deal of a lifetime’ right now