In This Article:

(Bloomberg) -- PDD Holdings Inc.’s position as China’s top-performing tech stock is in danger, amid a crisis of investor confidence over the e-commerce firm’s worse-than-expected sales and growing competitive threats.

Most Read from Bloomberg

-

Housing’s Worst Crisis in Decades Reverberates Through 2024 Race

-

An Affordable Nomadic Home Design Struggles to Adapt to Urban Life

-

The Hague Is World’s First City to Ban Oil and Air Travel Ads

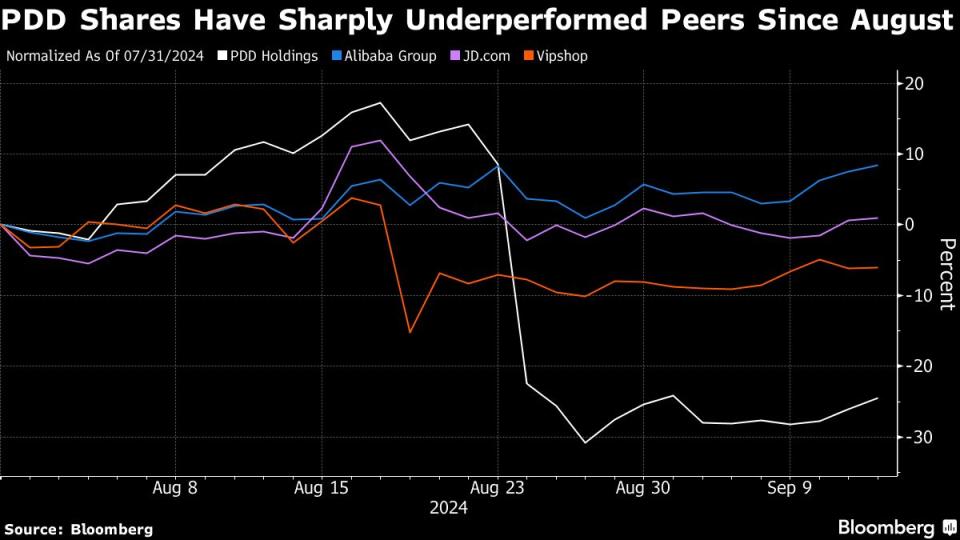

The company behind the popular Temu platform and its Chinese equivalent Pinduoduo has seen its US-listed shares slide more than 30% since results that disappointed the market last month. That’s the worst performance on the Nasdaq 100 Index, and the pain seems far from over as analysts slash expectations for the former market darling.

PDD’s weak outlook and lack of shareholder returns have raised concerns. Meanwhile rivals including Alibaba Group Holding Ltd. are showing success in matching the company’s cutthroat pricing, and heated US rhetoric continues to build over the Chinese business model.

On Friday, PDD’s shares dropped as much as 6.3% in US trading after the Biden administration announced steps to limit use of a trade loophole favored by Chinese retailers that allows millions of packages with cheap goods into the US every day without customs declarations or duties.

In the August earnings briefing, management was “guiding for lower growth and lower margins in the long term,” while also saying they need to spend more to defend market share, said Chelsey Tam, an analyst at Morningstar Inc. “They’re saying competition is intense,” she said.

Until recently, PDD had been seen as a rare bright spot in China e-commerce, as its low-price strategy enabled Pinduoduo to grab share among consumers looking for value in a weakening economy. It also reaped praise by duplicating that success overseas with Temu. PDD’s shares are still up more than 160% over the past five years, topping a Bloomberg gauge of the largest Chinese tech stocks.

That’s changed with the company’s warning that revenue growth will inevitably dwindle. PDD has shed more than $80 billion in market value from a high in May, falling back behind Alibaba as China’s largest e-commerce firm. In the process, PDD founder Colin Huang lost his briefly-held position as the nation’s richest person.

“The market has quickly become concerned that the hyper-growth phase for PDD could be coming to an end,” said James Kenney, senior investment manager at Pictet Asset Management. “The domestic macro headwinds and an increasing competitive landscape are both likely to moderate this strong growth in the shorter term.”