'Stuck in no man’s land': A working mom details dealing with her sick child's student loan bill

“Natalie” is $148,851 deep in student loans for her child and is finding it increasingly harder to get by. (We changed Natalie’s name for privacy purposes, as she is not a public figure.)

A real estate agent just outside of Nashville, Tennessee, Natalie shared the student loan records with Yahoo Finance to corroborate her claims.

Unforeseen medical expenses piled up for a son diagnosed with leukemia, and her family is stuck without any of the repayment options offered to regular student loan borrowers. Consequently, she said she was feeling “stuck in no man’s land,” and the financial pain was intensifying.

How to repay student loans: The full breakdown

The Trump administration reportedly considered ways to help people like Natalie with their student debt, specifically with their Parent PLUS loans, given the relative age of the borrowing group.

And in a recent budget proposal this year, the administration proposed limits on PLUS loans. A separate report stated that it had also been thinking of making it easier to discharge student loans in bankruptcy.

Parent PLUS program

The PLUS program launched in 1980 with limits on how much parents could borrow. Congress lifted those caps a decade later and since 1993, parents have been able to borrow up to the cost of attendance (minus aid received by the student).

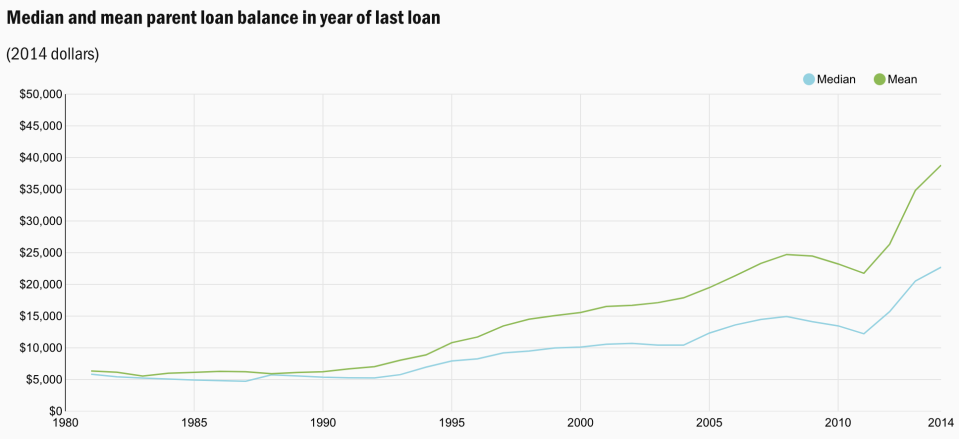

The move resulted in approximately 3.5 million Parent PLUS borrowers now holding around $92.9 billion in student loans at the end of Q3 2019 at an average of $26,543 per recipient, according to data from the National Student Loan Data System (NSLDS). That’s about 6% of all outstanding federal loans.

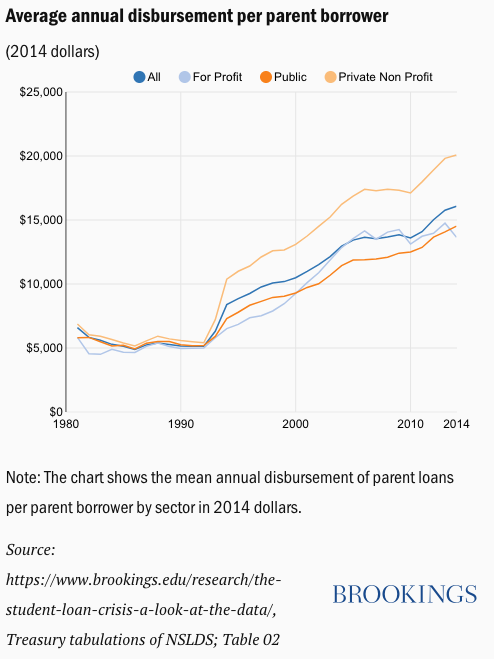

The average annual borrowing amount has spiked from $5,200 in 1990 (adjusted for inflation) to $16,100 in 2014, Brookings estimated in 2018.

“While we’ve seen student borrowing decrease in the past eight years, Parent PLUS borrowing has increased,” Rebecca Safier, a student loan expert at Student Loan Hero, told Yahoo Finance.

Many critics of the PLUS loans say that the application criteria is too simple, too easy, and when the parents are unable to repay, they sometimes have their wages or Social Security checks garnished because of the debt.

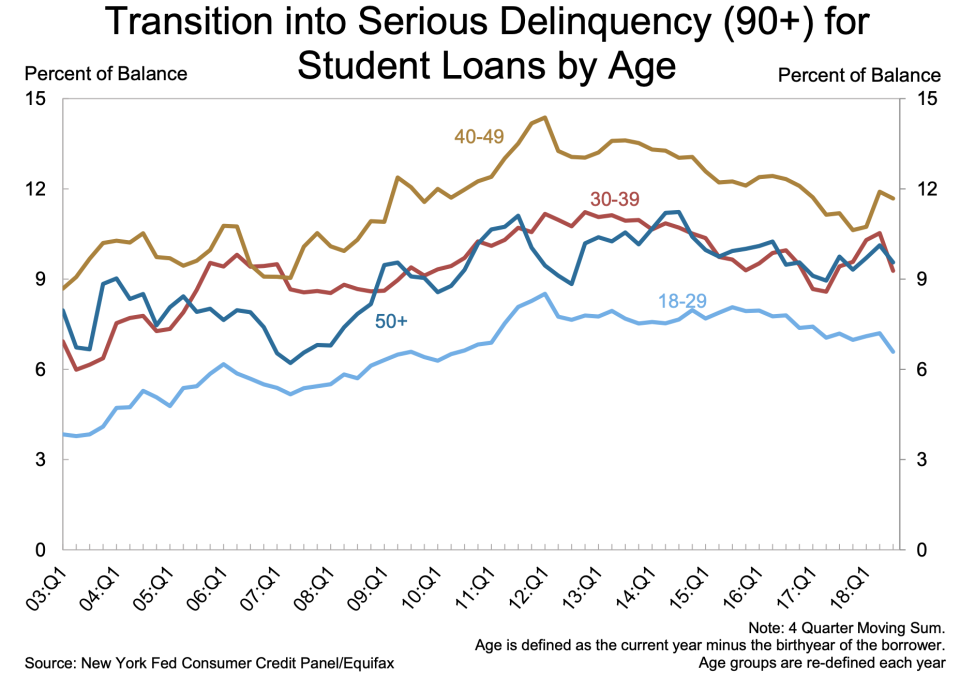

Between 2005 and 2015, the number of people aged 60 and older with student debt quadrupled — from 700,000 to 2.8 million, according to a Consumer Financial Protection Bureau (CFPB) report from 2017.

In 2015 alone, almost 114,000 borrowers aged 50 and above had their Social Security benefits garnished to repay federal student loans, according to a Government Accountability Report from 2016.

At the same time, PLUS loans do serve an important role to help some struggling students.

“Parent PLUS loans can fill a gap for low-income families who still have unmet needs for higher education beyond their undergraduate loan allowances,” Harrington asserted. “Moreover, many of these borrowers are also not well served by the private market.”

‘You do what you have to do for your kids’

Natalie, who’s lived in the same house for 24 years, said that she and her husband both paid off their own student debt years ago. Their current problems began when she took out loans for her second son to go to a private school.

When Natalie approached her son’s college’s financial aid office, according to her account, the officials weren’t very informative about the PLUS loans.

“They make you feel like you have to do this and there’s no other way ... it was very matter of fact and you had no other option,” she added. “The whole system needs to be redone.”

Asked why she took on the loans despite the lack of clarity and the 7.6% interest rate, Natalie explained: “You do what you have to do for your kids.”

A few months after her son graduated in 2017 with a degree in business and marketing, he was diagnosed with acute leukemia. He was 22.

“That night, it was at 9:30 [PM], and I will never forget,” she recalled receiving the call from the doctor and then telling her son: “You’re young and you can fight this.”

While their annual household income was around $110,000 after Natalie quit her job at the time to take care of their sick son, the medical bills began piling up. She estimated medical expenses to come up to around $40,000 a month during the time her son needed a transplant.

In the meantime, Nelnet, the son’s loan servicer, kept prodding her to pay $1,041 per month for the son’s student debt.

Natalie claims that she tried to work with Nelnet, but found it a herculean task. More recently, she said that the company told her that they didn’t receive the paperwork she had sent over multiple times. Nelnet did not respond to multiple requests for comment from Yahoo Finance.

The loans are “about to take us down,” she said. “We make too much money on their scale for assistance, but we cannot afford it... all this debt and stress is crippling.”

She detailed her options as she saw them.

“I could sell the house and cash in my retirement... to pay these guys off,” she said. But “we are just stuck in no man’s land... And I don’t see anybody really doing anything about this. … We’re just stuck in a situation, and it’s frustrating.”

Parent PLUS Loans ‘especially difficult to pay back’

The stats for Parent PLUS loans as it evolved are sobering.

Brookings found that the 5-year default rate for parents with PLUS loans grew from about 7% in 2000 to 11% in 2009. Repayment also fell over the roughly same period. (Brookings’ 2018 analysis is the most recent comprehensive data that is publicly available.)

“Parent PLUS loans can be especially difficult to pay back, since they come with an interest rate higher than 7%,” Safier noted. In contrast, the interest rate for Direct Loans for graduates is only 4.53%.

Furthermore, PLUS loans aren’t treated the same way as regular student loans in that they’re not eligible for normal income-driven repayment plans. PLUS loans are eligible for the income-contingent repayment plan, Safier noted, though “this somewhat complicated process might be enough to scare away some parent borrowers from applying in the first place.”

One silver lining of this type of student loan is that if PLUS borrowers are in default, “they can consolidate or rehabilitate their loans,” Ashley Harrington, senior policy counsel for the Center for Responsible Lending, told Yahoo Finance. “Refinancing may be an option, but borrowers should consult a counselor and evaluate all terms, including how much they will pay over the life of each loan and the protections and flexibility under the federal plan.”

Department of Education recognizes the problem

The President Trump-era Department of Education (ED), which has been heavily criticized over its handling of the roughly 90% of student debt that originated with or was guaranteed by the federal government, told Yahoo Finance that it recognized the issues with the current system.

“Secretary [Betsy] DeVos is working with the White House and other stakeholders to fix an unsustainable system without unfairly burdening taxpayers with another bailout,” U.S. Department of Education Press Secretary Angela Morabito said in a statement. “Secretary DeVos is focused on bringing transparency and accountability to higher education.”

While noting new initiatives the department had launched, such as a new College Scorecard to display median debt and earnings for each field of study, Morabito added the Secretary has “floated the idea of making Federal Student Aid a standalone entity” as a possible fix to the student debt crisis.

Options for parents to consider

So what can parents do in this situation?

Student Loan Hero’s Safier offered a few routes: Apply for an income-based repayment plan to lower monthly payments, refinance the PLUS loans with a private lender to get a lower rate, explore the Public Service Loan Forgiveness (PSLF) program — which forgives student debt for public service workers after 10 years — or transfer the PLUS loan into their child’s name through refinancing.

“If their child can assume repayment, then the parent can wash their hands clean of the debt completely,” she noted.

In any case, at the end of the day, genuine reform will be required, experts added.

“We need to improve our student loan system so that fewer families must rely on debt to go to college and make income-based repayment affordable and accessible to all federal education loan holders,” Harrington said.

For her part, Natalie recognized that she knew she was “an adult” and “should’ve read better.” She has also reached out to her local congresswoman to ask for help. And amid the financial mess she finds herself in, her son is recovering and feeling much better.

—

Aarthi is a writer for Yahoo Finance. She can be reached at [email protected]. Follow her on Twitter @aarthiswami.

Read more:

'I can't afford that': Woman in student loan limbo since 1997 decries a muddy system

‘I’m working until I’m 75’: Factory worker describes family’s student debt nightmare

Read more personal finance information, news, and tips on Cashay